CarMax 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

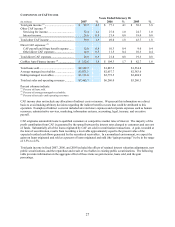

Wholesale Vehicle Gross Profit

Fiscal 2007 Versus Fiscal 2006. In spite of the challenging comparison with the prior year, our wholesale vehicle

gross profit increased $42 per unit in fiscal 2007. Our wholesale vehicle profitability has steadily increased over the

last several years, reflecting the benefits realized from improvements and refinements in our car-buying strategies,

our appraisal delivery processes, and our in-store auction processes. We have made continuous improvements in

these processes, which we believe has allowed us to become more efficient. Our in-store auctions have benefited

from our initiatives to increase average dealer attendance, which we believe has allowed us to achieve higher prices.

Fiscal 2006 Versus Fiscal 2005. Our wholesale vehicle gross profit increased $236 per unit in fiscal 2006. We

believe a portion of this increase resulted from the unusually strong wholesale pricing environment in fiscal 2006.

In addition, the refinements in our in-store appraisal strategy benefited our wholesale operations, while allowing us

to maintain used vehicle gross profit dollars per unit levels in the face of rising vehicle acquisition costs. While we

did not increase our appraisal offers at the same rate as the steep increase in the major public wholesale auction

market prices, our own wholesale auctions generally reflected the pricing trends of the public wholesale auctions.

Our wholesale gross profit was particularly strong in the second half of fiscal 2006 as the result of a combination of

factors. The supply/demand imbalance for older, higher mileage cars created by Hurricanes Katrina, Rita, and

Wilma resulted in unusually strong demand and price realizations for our wholesale vehicles. In addition, as we

normally do in the third quarter, we adjusted our appraisal offers to incorporate the anticipated seasonal drop in

wholesale pricing. Wholesale industry pricing typically declines during the fall due to pressure from model year

closeout sales and from reduced demand at auction as dealers pare back inventories heading into the slower-volume

winter months. We were particularly aggressive in our appraisals of SUVs where wholesale prices had fallen

dramatically through the summer following sharp increases in the cost of gasoline. Pricing in the overall wholesale

marketplace did not decline as much as anticipated, however, giving us unusually high third quarter wholesale gross

profits.

Other Gross Profit

Fiscal 2007 Versus Fiscal 2006. Other gross profit increased $40 per unit in fiscal 2007. The improvement was the

result of the growth in ESP sales and third-party finance fees, both of which have no associated cost of sales, and an

increase in service department margins. Our service department reported higher profits, reflecting the greater

overhead expense absorption provided by the significant increase in used vehicles sales and the associated

reconditioning volumes.

Fiscal 2006 Versus Fiscal 2005. Other gross profit per unit increased $25 per unit in fiscal 2006. The

improvement was primarily the result of improved penetration in sales of ESPs and the growth in service profits.

The service department, which is the only category within other sales and revenues that has an associated cost of

sales, reported higher profits reflecting the greater overhead expense absorption provided by the higher vehicle sales

and reconditioning volumes.

Impact of Inflation

Inflation has not been a significant contributor to results. Profitability is based on achieving targeted unit sales and

gross profit dollars per vehicle rather than on average retail prices. However, CAF income will benefit from an

increase in the average amount financed.

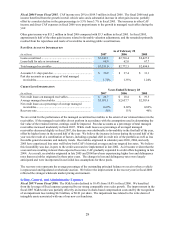

CarMax Auto Finance Income

CAF provides automobile financing for our used and new car sales. Because the purchase of an automobile is

traditionally reliant on the consumer’ s ability to obtain on-the-spot financing, it is important to our business that

financing be available to creditworthy customers. While financing can also be obtained from third-party sources, we

believe that total reliance on third parties can create unacceptable volatility and business risk. Furthermore, we

believe that our processes and systems, the transparency of our pricing, and our vehicle quality provide a unique and

ideal environment in which to procure high-quality auto finance receivables, both for CAF and for our third-party

lenders. CAF provides us the opportunity to capture additional profits and cash flows from auto loan receivables

while managing our reliance on third-party finance sources.