CarMax 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.54

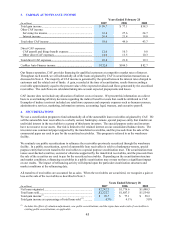

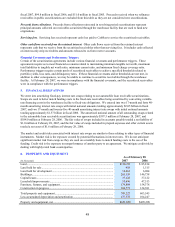

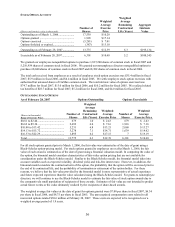

based on LIBOR, the federal funds rate, or the prime rate, depending on the type of borrowing. We pay a

commitment fee on the used and unused portions of the available funds. All outstanding principal amounts will be

due and payable in December 2011, and there are no penalties for prepayment.

As of February 28, 2007, $150.7 million was outstanding under the credit agreement, with the remainder fully

available to us. The outstanding balance included $3.3 million of loans classified as short-term debt, and $147.4

million classified as current portion of long-term debt. We classified the outstanding balance at February 28, 2007,

as current portion of long-term debt based on our expectation that this balance will not remain outstanding for more

than one year.

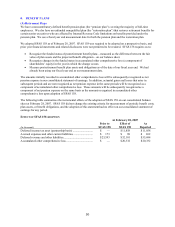

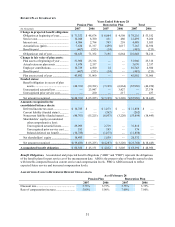

We have recorded six capital leases for store facilities. The related capital lease assets are included in property and

equipment. These leases were structured at varying interest rates with initial lease terms ranging from 10 to 20 years

with payments made monthly. The present value of future minimum lease payments totaled $34.8 million at

February 28, 2007, and $35.7 million at February 28, 2006.

The weighted average interest rate on outstanding short-term debt was 6.4% during fiscal 2007, 5.5% during fiscal

2006, and 4.3% during fiscal 2005.

We capitalize interest in connection with the construction of certain facilities. Capitalized interest totaled $4.5

million in fiscal 2007, $6.0 million in fiscal 2006, and $3.5 million in fiscal 2005.

10. STOCK AND STOCK-BASED INCENTIVE PLANS

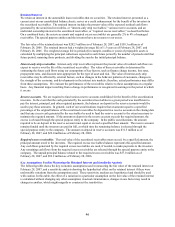

(A) Shareholder Right Plan and Undesignated Preferred Stock

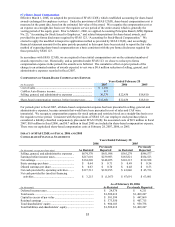

In conjunction with the company’ s shareholder rights plan, shareholders received preferred stock purchase rights as

a dividend at the rate of one right for each share of CarMax, Inc. common stock owned. The rights are exercisable

only upon the attainment of, or the commencement of a tender offer to attain, a 15% or greater ownership interest in

the company by a person or group. When exercisable, and as adjusted for our March 2007 2-for-1 stock split, each

right would entitle the holder to buy one half of one one-thousandth of a share of Cumulative Participating Preferred

Stock, Series A, $20 par value, at an exercise price of $140 per share, subject to adjustment. A total of 120,000

shares of such preferred stock, which has preferential dividend and liquidation rights, have been authorized and

designated. No such shares are outstanding. In the event that an acquiring person or group acquires the specified

ownership percentage of CarMax, Inc. common stock (except pursuant to a cash tender offer for all outstanding

shares determined to be fair by the board of directors) or engages in certain transactions with the company after the

rights become exercisable, each right will be converted into a right to purchase, for half the current market price at

that time, shares of CarMax, Inc. common stock valued at two times the exercise price. We also have an additional

19,880,000 authorized shares of undesignated preferred stock of which no shares are outstanding.

(B) Stock Incentive Plans

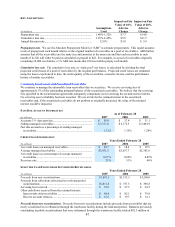

We maintain long-term incentive plans for management, key employees, and the nonemployee members of the

board of directors. The plans allow for the grant of equity-based compensation awards, including nonqualified stock

options, incentive stock options, stock appreciation rights, restricted stock awards, stock grants, or a combination of

awards.

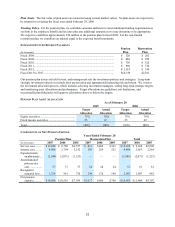

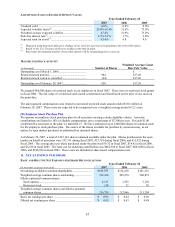

In fiscal 2006 and prior years, we primarily awarded stock options to employees that received share-based

compensation. Beginning in fiscal 2007, the substantial majority of employees receiving awards now receive

restricted stock instead of stock options. Senior management continues to receive awards of nonqualified stock

options. Nonemployee directors continue to receive awards of nonqualified stock options and stock grants.

Stock options are awards that allow the recipient to purchase shares of our stock at a fixed price. Stock options are

granted at an exercise price equal to the fair market value of our stock on the grant date. Substantially all of the

awards vest annually in equal amounts over periods of three to four years. These options generally expire no later

than ten years after the date of the grant. Restricted stock awards are subject to specified restrictions and a risk of

forfeiture. The restrictions typically lapse three years from the grant date.

As of February 28, 2007, a total of 34,000,000 shares of CarMax common stock have been authorized to be issued

under the long-term incentive plans. The number of unissued common shares reserved for future grants under the

long-term incentive plans was 10,117,116 at February 28, 2007.