CarMax 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

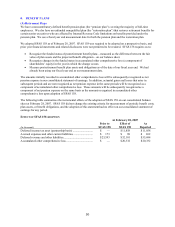

(C) Share-Based Compensation

Effective March 1, 2006, we adopted the provisions of SFAS 123(R), which established accounting for share-based

awards exchanged for employee services. Under the provisions of SFAS 123(R), share-based compensation cost is

measured at the grant date, based on the estimated fair value of the award. We recognize the compensation cost as

an expense on a straight-line basis over the requisite service period of the entire award, which is generally the

vesting period of the equity grant. Prior to March 1, 2006, we applied Accounting Principles Board (APB) Opinion

No. 25, “Accounting for Stock Issued to Employees,” and related interpretations for share-based awards, and

provided the pro forma disclosures required by SFAS 123, “Accounting for Stock-Based Compensation.” We

elected to apply the modified retrospective application method as provided by SFAS 123(R), and, accordingly,

financial statement amounts for the prior periods presented in this report have been restated to report the fair value

method of expensing share-based compensation on a basis consistent with the pro forma disclosures required for

those periods by SFAS 123.

In accordance with SFAS 123(R), we are required to base initial compensation cost on the estimated number of

awards expected to vest. Historically, and as permitted under SFAS 123, we chose to reduce pro forma

compensation expense in the periods the awards were forfeited. The cumulative effect on prior periods of the

change to an estimated number of awards expected to vest was a $0.6 million reduction of selling, general, and

administrative expenses recorded in fiscal 2007.

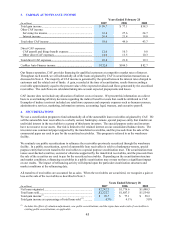

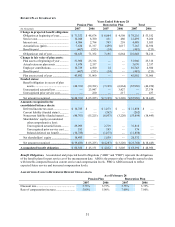

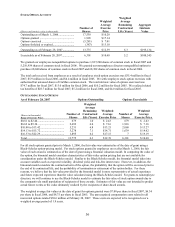

COMPOSITION OF SHARE-BASED COMPENSATION EXPENSE

Years Ended February 28

(In thousands) 2007 2006 2005

Cost of sales............................................................................... $ 1,392

CarMax Auto Finance income................................................... 917

Selling, general, and administrative expenses ........................... 30,379 $ 22,436 $ 18,810

Share-based compensation expense, before income taxes ......... $ 32,688 $ 22,436 $ 18,810

For periods prior to fiscal 2007, all share-based compensation expense has been presented in selling, general, and

administrative expenses, because amounts that would have been presented in cost of sales and CAF were

immaterial. We recognize compensation expense for stock options and restricted stock on a straight-line basis over

the requisite service period. Consistent with the provisions of SFAS 123, our employee stock purchase plan is

considered a liability-classified compensatory plan under SFAS 123(R); the associated costs of $0.9 million in fiscal

2007, $0.8 million in fiscal 2006, and $0.7 million in fiscal 2005 are included in share-based compensation expense.

There were no capitalized share-based compensation costs at February 28, 2007, 2006, or 2005.

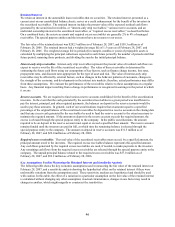

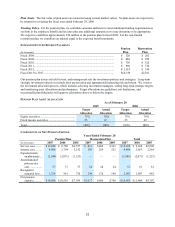

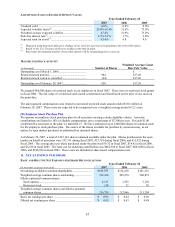

IMPACT OF SFAS 123(R) ON FISCAL 2006 AND 2005

CONSOLIDATED FINANCIAL STATEMENTS

Years Ended February 28

2006 2005

(In thousands, except per share data) As Restated

Previously

Reported As Restated

Previously

Reported

Selling, general, and administrative expenses .. $ 674,370 $ 651,988 $ 565,279 $ 546,577

Earnings before income taxes........................... $ 217,601 $ 239,983 $ 165,821 $ 184,523

Net earnings...................................................... $ 134,220 $ 148,055 $ 101,315 $ 112,928

Basic earnings per share ................................... $ 0.64 $ 0.71 $ 0.49 $ 0.54

Diluted earnings per share ................................ $ 0.63 $ 0.70 $ 0.48 $ 0.53

Net cash provided by operating activities......... $ 117,513 $ 122,295 $ 41,846 $ 45,736

Net cash provided by (used in) financing

activities ........................................................ $ 3,215 $ (1,567) $ 67,691 $ 63,801

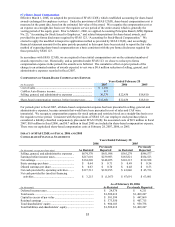

As of February 28, 2006

(In thousands) As Restated Previously Reported

Deferred income taxes ................................................................. $ 24,576 $ 4,211

Total assets .................................................................................. $ 1,509,612 $ 1,489,247

Capital in excess of par value ...................................................... $ 501,599 $ 447,069

Retained earnings ........................................................................ $ 373,550 $ 407,715

Total shareholders’ equity ........................................................... $ 980,103 $ 959,738

Total liabilities and shareholders’ equity..................................... $ 1,509,612 $ 1,489,247