CarMax 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

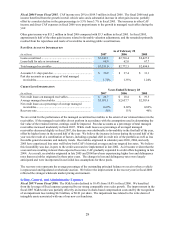

estimate reflects more real estate purchases for future development in larger, multi-store markets. In addition, the

fiscal 2007 capital spending amount was lower than originally projected, due in part to the acquisition of some store

sites pursuant to ground leases.

Fiscal 2008 Expectations

The fiscal 2008 expectations discussed below are based on historical and current trends in our business and should

be read in conjunction with “Risk Factors,” in Part I, Item 1A of this Form 10-K.

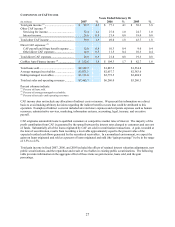

Fiscal 2008 Sales. We currently anticipate comparable store used unit growth for fiscal 2008 in the range of 3% to

9%. We also expect wholesale unit sales growth to be consistent with our total used unit sales increase. Total

revenues are expected to climb by between 14% and 20%, reflecting our expectations for comparable store used unit

growth, new store openings, a modest increase in used vehicle average selling price, and a continued decline in our

new vehicle sales.

Fiscal 2008 Earnings Per Share. We currently anticipate fiscal 2008 earnings per share in the range of $1.03 to

$1.14, representing EPS growth in the range of 12% to 24%. We expect modest improvement in both used vehicle

and wholesale gross profits per unit in fiscal 2008, as we continue to refine and improve our car-buying processes.

We expect CAF income to increase modestly, but at a pace slower than anticipated sales growth, primarily reflecting

the challenging comparison created by the $13.0 million of favorable CAF items reported in fiscal 2007. The CAF

gain percentage is anticipated to be slightly above the midpoint of our normalized 3.5% to 4.5% range in fiscal

2008, assuming no significant change in the interest rate environment.

Our effective tax rate for fiscal 2008 is expected to be similar to the fiscal 2007 rate. However, our diluted share

count is expected to increase by approximately 3%, reflecting the effects of the recent increase in our stock price and

option exercises on the weighted average share calculation. The diluted share count for the fourth quarter of fiscal

2007 was 1.4% higher than the average for the full year, accounting for approximately one-half of the anticipated

3% increase.

RECENT ACCOUNTING PRONOUNCEMENTS

For a discussion of recent accounting pronouncements applicable to the company, see Note 15.

FINANCIAL CONDITION

Operating Activities

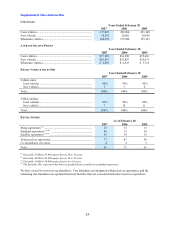

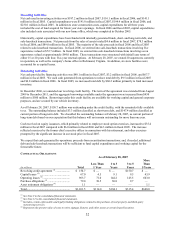

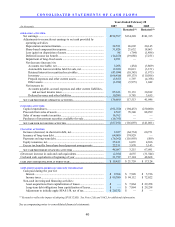

We generated net cash from operating activities of $136.8 million in fiscal 2007, $117.5 million in fiscal 2006, and

$41.8 million in fiscal 2005. Cash generated from operating activities was $19.3 million higher in fiscal 2007

compared with fiscal 2006. The $64.4 million increase in net earnings in fiscal 2007 was more than offset by the

increased growth in inventories. Inventories increased by $166.4 million in fiscal 2007 compared with a $93.1

million increase in fiscal 2006. The fiscal 2007 inventory increase related to store openings during fiscal 2007 and

shortly after the end of the fiscal year, as well as to added vehicle inventory required to support our strong increase

in fourth quarter comparable store used unit sales.

Cash generated from operating activities was $75.7 million higher in fiscal 2006 compared with fiscal 2005. The

increase reflected the $32.9 million increase in net earnings in fiscal 2006 and a $44.6 million reduction in the year-

over-year growth in working capital.

The aggregate principal amount of automobile loan receivables funded through securitizations, which are discussed

in Notes 3 and 4 totaled $3.24 billion at February 28, 2007, $2.71 billion at February 28, 2006, and $2.43 billion at

February 28, 2005. During fiscal 2007, we completed three public automobile securitizations totaling $1.87 billion.

At February 28, 2007, the warehouse facility limit was $825.0 million and unused warehouse capacity totaled

$227.0 million. The warehouse facility matures in July 2007. Note 4 includes a discussion of the warehouse

facility. We anticipate that we will be able to renew, expand, or enter into new securitization arrangements to meet

CAF’ s future needs.