CarMax 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.19

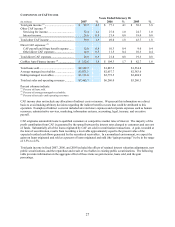

We target a similar dollar amount of gross profit per used unit, regardless of retail price. Used unit sales growth is

our primary focus. We plan to open used car superstores at a rate of approximately 15% to 20% of our used car

superstore base each year. In fiscal 2008, we plan to open 13 superstores, expanding our store base by

approximately 17%. Over the long term, we expect comparable store used unit sales increases to average in the

range of 4% to 8%, reflecting the multi-year ramp in sales at newly opened stores as they mature, continued market

share gains at stores that have reached basic maturity sales levels, which we estimate occurs in a store’ s fifth year of

operation, and underlying industry sales growth.

The principal challenges we face in expanding our store base include our ability to build our management bench

strength to support the store growth and our ability to procure suitable real estate at reasonable costs. We staff each

newly opened store with an experienced management team. We must therefore continually recruit, train, and

develop managers and associates to fill the pipeline necessary to support future store openings. If at any time we

believed that the rate of store growth was causing our performance to falter, we would consider slowing the growth

rate.

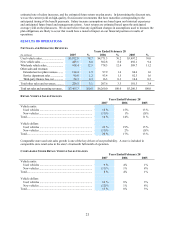

Fiscal 2007 Highlights

• Net sales and operating revenues increased 19% to $7.47 billion from $6.26 billion in fiscal 2006, while net

earnings increased 48% to $198.6 million, or $0.92 per share, from $134.2 million, or $0.63 per share.

• Total used vehicle unit sales increased 16%, reflecting the combination of our 9% increase in comparable store

used unit sales and the growth in our store base.

• Total wholesale vehicle unit sales increased 16%, consistent with our used vehicle unit sales growth.

• We opened ten used car superstores in fiscal 2007, including five standard superstores and five satellite

superstores.

• Our total gross profit per unit increased to $2,731 from $2,544 in fiscal 2006. We realized improvements in

gross profit per unit in all categories, including used vehicles, new vehicles, wholesale vehicles, and other. We

believe our used vehicle gross profit benefited from our strong, consistent sales performance, which resulted in

fewer pricing markdowns being made, as well as a more stable underlying economic environment.

• CAF income increased 27% to $132.6 million from $104.3 million in fiscal 2006. The improvement reflected

the growth in retail vehicle sales and managed receivables, an improvement in the gain on loans originated and

sold, and an increase in the average amount financed. CAF income included a benefit of $13.0 million, or

$0.04 per share for favorable items, primarily valuation adjustments of our retained interest, in fiscal 2007,

compared with a benefit of $15.2 million, or $0.04 per share in fiscal 2006.

• Selling, general, and administrative expenses as a percent of net sales and operating revenues (the “SG&A

ratio”) declined to 10.4% from 10.8% in fiscal 2006. We benefited from the leverage of fixed expenses

generated by our strong comparable store sales growth.

• As a result of adopting SFAS 123(R) in fiscal 2007, we recognized share-based compensation expense of $0.09

per share in fiscal 2007 compared with $0.07 per share in fiscal 2006, as restated. The fiscal 2007 expense

includes costs of $0.02 per share resulting from the retirement of our former chief executive officer.

• Net cash provided by operations increased to $136.8 million from $117.5 million in fiscal 2006, primarily

reflecting the improved net earnings offset by increased investment in working capital.

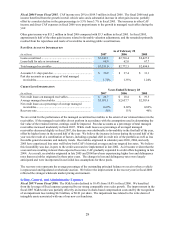

CRITICAL ACCOUNTING POLICIES

Our results of operations and financial condition as reflected in the consolidated financial statements have been

prepared in accordance with U.S. generally accepted accounting principles. Preparation of financial statements

requires management to make estimates and assumptions affecting the reported amounts of assets, liabilities,

revenues, expenses, and the disclosures of contingent assets and liabilities. We use our historical experience and

other relevant factors when developing our estimates and assumptions. We continually evaluate these estimates and

assumptions. Note 2 includes a discussion of significant accounting policies. The accounting policies discussed

below are the ones we consider critical to an understanding of our consolidated financial statements because their

application places the most significant demands on our judgment. Our financial results might have been different if

different assumptions had been used or other conditions had prevailed.

Securitization Transactions

We use a securitization program to fund substantially all of the automobile loan receivables originated by CAF. The

securitization transactions are accounted for as sales. A gain, recorded at the time of the securitization transaction,