CarMax 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

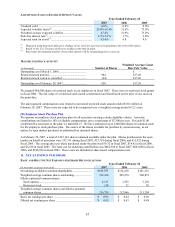

Land held for development represents land owned for potential expansion. Leased property meeting capital lease

criteria is capitalized and the present value of the related lease payments is recorded as long-term debt.

Accumulated amortization on capital lease assets was $6.0 million as of February 28, 2007, and $3.6 million as of

February 28, 2006.

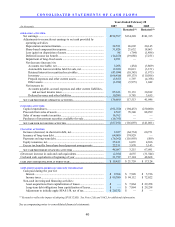

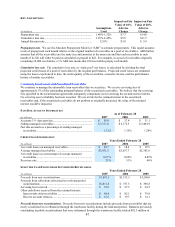

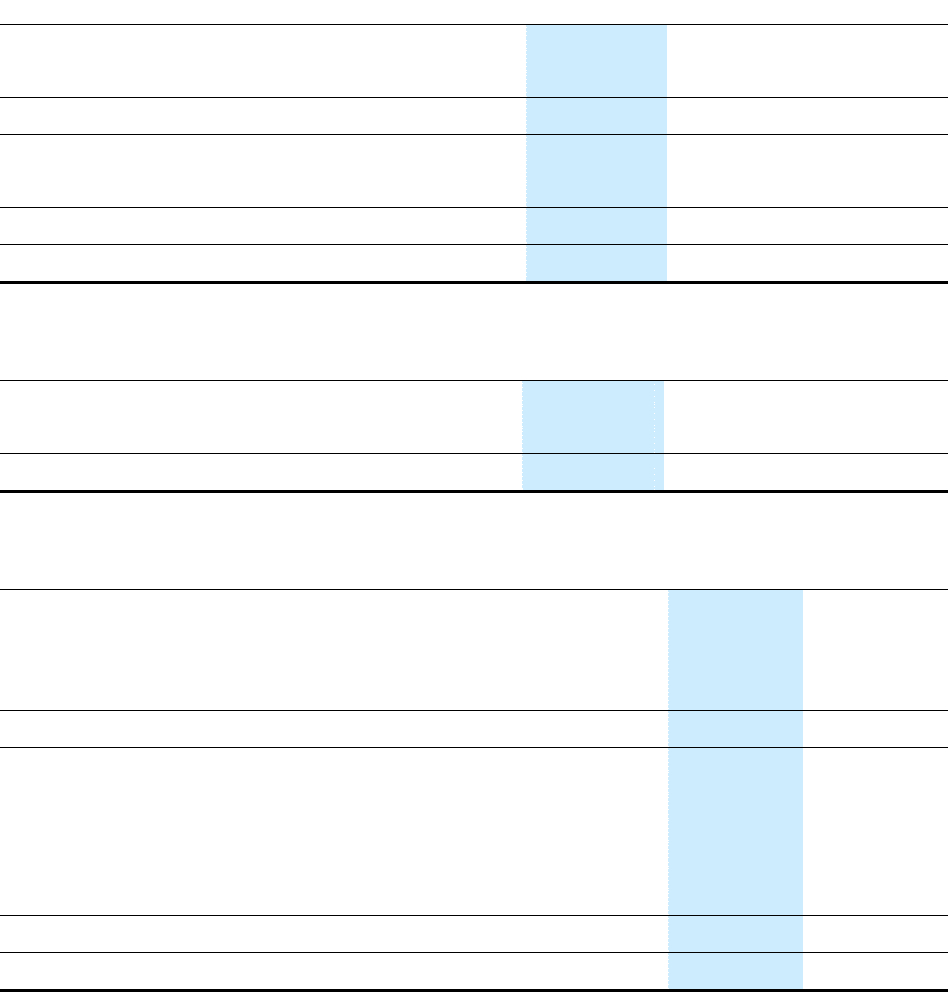

7. INCOME TAXES

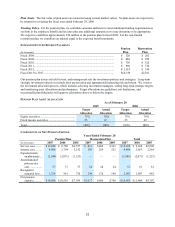

PROVISION FOR INCOME TAXES

Years Ended February 28

(In thousands) 2007 2006 2005

Current:

Federal .................................................................................. $ 116,125 $ 92,488 $ 62,662

State ...................................................................................... 18,031 11,431 10,117

Total.......................................................................................... 134,156 103,919 72,779

Deferred:

Federal .................................................................................. (9,024) (18,764) (7,463)

State ...................................................................................... (380) (1,774) (810)

Total.......................................................................................... (9,404) (20,538) (8,273)

Provision for income taxes................................................................. $ 124,752 $ 83,381 $ 64,506

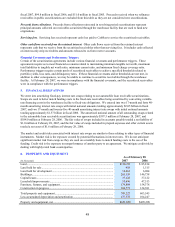

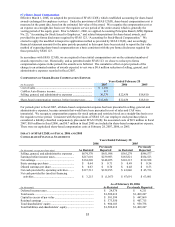

EFFECTIVE INCOME TAX RATE RECONCILIATION

Years Ended February 28

2007 2006 2005

Federal statutory income tax rate............................................... 35.0% 35.0% 35.0%

State and local income taxes, net of federal benefit................... 3.5 3.0 3.6

Nondeductible items.................................................................. 0.1 0.3 0.3

Effective income tax rate........................................................... 38.6% 38.3% 38.9%

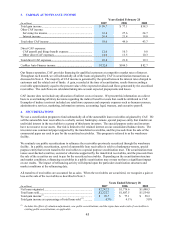

TEMPORARY DIFFERENCES RESULTING IN DEFERRED TAX ASSETS AND LIABILITIES

As of February 28

(In thousands) 2007 2006

Deferred tax assets:

Accrued expenses............................................................................................... $20,954 $16,887

Partnership basis ................................................................................................ 6,138 6,229

Inventory............................................................................................................ 2,036 —

Stock compensation ........................................................................................... 24,282 20,365

Total gross deferred tax assets............................................................................... 53,410 43,481

Deferred tax liabilities:

Securitized receivables....................................................................................... 18,540 19,699

Prepaid expenses................................................................................................ 7,295 10,757

Inventory............................................................................................................ — 7,476

Depreciation and amortization ........................................................................... 504 4,508

Other .................................................................................................................. 29 27

Total gross deferred tax liabilities ......................................................................... 26,368 42,467

Net deferred tax asset ............................................................................................ $27,042 $ 1,014

Based on our historical and current pretax earnings, management believes the amount of gross deferred tax assets

will more likely than not be realized through future taxable income and future reversals of existing temporary

differences; therefore, no valuation allowance is necessary.