CarMax 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

(C) Advertising Expense

Selling, general, and administrative expenses on the consolidated statements of earnings included advertising

expense of $97.8 million in fiscal 2007, $86.7 million in fiscal 2006, and $73.6 million in fiscal 2005. Advertising

expenses were 1.3% of net sales and operating revenues for fiscal 2007 and 1.4% of net sales and operating revenues

for fiscal 2006 and fiscal 2005.

14. CONTINGENT LIABILITIES

(A) Litigation

On August 29, 2006, Heather Herron, et al. filed a putative class action lawsuit against numerous South Carolina

automobile dealers, including CarMax Auto Superstores, Inc., in the Court of Common Pleas in Aiken County,

South Carolina. Subject to final judicial approval, we have settled this lawsuit, and we believe the settlement will

not materially affect our financial position or results of operations.

We are involved in various other legal proceedings in the normal course of business. Based upon our evaluation of

information currently available, we believe that the ultimate resolution of any such proceedings will not have a

material adverse effect, either individually or in the aggregate, on our financial position, liquidity, or results of

operations.

(B) Other Matters

In accordance with the terms of real estate lease agreements, CarMax generally agrees to indemnify the lessor from

certain liabilities arising as a result of the use of the leased premises, including environmental liabilities and repairs

to leased property upon termination of the lease. Additionally, in accordance with the terms of agreements entered

into for the sale of properties, we generally agree to indemnify the buyer from certain liabilities and costs arising

subsequent to the date of the sale, including environmental liabilities and liabilities resulting from the breach of

representations or warranties made in accordance with the agreements. We do not have any known material

environmental commitments, contingencies, or other indemnification issues arising from these arrangements.

As part of our customer service strategy, we guarantee the used vehicles we retail with a 30-day limited warranty. A

vehicle in need of repair within 30 days of the customer's purchase will be repaired free of charge. As a result, each

vehicle sold has an implied liability associated with it. Accordingly, we record a provision for estimated repairs

during the guarantee period for each vehicle sold based on historical trends. The liability for this guarantee was $2.4

million at February 28, 2007, and $1.9 million at February 28, 2006, and is included in accrued expenses and other

current liabilities in the consolidated balance sheets.

15. RECENT ACCOUNTING PRONOUNCEMENTS

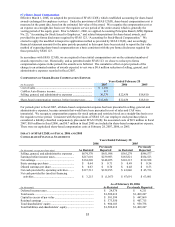

In July 2006, the Financial Accounting Standards Board (“FASB”) issued FASB Interpretation No. 48, “Accounting

for Uncertainty in Income Taxes” (“FIN 48”), which establishes a consistent framework to use to determine the

appropriate level of tax reserves to maintain for “uncertain tax positions.” This interpretation of SFAS No. 109,

“Accounting for Income Taxes,” uses a two-step approach wherein a tax benefit is recognized if a position is more

likely than not to be sustained. The amount of the benefit is then measured as the highest tax benefit that is greater

than fifty percent likely to be realized. FIN 48 also establishes new disclosure requirements related to tax reserves.

We will be required to adopt FIN 48 as of March 1, 2007. We do not expect the adoption of FIN 48 to have a

material impact on our financial position, results of operations, or cash flows.

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS 157”), which defines fair

value, establishes a framework for measuring fair value in U.S. generally accepted accounting principles, and

expands disclosures about fair value measurements. The statement does not require new fair value measurements,

but is applied to the extent that other accounting pronouncements require or permit fair value measurements.

Companies will be required to disclose the extent to which fair value is used to measure assets and liabilities, the

inputs used to develop the measurements, and the effect of certain of the measurements on earnings (or changes in

net assets) for the period. CarMax will be required to adopt SFAS 157 as of March 1, 2008. We are currently

evaluating the impact of adopting SFAS 157 on our financial position, results of operations, and cash flows.

In September 2006, the SEC staff published Staff Accounting Bulletin No. 108, “Considering the Effects of Prior

Year Misstatements when Quantifying Misstatements in Current Year Financial Statements” (“SAB 108”). The

bulletin addresses quantifying the financial statement effects of misstatements, specifically, how the effects of prior

year uncorrected errors must be considered in quantifying misstatements in the current year financial statements.

The bulletin offers a special “one-time” transition provision for correcting certain prior year misstatements that were