CarMax 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.20

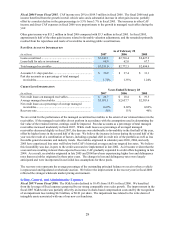

results from recording a receivable equal to the present value of the expected residual cash flows generated by the

securitized receivables. The fair value of our retained interest in securitization transactions includes the present

value of the expected residual cash flows generated by the securitized receivables, cash reserve accounts, and an

undivided ownership interest in the receivables.

The present value of the expected residual cash flows generated by the securitized receivables is determined by

estimating the future cash flows using management’ s assumptions of key factors, such as finance charge income,

loss rates, prepayment rates, and discount rates appropriate for the type of asset and risk. These assumptions are

derived from historical experience and projected economic trends. Adjustments to one or more of these assumptions

may have a material impact on the fair value of the retained interest. The fair value of the retained interest may also

be affected by external factors, such as changes in the behavior patterns of customers, changes in the economy, and

developments in the interest rate markets. Note 2(C) includes a discussion of accounting policies related to

securitizations. Note 4 includes a discussion of securitizations and provides a sensitivity analysis showing the

hypothetical effect on the retained interest if there were variations from the assumptions used. In addition, see the

“CarMax Auto Finance Income” section of this MD&A for a discussion of the effect of changes in our assumptions.

Revenue Recognition

We recognize revenue when the earnings process is complete, generally either at the time of sale to a customer or

upon delivery to a customer. We recognize used vehicle revenue when a sales contract has been executed and the

vehicle has been delivered, net of a reserve for returns under our 5-day, money-back guarantee. A reserve for

vehicle returns is recorded based on historical experience and trends, and it could be affected if future vehicle

returns differ from historical averages.

We also sell ESPs on behalf of unrelated third parties to customers who purchase a vehicle. Because these third

parties are the primary obligors under these programs, we recognize commission revenue on the ESPs at the time of

the sale, net of a reserve for returns. The reserve for ESP returns is recorded based on historical experience and

trends, and it could be affected if future returns differ from historical averages.

Income Taxes

Estimates and judgments are used in the calculation of certain tax liabilities and in the determination of the

recoverability of certain of the deferred tax assets. In the ordinary course of business, transactions occur for which

the ultimate tax outcome is uncertain at the time of the transactions. We adjust our income tax provision in the

period in which we determine that it is probable that our actual results will differ from our estimates. Tax law and

rate changes are reflected in the income tax provision in the period in which such changes are enacted.

We evaluate the need to record valuation allowances that would reduce deferred tax assets to the amount that will

more likely than not be realized. When assessing the need for valuation allowances, we consider future reversals of

existing temporary differences and future taxable income. We believe that all of our recorded deferred tax assets as

of February 28, 2007, will more likely than not be realized. However, if a change in circumstances results in a

change in our ability to realize our deferred tax assets, our tax provision would increase in the period when the

change in circumstances occurs.

In addition, the calculation of our tax liabilities involves dealing with uncertainties in the application of complex tax

regulations. We recognize potential liabilities for anticipated tax audit issues in the U.S. and other tax jurisdictions

based on our estimate of whether, and the extent to which, additional taxes will be due. If payments of these

amounts ultimately prove to be unnecessary, the reversal of the liabilities would result in tax benefits being

recognized in the period when we determine the liabilities are no longer necessary. If our estimate of tax liabilities

proves to be less than the ultimate assessment, a further charge to expense would result in the period of

determination.

Information regarding income taxes is presented in Note 7.

Defined Benefit Retirement Plan

The plan obligations and related assets of our defined benefit retirement plan are presented in Note 8. Plan assets,

which consist primarily of marketable equity and debt instruments, are valued using current market quotations. Plan

obligations and the annual pension expense are determined by independent actuaries using a number of assumptions

provided by the company. Key assumptions used to measure the plan obligations include the discount rate, the