Cisco 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

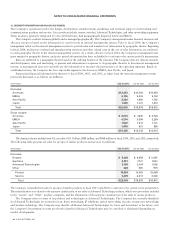

In addition, beginning on April 23, 2001, a number of purported shareholder derivative lawsuits were filed in the Superior Court

of California, County of Santa Clara, and in the Superior Court of California, County of San Mateo. There is a procedure in place for

the coordination of such actions (one of which has been dismissed and is currently on appeal). Two purported derivative suits were

filed in the United States District Court for the Northern District of California, and those federal court actions have been consolidated.

The consolidated federal court derivative action was dismissed by the court, and plaintiffs have appealed from that decision. The

complaints in the various derivative actions include claims for breach of fiduciary duty, waste of corporate assets, mismanagement,

unjust enrichment, and violations of the California Corporations Code; seek compensatory and other damages, disgorgement, and

other relief; and are based on essentially the same allegations as the class actions.

With respect to the above-described shareholder litigation, Cisco believes there is no legal basis for liability. However, due to the

uncertainty surrounding the litigation process, Cisco is unable to reasonably estimate a range of loss, if any, at this time. In addition,

the Company is subject to legal proceedings, claims, and litigation arising in the ordinary course of business. While the outcome of

these matters is currently not determinable, the Company does not expect that the ultimate costs to resolve these matters will have a

material adverse effect on the Company’s consolidated financial position, results of operations, or cash flows.

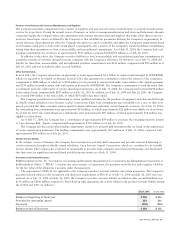

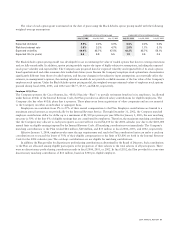

9. SHAREHOLDERS’ EQUITY

Stock Repurchase Program

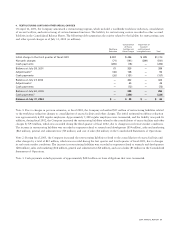

In September 2001, the Company’s Board of Directors authorized a stock repurchase program. As of July 31, 2004, the Company’s

Board of Directors has authorized the repurchase of up to $25 billion of common stock under this program. During fiscal 2004, the

Company repurchased and retired 408 million shares of Cisco common stock at an average price of $22.30 per share for an aggregate

purchase price of $9.1 billion. As of July 31, 2004, the Company has repurchased and retired 956 million shares of Cisco common stock

for an average price of $17.70 per share for an aggregate purchase price of $16.9 billion since inception of the stock repurchase program,

and the remaining authorized amount for stock repurchases under this program was $8.1 billion with no termination date.

The purchase price for the shares of the Company’s common stock repurchased was reflected as a reduction to shareholders’

equity. In accordance with Accounting Principles Board Opinion No. 6, “Status of Accounting Research Bulletins,” the Company is

required to allocate the purchase price of the repurchased shares as a reduction to retained earnings and common stock and additional

paid-in capital.

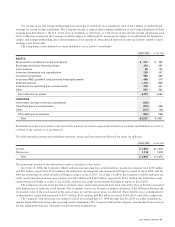

Shareholders’ Rights Plan

In June 1998, the Board of Directors approved a Shareholders’ Rights Plan (“Rights Plan”). The Rights Plan is intended to protect

shareholders’ rights in the event of an unsolicited takeover attempt. It is not intended to prevent a takeover of the Company on terms

that are favorable and fair to all shareholders and will not interfere with a merger approved by the Board of Directors. Each right entitles

shareholders to buy a unit equal to a portion of a new share of Series A Preferred Stock of the Company. The rights will be exercisable

only if a person or a group acquires or announces a tender or exchange offer to acquire 15% or more of the Company’s common stock.

In the event the rights become exercisable, the Rights Plan allows for Cisco shareholders to acquire, at an exercise price of $108

per right owned, stock of the surviving corporation having a market value of $217, whether or not Cisco is the surviving corporation.

The rights, which expire in June 2008, are redeemable for $0.00017 per right at the approval of the Board of Directors.

Preferred Stock

Under the terms of the Company’s Articles of Incorporation, the Board of Directors may determine the rights, preferences, and terms

of the Company’s authorized but unissued shares of preferred stock.

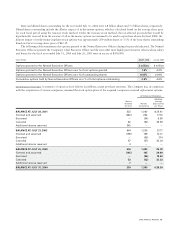

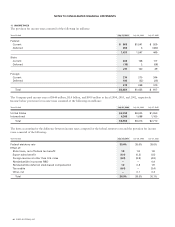

Comprehensive Income

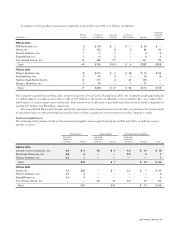

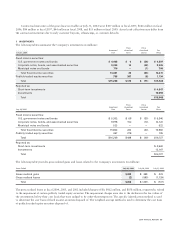

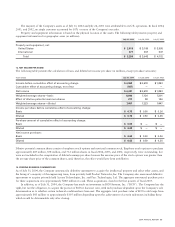

The components of comprehensive income are as follows (in millions):

Years Ended July 31, 2004 July 26, 2003 July 27, 2002

Net income $4,401$3,578 $1,893

Other comprehensive income:

Change in unrealized gains and losses on investments, net of tax benefit

(expense) of $42, $(150), and $9 in fiscal 2004, 2003, and 2002, respectively (77) 352 224

Other 19 29 24

Other comprehensive income before minority interest 4,343 3,959 2,141

Less minority interest (84) ——

Total $4,259 $3,959 $2,141

2004 ANNUAL REPORT 57