Cisco 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

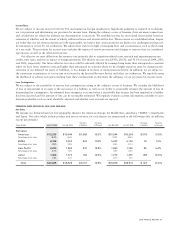

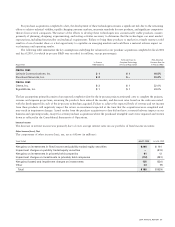

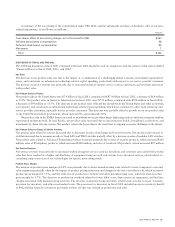

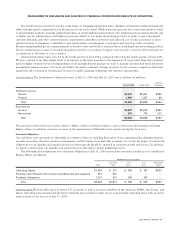

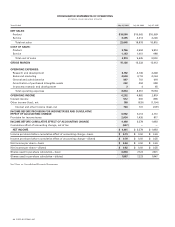

The following table summarizes the key assumptions underlying the valuation for our purchase acquisitions completed in fiscal 2003

and 2002, for which in-process R&D was recorded (in millions, except percentages):

Estimated Cost to Risk-Adjusted

In-Process Complete Technology Discount Rate for

Acquisition R&D Expense at Time of Acquisition In-Process R&D

FISCAL 2003

Okena, Inc. $ 3 $1 22.0%

SignalWorks, Inc. $ 1 $1 24.0%

FISCAL 2002

Allegro Systems, Inc. $28 $5 52.5%

AuroraNetics, Inc. $ 9 $2 35.0%

Hammerhead Networks, Inc. $27 $2 23.0%

Navarro Networks, Inc. $ 1 $1 23.0%

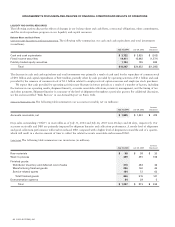

Interest Income

The decrease in interest income was primarily due to lower average interest rates on our portfolio of fixed income securities.

Other Income (Loss), Net

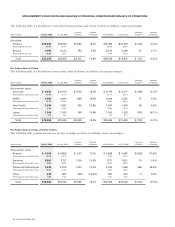

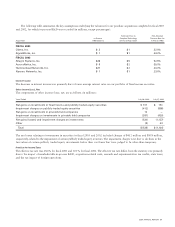

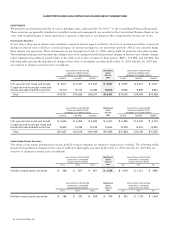

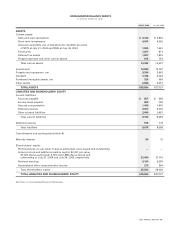

The components of other income (loss), net, are as follows (in millions):

Years Ended July 26, 2003 July 27, 2002

Net gains on investments in fixed income and publicly traded equity securities $ 161 $ 151

Impairment charges on publicly traded equity securities (412) (858)

Net gains on investments in privately held companies 12 —

Impairment charges on investments in privately held companies (281) (420)

Net gains (losses) and impairment charges on investments (520) (1,127)

Other (9) 23

Total $(529) $ (1,104)

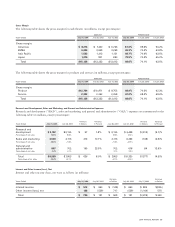

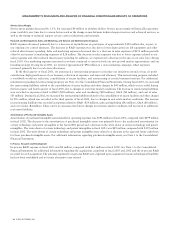

The net losses relating to investments in securities in fiscal 2003 and 2002 included charges of $412 million and $858 million,

respectively, related to the impairment of certain publicly traded equity securities. The impairment charges were due to declines in the

fair values of certain publicly traded equity investments below their cost basis that were judged to be other-than-temporary.

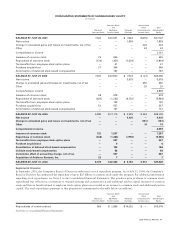

Provision for Income Taxes

The effective tax rate was 28.6% for fiscal 2003 and 30.1% for fiscal 2002. The effective tax rate differs from the statutory rate primarily

due to the impact of nondeductible in-process R&D, acquisition-related costs, research and experimentation tax credits, state taxes,

and the tax impact of foreign operations.

2004 ANNUAL REPORT 31