CarMax 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

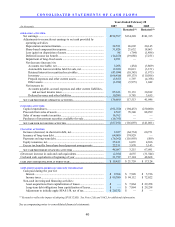

32

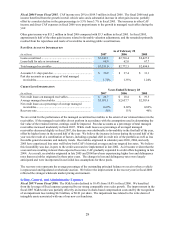

Investing Activities

Net cash used in investing activities was $187.2 million in fiscal 2007, $116.1 million in fiscal 2006, and $141.1

million in fiscal 2005. Capital expenditures were $191.8 million in fiscal 2007, $194.4 million in fiscal 2006, and

$230.1 million in fiscal 2005. In addition to store construction costs, capital expenditures for all three years

included the cost of land acquired for future year store openings. In fiscal 2006 and fiscal 2005, capital expenditures

also included costs associated with our new home office, which was completed in October 2005.

Historically, capital expenditures have been funded with internally generated funds, short- and long-term debt, and

sale-leaseback transactions. Net proceeds from the sales of assets totaled $4.6 million in fiscal 2007, $78.3 million

in fiscal 2006, and $89.0 million in fiscal 2005. The majority of the sale proceeds in fiscal 2006 and fiscal 2005

related to sale-leaseback transactions. In fiscal 2006, we entered into sale-leaseback transactions involving five

superstores valued at $72.7 million. In fiscal 2005, we entered into sale-leaseback transactions involving seven

superstores valued at approximately $84.0 million. These transactions were structured with initial lease terms of

either 15 or 20 years with four, five-year renewal options. At February 28, 2007, we owned 20 superstores currently

in operation, as well as the company’ s home office in Richmond, Virginia. In addition, six store facilities were

accounted for as capital leases.

Financing Activities

Net cash provided by financing activities was $48.1 million in fiscal 2007, $3.2 million in fiscal 2006, and $67.7

million in fiscal 2005. We used cash generated from operations to reduce total debt by $9.5 million in fiscal 2007

and $6.8 million in fiscal 2006. In fiscal 2005, we increased total debt by $60.2 million primarily to fund increased

inventory.

In December 2006, we amended our revolving credit facility. The term of the agreement was extended from August

2009 to December 2011, and the aggregate borrowings available under the agreement were increased from $450

million to $500 million. Borrowings under this credit facility are available for working capital and general corporate

purposes, and are secured by our vehicle inventory.

As of February 28, 2007, $150.7 million was outstanding under the credit facility, with the remainder fully available

to us. The outstanding balance included $3.3 million classified as short-term debt, and $147.4 million classified as

current portion of long-term debt. We classified the outstanding balance at February 28, 2007, as current portion of

long-term debt based on our expectation that this balance will not remain outstanding for more than one year.

Cash received on equity issuances, which primarily related to employee stock option exercises, increased to $35.4

million in fiscal 2007 compared with $6.0 million in fiscal 2006 and $4.3 million in fiscal 2005. The increase

reflected exercises by the former chief executive officer in connection with his retirement, and other exercises

prompted by the significant increase in our stock price in fiscal 2007.

We expect that cash generated by operations; proceeds from securitization transactions; and, if needed, additional

debt and sale-leaseback transactions will be sufficient to fund capital expenditures and working capital for the

foreseeable future.

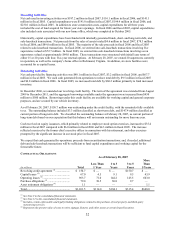

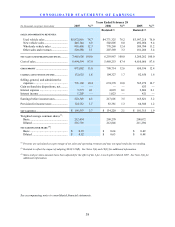

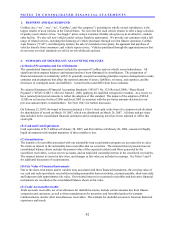

CONTRACTUAL OBLIGATIONS

As of February 28, 2007

(In millions)

Total

Less Than

1 Year

1 to 3

Years

3 to 5

Years

More

Than

5 Years

Revolving credit agreement (1) .................... $ 150.7 $ — $ — $ 150.7 $ —

Capital leases (2) .......................................... 67.0 4.5 9.1 9.5 43.9

Operating leases (2)...................................... 963.7 71.0 144.2 145.5 603.0

Purchase obligations (3) ............................... 79.0 38.5 30.8 9.7 —

Asset retirement obligations (4) 1.1 — — — 1.1

Total............................................................ $1,261.5 $114.0 $184.1 $ 315.4 $ 648.0

(1) See Note 9 to the consolidated financial statements.

(2) See Note 12 to the consolidated financial statements.

(3) Includes certain enforceable and legally binding obligations related to the purchase of real property and third-party

outsourcing services.

(4) Represents the present value of costs to retire signage, fixtures, and other assets at certain leased locations.