CarMax 2007 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

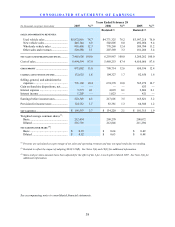

47

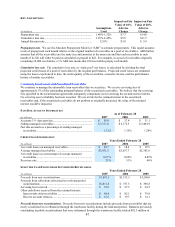

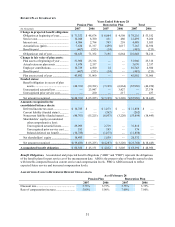

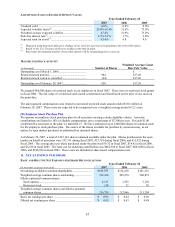

KEY ASSUMPTIONS

(In millions)

Assumptions

Used

Impact on Fair

Value of 10%

Adverse

Change

Impact on Fair

Value of 20%

Adverse

Change

Prepayment rate........................................................................ 1.40%-1.52% $ 7.7 $ 14.8

Cumulative loss rate ................................................................. 1.25%-2.45% $ 5.9 $ 11.7

Annual discount rate................................................................. 12.0% $ 3.0 $ 5.9

Prepayment rate. We use the Absolute Prepayment Model or “ABS” to estimate prepayments. This model assumes

a rate of prepayment each month relative to the original number of receivables in a pool of receivables. ABS further

assumes that all the receivables are the same size and amortize at the same rate and that each receivable in each

month of its life will either be paid as scheduled or prepaid in full. For example, in a pool of receivables originally

containing 10,000 receivables, a 1% ABS rate means that 100 receivables prepay each month.

Cumulative loss rate. The cumulative loss rate, or “static pool” net losses, is calculated by dividing the total

projected credit losses of a pool of receivables by the original pool balance. Projected credit losses are estimated

using the losses experienced to date, the credit quality of the receivables, economic factors, and the performance

history of similar receivables.

Continuing Involvement with Securitized Receivables

We continue to manage the automobile loan receivables that we securitize. We receive servicing fees of

approximately 1% of the outstanding principal balance of the securitized receivables. We believe that the servicing

fees specified in the securitization agreements adequately compensate us for servicing the securitized receivables.

No servicing asset or liability has been recorded. We are at risk for the retained interest in the securitized

receivables and, if the securitized receivables do not perform as originally projected, the value of the retained

interest would be impacted.

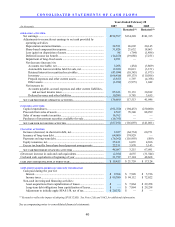

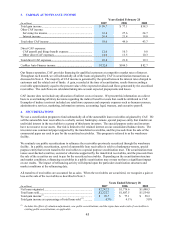

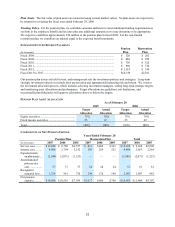

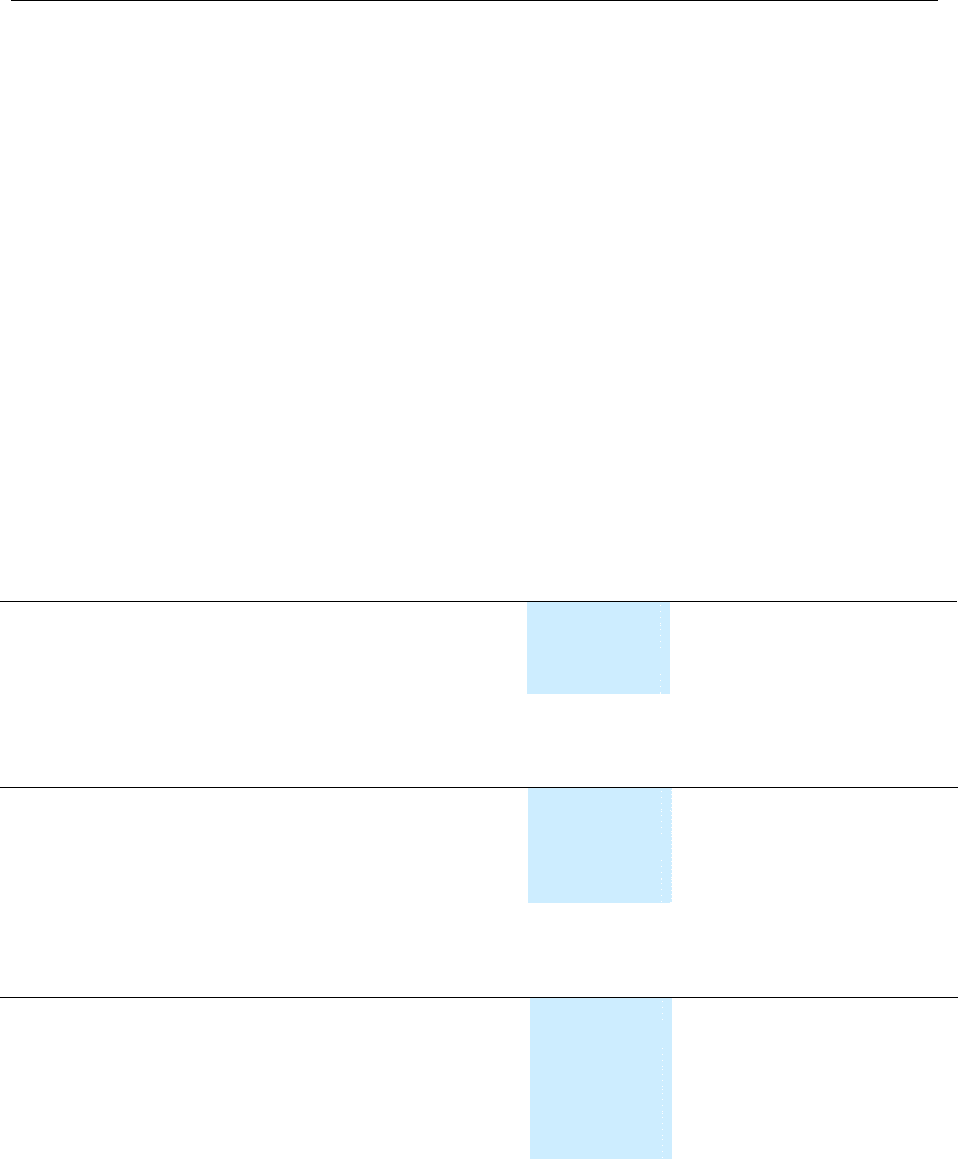

PAST DUE ACCOUNT INFORMATION

As of February 28

(In millions) 2007 2006 2005

Accounts 31+ days past due....................................................... $ 56.9 $ 37.4 $ 31.1

Ending managed receivables...................................................... $ 3,311.0 $ 2,772.5 $ 2,494.9

Past due accounts as a percentage of ending managed

receivables.............................................................................. 1.72% 1.35% 1.24%

CREDIT LOSS INFORMATION

Years Ended February 28

(In millions) 2007 2006 2005

Net credit losses on managed receivables.................................. $ 20.7 $ 18.4 $ 19.5

Average managed receivables ................................................... $ 3,071.1 $ 2,657.7 $ 2,383.6

Net credit losses as a percentage of average managed

receivables.............................................................................. 0.67% 0.69% 0.82%

Recovery rate............................................................................. 51% 51% 46%

SELECTED CASH FLOWS FROM SECURITIZED RECEIVABLES

Years Ended February 28

(In millions) 2007 2006 2005

Proceeds from new securitizations ............................................ $1,867.5 $1,513.5 $1,260.0

Proceeds from collections reinvested in revolving period

securitizations ........................................................................ $1,011.8 $ 757.5 $ 590.8

Servicing fees received.............................................................. $ 32.0 $ 27.3 $ 24.5

Other cash flows received from the retained interest:

Interest-only strip receivables ................................................ $ 88.4 $ 82.1 $ 79.8

Reserve account releases........................................................ $ 15.2 $ 19.7 $ 14.1

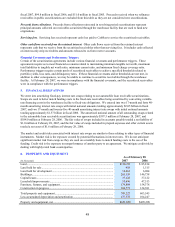

Proceeds from new securitizations. Proceeds from new securitizations include proceeds from receivables that are

newly securitized in or refinanced through the warehouse facility during the indicated period. Balances previously

outstanding in public securitizations that were refinanced through the warehouse facility totaled $82.5 million in