CarMax 2007 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.18

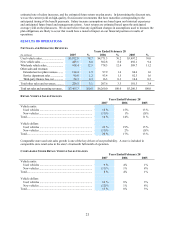

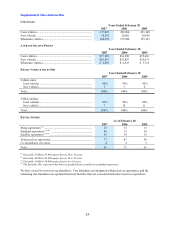

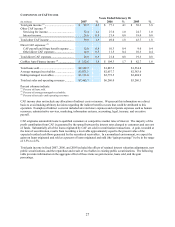

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of

Operations.

The following Management’ s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”)

is provided as a supplement to, and should be read in conjunction with, our consolidated financial statements and the

accompanying notes presented in Item 8, Consolidated Financial Statements and Supplementary Data. Note

references are to the notes to consolidated financial statements included in Item 8. Amounts and percentages in

tables may not total due to rounding. Certain prior year amounts have been reclassified to conform to the current

year’ s presentation.

We adopted Statement of Financial Accounting Standards (“SFAS”) No. 123 (Revised 2004), “Share-Based

Payment” (“SFAS 123(R)”), effective March 1, 2006, applying the modified retrospective method. As a result, prior

period amounts have been restated to reflect the adoption of this standard.

On February 22, 2007, the board of directors declared a 2-for-1 stock split in the form of a common stock dividend

for shareholders of record on March 19, 2007, which was distributed on March 26, 2007. All share and per share

data included in MD&A have been adjusted to reflect this stock split.

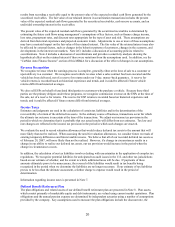

BUSINESS OVERVIEW

General

CarMax is the nation’ s largest retailer of used vehicles. We pioneered the used car superstore concept, opening our

first store in 1993. At February 28, 2007, we operated 77 used car superstores in 36 markets, including 26 mid-sized

markets, 9 large markets, and 1 small market. We define mid-sized markets as those with television viewing

populations generally between 600,000 and 2.5 million people. We also operated seven new car franchises, all of

which are integrated or co-located with our used car superstores. In fiscal 2007, we sold 337,021 used cars,

representing 95% of the total 355,584 vehicles we sold at retail.

We believe the CarMax consumer offer is unique in the automobile retailing marketplace. Our offer gives

consumers a way to shop for cars in the same manner that they shop for items at other “big box” retailers. Our

consumer offer is structured around our four core equities: low, no-haggle prices; a broad selection; high quality;

and customer-friendly service. Our website, carmax.com, is a valuable tool for communicating the CarMax

consumer offer, a sophisticated search engine, and an efficient channel for customers who prefer to conduct their

shopping online. We generate revenues, income, and cash flows primarily by retailing used vehicles and associated

items including vehicle financing, extended service plans (“ESP”), and retail service. A majority of the used

vehicles we sell at retail are purchased directly from consumers.

We also generate revenues, income, and cash flows from the sale of vehicles purchased through our appraisal

process that do not meet our retail standards. These vehicles are sold at our on-site wholesale auctions. Wholesale

auctions are conducted at the majority of our superstores and are held on a weekly, bi-weekly, or monthly basis. In

fiscal 2007, we sold 208,959 vehicles at our wholesale auctions. On average, the vehicles we wholesale are

approximately 10 years old and have more than 100,000 miles. Participation in our wholesale auctions is restricted

to licensed automobile dealers, the majority of whom are independent dealers and licensed wholesalers.

CarMax provides financing to qualified customers through CarMax Auto Finance (“CAF”), the company’ s finance

operation, and Bank of America, and through several other third-party lenders. We collect fixed, prenegotiated fees

from the majority of our third-party lenders, and we periodically test additional lenders. CarMax has no recourse

liability for the loans provided by third-party lenders.

We sell ESPs on behalf of unrelated third parties who are the primary obligors. We have no contractual liability to

the customer under these third-party service plans. Extended service plan revenue represents commissions from the

unrelated third parties.

We are still at a relatively early stage in the national rollout of our retail concept. We believe the primary driver for

future earnings growth will be vehicle unit sales growth from comparable stores and from geographic expansion.