CarMax 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

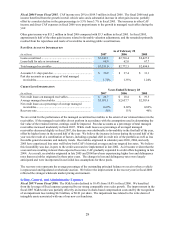

Off-Balance Sheet Arrangements

CAF provides financing for our used and new car sales. We use a securitization program to fund substantially all of

the automobile loan receivables originated by CAF. We sell the automobile loan receivables to a wholly owned,

bankruptcy-remote, special purpose entity that transfers an undivided interest in the receivables to a group of third-

party investors. This program is referred to as the warehouse facility.

We periodically use public securitizations to refinance the receivables previously securitized through the warehouse

facility. In a public securitization, a pool of automobile loan receivables is sold to a bankruptcy-remote, special

purpose entity that in turn transfers the receivables to a special purpose securitization trust.

Additional information regarding the nature, business purposes, and importance of our off-balance sheet

arrangement to our liquidity and capital resources can be found in the CarMax Auto Finance Income, Financial

Condition, and Market Risk sections of this MD&A, as well as in Notes 3 and 4.