CarMax 2007 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

(F) Inventory

Inventory is comprised primarily of vehicles held for sale or undergoing reconditioning and is stated at the lower of

cost or market. Vehicle inventory cost is determined by specific identification. Parts and labor used to recondition

vehicles, as well as transportation and other incremental expenses associated with acquiring and reconditioning

vehicles, are included in inventory. Certain manufacturer incentives and rebates for new car inventory, including

holdbacks, are recognized as a reduction to new car inventory when we purchase the vehicles. We recognize

volume-based incentives as a reduction to cost of sales when we determine the achievement of qualifying sales

volumes is probable.

(G) Property and Equipment

Property and equipment is stated at cost less accumulated depreciation and amortization. Depreciation and

amortization are calculated using the straight-line method over the shorter of the asset's estimated useful life or the

lease term, if applicable. Property held under capital lease is stated at the lesser of the present value of the future

minimum lease payments at the inception of the lease or fair value. Amortization of capital lease assets is computed

on a straight-line basis over the shorter of the initial lease term or the estimated useful life of the asset and is

included in depreciation expense. Costs incurred during new store construction are capitalized as construction-in-

progress and reclassified to the appropriate fixed asset category when the store opens.

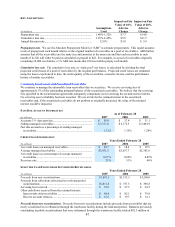

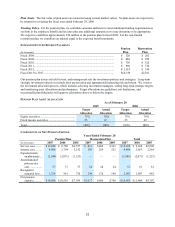

ESTIMATED USEFUL LIVES

Life

Buildings.......................................................................................................................................... 25 – 40 years

Capital leases ................................................................................................................................... 10 – 20 years

Leasehold improvements................................................................................................................. 8 – 15 years

Furniture, fixtures, and equipment................................................................................................... 5 – 15 years

We review long-lived assets for impairment when circumstances indicate the carrying amount of an asset may not be

recoverable. We recognize impairment when the sum of undiscounted estimated future cash flows expected to result

from the use of the asset is less than the carrying value of the asset.

(H) Other Assets

Computer Software Costs

We capitalize external direct costs of materials and services used in the development of internal-use software and

payroll and payroll-related costs for employees directly involved in the development of internal-use software. We

amortize amounts capitalized on a straight-line basis over five years.

Goodwill and Intangible Assets

We review goodwill and intangible assets for impairment annually or when circumstances indicate the carrying

amount may not be recoverable.

Restricted Cash Deposits

At February 28, 2007, and February 28, 2006, other assets included restricted cash deposits of $21.7 million and

$17.7 million, respectively, associated with certain insurance programs.

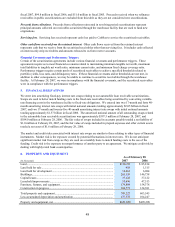

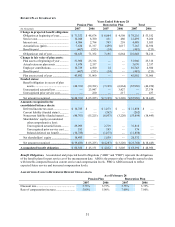

(I) Defined Benefit Plan Obligations

Defined benefit retirement plan obligations are included in accrued expenses and other current liabilities and

deferred revenue and other liabilities on our consolidated balance sheets. The current portion represents benefits

expected to be paid over the next 12 months from our benefit restoration plan. We previously reported defined

benefit retirement plan obligations entirely in accrued expenses and other current liabilities. The defined benefit

retirement plan obligations are determined by independent actuaries using a number of assumptions provided by the

company. Key assumptions used in measuring the plan obligations include the discount rate, the estimated long-

term return on plan assets, the estimated rate of compensation increases, and the mortality rate.

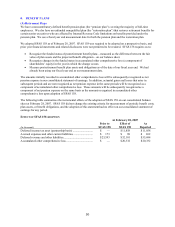

On February 28, 2007, we adopted SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Plans – an amendment of FASB Statements No. 87, 88, 106 and 132(R),” (“SFAS 158”). See Note

8(A) for additional discussion.

(J) Insurance Liabilities

Insurance liabilities are included in accrued expenses and other current liabilities on our consolidated balance sheets.

We use a combination of insurance and self-insurance for a number of risks including workers' compensation,