Cisco 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

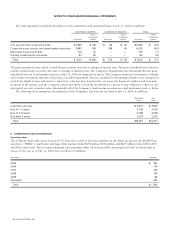

3. BUSINESS COMBINATIONS

Purchase Acquisitions

During the second quarter of fiscal 2004, the Company completed the acquisition of Latitude Communications, Inc. (“Latitude”) to

add rich-media conferencing that combines voice, video, and Web conferencing to its IP communications. During the third quarter of

fiscal 2004, the Company completed the acquisition of Riverhead Networks, Inc. to add to its portfolio of security solutions that help

customers defend against Distributed Denial of Service (DDoS) attacks and other security threats. In addition, during the third quarter

of fiscal 2004, the Company completed the acquisition of Twingo Systems, Inc. to add desktop security features for Secure Sockets Layer

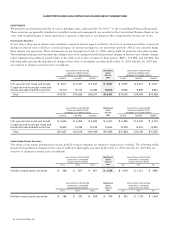

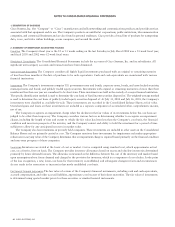

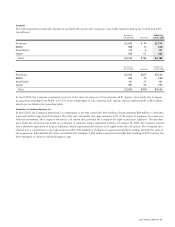

(SSL) virtual private networks (VPNs) to its networking products. A summary of the acquisitions is as follows (in millions):

Purchased

Cash Purchase Assumed In-Process Intangible

Acquisition Consideration Liabilities R&D Expense Goodwill Assets

Latitude Communications, Inc. $ 86 $29 $ 1 $ 60 $ 16

Riverhead Networks, Inc. 36 6 2 25 7

Twingo Systems, Inc. 5 1 — 5 1

Total $127 $ 36 $ 3 $ 90 $ 24

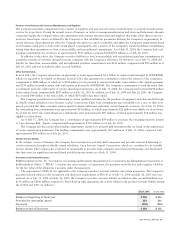

The purchase consideration for the Company’s acquisitions is also allocated to tangible assets and deferred stock-based compensation.

Deferred stock-based compensation represents the intrinsic value of the unvested portion of any restricted shares exchanged, options

assumed, or options canceled and replaced with the Company’s options and is amortized as compensation expense over the remaining

respective future vesting periods. The balance for deferred stock-based compensation is reflected as a reduction to additional paid-in

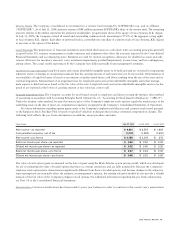

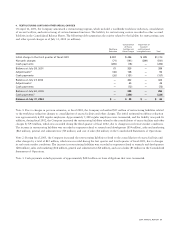

capital in the Consolidated Statements of Shareholders’ Equity. The following table presents the activity of deferred stock-based

compensation, including the deferred stock-based compensation relating to the acquisition of Andiamo of $90 million (in millions):

July 31, 2004 July 26, 2003 July 27, 2002

Balance at beginning of fiscal year $ 262 $ 182 $293

Purchase acquisitions 94 227 91

Amortization (186) (131) (187)

Canceled unvested options (17) (16) (15)

Balance at end of fiscal year $153 $262 $182

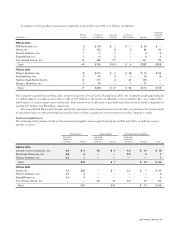

The Company’s methodology for allocating the purchase price to purchase acquisitions and to in-process research and development

(“in-process R&D”) is determined through established valuation techniques in the high-technology communications equipment industry.

In-process R&D is expensed upon acquisition because technological feasibility has not been established and no future alternative uses

exist. Total in-process R&D expense in fiscal 2004, 2003, and 2002 was $3 million, $4 million, and $65 million, respectively. The

in-process R&D expense that was attributable to stock consideration for the same periods was $0, $4 million, and $53 million, respectively.

46 CISCO SYSTEMS, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS