CarMax 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

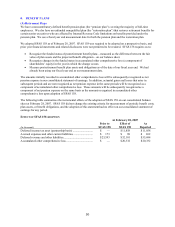

8. BENEFIT PLANS

(A) Retirement Plans

We have a noncontributory defined benefit pension plan (the “pension plan”) covering the majority of full-time

employees. We also have an unfunded nonqualified plan (the “restoration plan”) that restores retirement benefits for

certain senior executives who are affected by Internal Revenue Code limitations on benefits provided under the

pension plan. We use a fiscal year end measurement date for both the pension plan and the restoration plan.

We adopted SFAS 158 as of February 28, 2007. SFAS 158 was required to be adopted on a prospective basis, and

prior year financial statements and related disclosures were not permitted to be restated. SFAS 158 requires us to:

• Recognize the funded status of postretirement benefit plans – measured as the difference between the fair

value of plan assets and the projected benefit obligation – on our balance sheet.

• Recognize changes in the funded status in accumulated other comprehensive loss (a component of

shareholders’ equity) in the year in which the change occurs.

• Measure postretirement benefit plan assets and obligations as of the date of our fiscal year end. We had

already been using our fiscal year end as our measurement date.

The amounts initially recorded in accumulated other comprehensive loss will be subsequently recognized as net

pension expense in our consolidated statement of earnings. In addition, actuarial gains and losses that arise in

subsequent periods and are not recognized as net pension expense in the same periods will be recognized as a

component of accumulated other comprehensive loss. Those amounts will be subsequently recognized as a

component of net pension expense on the same basis as the amounts recognized in accumulated other

comprehensive loss upon adoption of SFAS 158.

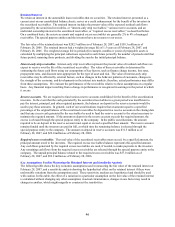

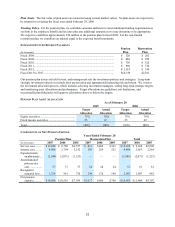

The following table summarizes the incremental effects of the adoption of SFAS 158 on our consolidated balance

sheet at February 28, 2007. SFAS 158 did not change the existing criteria for measurement of periodic benefit costs,

plan assets, or benefit obligations, and the adoption of this statement had no effect on our consolidated statement of

earnings for any period.

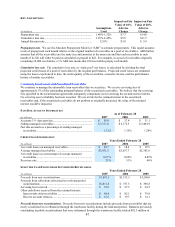

EFFECT OF SFAS 158 ADOPTION

At February 28, 2007

Prior to Effect of As

(In thousands) SFAS 158 SFAS 158 Reported

Deferred income tax asset (partnership basis) ............................ $ — $ 11,858 $ 11,858

Accrued expenses and other current liabilities ........................... $ 173 $ 89 $ 262

Deferred revenue and other liabilities......................................... $ 23,593 $ 32,101 $ 55,694

Accumulated other comprehensive loss ..................................... $ — $ 20,332 $ 20,332