CarMax 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Fiscal Year 2007

CARMAX, INC. ANNUAL REPORT

Table of contents

-

Page 1

CARMAX, INC. ANNUAL REPORT Fiscal Year 2007 -

Page 2

... a fixed fee per origination in return for loan portfolios that we estimate are significantly less risky than their other auto loan portfolios due to the straightforward way CarMax manages Tom Folliard President and Chief Executive Officer financing and the meticulous reconditioning of our vehicles... -

Page 3

...: low, no-haggle prices; a broad selection; high-quality vehicles; and customer-friendly service. During fiscal 2007, we retailed 337,021 used vehicles and sold 208,959 wholesale vehicles at our in-store auctions. As of February 28, 2007, we operated 77 used car superstores in 36 markets. ways to... -

Page 4

...BELOW] We were the first used vehicle retailer to offer a large selection of high-quality used vehicles at competitively low, no-haggle prices using a customer-friendly sales process in an attractive, modern sales facility. For 14 years, we have revolutionized the used car industry. We have built... -

Page 5

... CarMax; we'll buy their car every time, whether or not they buy from us. Our buyers will independently appraise the customer's vehicle and make an offer based solely on the vehicle's estimated wholesale value and current market conditions. Customers also trust in the quality of the vehicles we sell... -

Page 6

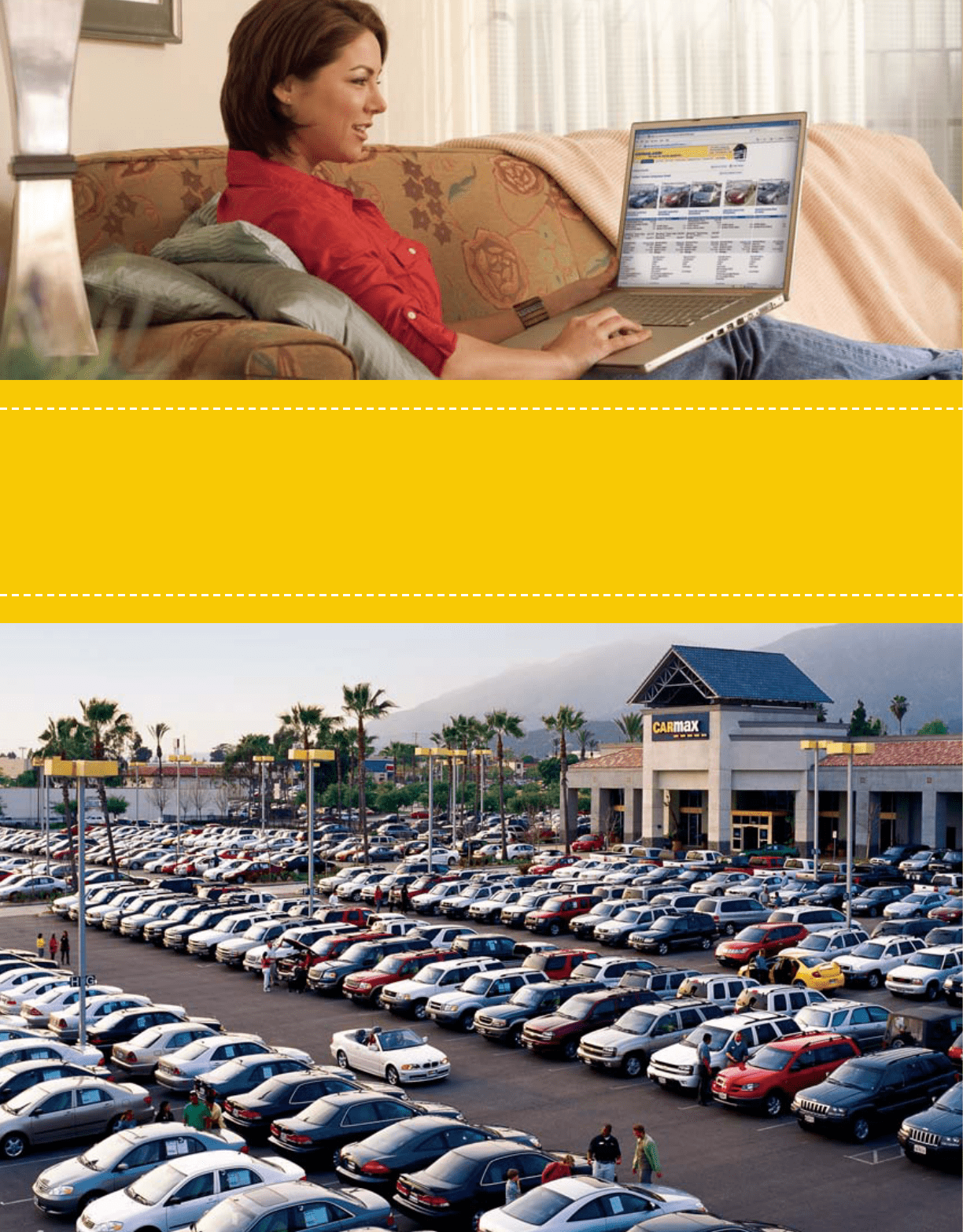

[LEFT] CarMax's unique finance origination process allows our customers to see each offer directly from the lender, and where multiple offers exist, they may choose the one that best suits their needs. [BELOW] At the end of fiscal 2007, we had 77 used car superstores located in 36 markets. ... -

Page 7

... between driving sales and improving profits. Low, fixed prices, customer-friendly service, and transparency throughout the process of selling and buying a vehicle are ways CarMax offers greater value. Customers view all pertinent information along with their sales consultant, including financing... -

Page 8

... vehicles for sale, many times the number of used vehicles at most competitors. [BELOW] Our sales consultants play a significant role in ensuring a customer-friendly sales process. Our "no-haggle" pricing and our commission structure allow our sales consultants to focus solely on meeting customer... -

Page 9

... of our auctions, as well as expanding the services offered to dealers. In fiscal 2007, we upgraded our CarMax auctions website, expanding the available vehicle data and adding new search and alert features. We also expanded our free vehicle history service to include all our wholesale vehicles, and... -

Page 10

... to our customers. Outstanding customer service is one of CarMax's founding principles. Many of our associates demonstrate commitment to customers that goes well beyond our own high standards. We celebrate these special associates with our Above & Beyond award program. Their stories of care and... -

Page 11

..., RICHMOND, VIRGINIA (Address of principal executive offices) 23238 (Zip Code) Registrant's telephone number, including area code: (804) 747-0422 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, par value... -

Page 12

... closing price of the registrant' s common stock on the New York Stock Exchange on that date, was $4.0 billion. On March 31, 2007, there were 216,045,438 outstanding shares of CarMax, Inc. common stock. DOCUMENTS INCORPORATED BY REFERENCE Portions of the CarMax, Inc. Notice of 2007 Annual Meeting... -

Page 13

... with Accountants on Accounting and Financial Disclosure ...Controls and Procedures...Other Information...PART III Item 10. Item 11. Item 12. Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 14

...959 wholesale vehicles in fiscal 2007 through our on-site auctions. We were the first used vehicle retailer to offer a large selection of high quality used vehicles at competitively low, fixed prices using a customer-friendly sales process in an attractive, modern sales facility. The CarMax consumer... -

Page 15

... lenders; the sale of extended service plans and accessories; the appraisal and purchase of vehicles directly from consumers; and vehicle repair service. The CarMax consumer offer enables customers to evaluate separately each component of the sales process and to make informed decisions based on... -

Page 16

... store locations, as well as sorting and comparison features that allow consumers to easily compare vehicles. The site also includes features such as detailed vehicle reviews, payment calculators, and an option to estimate trade-in values via a link with Kelley Blue Book. Customers can contact sales... -

Page 17

... offer that is good for 7 days. An appraisal is available to every customer free of charge, whether or not the individual purchases a vehicle from us. Based on their age, mileage, or condition, fewer than half of the vehicles acquired through this in-store appraisal process meet our high quality... -

Page 18

... vehicle appraisal offers, financing rates, accessories, extended service plan pricing, and vehicle documentation fees. Reconditioning and Service. An integral part of our used car consumer offer is the reconditioning process. This process includes a comprehensive, Certified Quality Inspection... -

Page 19

...and salaried associates and 3,342 sales associates, who worked on a commission basis. Sales associates include both full-time and part-time employees. We employ additional associates during peak selling seasons. At February 28, 2007, our location general managers averaged more than 8 years of CarMax... -

Page 20

...Most new store associates are also assigned mentors who provide on-the-job guidance and support. We also provide comprehensive, facilitated classroom training courses to sales consultants, buyers, automotive technicians, and managers. All sales consultants receive extensive customer service training... -

Page 21

... business. Our competition includes publicly and privately owned franchised new car dealers and independent dealers, as well as millions of private individuals. Our competitors may sell the same or similar makes of vehicles that we offer in the same or similar markets at competitive prices... -

Page 22

... to local economic, competitive, and other conditions prevailing in geographic areas where we operate. Since a large number of our superstores are located in the Southeastern U.S. and in the Chicago, Los Angeles, Houston, Dallas, and Washington, D.C./Baltimore markets, our results of operations... -

Page 23

...28, 2007 Used Car Superstores Mega Standard (2) Satellite (2) Co-Located New Car Stores (1) Total Alabama...California...Connecticut...Florida...Georgia ...Illinois...Indiana ...Kansas...Kentucky...Maryland...Missouri...Nevada...New Mexico ...North Carolina ...Ohio ...Oklahoma ...South Carolina... -

Page 24

...from a real estate and an advertising/awareness building perspective, and they are where we have generally experienced the fastest ramp-up in store sales and profitability. We are also beginning to resume store growth in new large markets. For additional details on fiscal 2008 planned store openings... -

Page 25

... II Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. Our common stock is listed and traded on the New York Stock Exchange under the ticker symbol KMX. As of February 28, 2007, there were approximately 6,300 CarMax shareholders of... -

Page 26

COMP ARI SON OF CUMULATI VE FI VE YE AR TOTAL RETURN (I ncl ude s rei nves tment of di vi dends, i f an y) 250 200 DOLLARS 150 100 50 0 2002 2003 2004 2005 2006 2007 CarMax S&P 500 Index S&P 500 Retailing Index CarMax ...S&P 500 Index ...S&P 500 Retailing Index ... 2002 $100.00 $100.00... -

Page 27

... FY06 FY05 FY04 FY03 FY02 Used vehicle sales ...New vehicle sales ...Wholesale vehicle sales...Other sales and revenues...Net sales and operating revenues...Gross profit ...CarMax Auto Finance income...SG&A ...Earnings before income taxes...Provision for income taxes...Net earnings...Share and... -

Page 28

...of whom are independent dealers and licensed wholesalers. CarMax provides financing to qualified customers through CarMax Auto Finance ("CAF"), the company' s finance operation, and Bank of America, and through several other third-party lenders. We collect fixed, prenegotiated fees from the majority... -

Page 29

... of gross profit per used unit, regardless of retail price. Used unit sales growth is our primary focus. We plan to open used car superstores at a rate of approximately 15% to 20% of our used car superstore base each year. In fiscal 2008, we plan to open 13 superstores, expanding our store base by... -

Page 30

...earnings process is complete, generally either at the time of sale to a customer or upon delivery to a customer. We recognize used vehicle revenue when a sales contract has been executed and the vehicle has been delivered, net of a reserve for returns under our 5-day, money-back guarantee. A reserve... -

Page 31

... rate of salary increases, and the estimated future return on plan assets. In determining the discount rate, we use the current yield on high-quality, fixed-income investments that have maturities corresponding to the anticipated timing of the benefit payments. Salary increase assumptions are... -

Page 32

... established specific "employee" prices, available to all consumers, for each make and model. These programs created greater clarity on new car pricing and increased traffic in the marketplace, both of which we believe benefited CarMax. Our no-haggle consumer offer makes price comparing easy... -

Page 33

... change in our new car unit sales. Wholesale Vehicle Sales Our operating strategy is to build customer satisfaction by offering high-quality vehicles. Fewer than half of the vehicles acquired from consumers through the appraisal purchase process meet our standards for reconditioning and subsequent... -

Page 34

... 253,168 18,563 20,901 20,636 208,959 179,548 155,393 Used vehicles...New vehicles ...Wholesale vehicles ...AVERAGE SELLING PRICES Used vehicles...New vehicles ...Wholesale vehicles ...RETAIL VEHICLE SALES MIX Years Ended February 28 2007 2006 2005 $17,249 $16,298 $15,663 $23,833 $23,887 $23,671... -

Page 35

... strong wholesale industry pricing and our desire to price our retail cars at competitive levels for consumers comparing options in the new and used car markets. A strong wholesale industry pricing environment increases our cost of acquiring vehicles both in our instore purchases and at auction. We... -

Page 36

... in-store appraisal strategy benefited our wholesale operations, while allowing us to maintain used vehicle gross profit dollars per unit levels in the face of rising vehicle acquisition costs. While we did not increase our appraisal offers at the same rate as the steep increase in the major public... -

Page 37

... of indirect costs not included are retail store expenses and corporate expenses such as human resources, administrative services, marketing, information systems, accounting, legal, treasury, and executive payroll. CAF originates automobile loans to qualified customers at competitive market rates of... -

Page 38

... in retail vehicle unit sales, and increases in the gain percentage, average amount financed, and total managed receivables. The gain percentage increased to 3.9% in fiscal 2007 from 3.5% in fiscal 2006, reflecting changes in the interest rate environment. In fiscal 2006, our funding costs were... -

Page 39

... public securitizations. PAST DUE ACCOUNT INFORMATION (In millions) Loans securitized ...Loans held for sale or investment...Total managed receivables ...Accounts 31+ days past due ...Past due accounts as a percentage of total managed receivables...CREDIT LOSS INFORMATION (In millions) 2007... -

Page 40

...sites will expand a test begun in fiscal 2007, when we opened our first car buying center in the Atlanta market. We only conduct appraisals and purchase cars at these sites and do not sell cars. These test stores are part of our long-term program to increase both appraisal traffic and retail vehicle... -

Page 41

... in both used vehicle and wholesale gross profits per unit in fiscal 2008, as we continue to refine and improve our car-buying processes. We expect CAF income to increase modestly, but at a pace slower than anticipated sales growth, primarily reflecting the challenging comparison created by... -

Page 42

... 15 or 20 years with four, five-year renewal options. At February 28, 2007, we owned 20 superstores currently in operation, as well as the company' s home office in Richmond, Virginia. In addition, six store facilities were accounted for as capital leases. Financing Activities Net cash provided by... -

Page 43

... the receivables to a special purpose securitization trust. Additional information regarding the nature, business purposes, and importance of our off-balance sheet arrangement to our liquidity and capital resources can be found in the CarMax Auto Finance Income, Financial Condition, and Market Risk... -

Page 44

... both fixed- and floating-rate securities. We manage the interest rate exposure relating to floating-rate securitizations through the use of interest rate swaps. Receivables held for investment or sale are financed with working capital. Generally, changes in interest rates associated with underlying... -

Page 45

... registered public accounting firm, has issued a report on our management's assessment of our internal control over financial reporting. Their report is included herein. THOMAS J. FOLLIARD PRESIDENT AND CHIEF EXECUTIVE OFFICER KEITH D. BROWNING EXECUTIVE VICE PRESIDENT AND CHIEF FINANCIAL OFFICER... -

Page 46

... of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate. In our opinion, management's assessment that CarMax, Inc. and subsidiaries maintained effective internal control over financial reporting as of February 28, 2007, is fairly stated, in all... -

Page 47

... by the Committee of Sponsoring Organizations of the Treadway Commission (COSO), and our report dated April 25, 2007, expressed an unqualified opinion on management' s assessment of, and the effective operation of, internal control over financial reporting. Richmond, Virginia April 25, 2007 37 -

Page 48

... 12.4 1.6 10.7 - 0.1 - 3.2 1.2 1.9 Cost of sales...GROSS PROFIT ...CARMAX AUTO FINANCE INCOME ... Selling, general, and administrative expenses ...Gain on franchise dispositions, net ...Interest expense ...Interest income ...Earnings before income taxes...Provision for income taxes ...NET EARNINGS... -

Page 49

... and cash equivalents ...Accounts receivable, net...Automobile loan receivables held for sale...Retained interest in securitized receivables ...Inventory ...Prepaid expenses and other current assets ...TOTAL CURRENT ASSETS ...Property and equipment, net...Deferred income taxes...Other assets...TOTAL... -

Page 50

... ...Sales of money market securities ...Purchases of investment securities available-for-sale ...NET CASH USED IN INVESTING ACTIVITIES ...FINANCING ACTIVITIES: Increase (decrease) in short-term debt, net...Issuance of long-term debt...Payments on long-term debt...Equity issuances, net ...Excess tax... -

Page 51

...134,220 Net earnings ...Share-based compensation expense for stock options and restricted stock...Exercise of common stock options. Shares issued under stock incentive plans...Shares cancelled upon reacquisition ...Tax benefit from the exercise of common stock options...BALANCE AT FEBRUARY 28, 2006... -

Page 52

... sale of extended service plans; the appraisal and purchase of vehicles directly from consumers; and vehicle repair service. Vehicles purchased through the appraisal process that do not meet our retail standards are sold at on-site wholesale auctions. 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES... -

Page 53

... minimum lease payments at the inception of the lease or fair value. Amortization of capital lease assets is computed on a straight-line basis over the shorter of the initial lease term or the estimated useful life of the asset and is included in depreciation expense. Costs incurred during new store... -

Page 54

... when the earnings process is complete, generally either at the time of sale to a customer or upon delivery to a customer. As part of our customer service strategy, we guarantee the vehicles we sell with a 5-day, money-back guarantee. If a customer returns the vehicle purchased within the parameters... -

Page 55

...and corporate expenses such as human resources, administrative services, marketing, information systems, accounting, legal, treasury, and executive payroll. 4. SECURITIZATIONS We use a securitization program to fund substantially all of the automobile loan receivables originated by CAF. We sell the... -

Page 56

...combined basis, the reserve accounts and required excess receivables are generally 2% to 4% of managed receivables. The special purpose entities and the investors have no recourse to our assets. The fair value of the retained interest was $202.3 million as of February 28, 2007, and $158.3 million as... -

Page 57

.... Projected credit losses are estimated using the losses experienced to date, the credit quality of the receivables, economic factors, and the performance history of similar receivables. Continuing Involvement with Securitized Receivables We continue to manage the automobile loan receivables that we... -

Page 58

... DERIVATIVES We enter into amortizing fixed-pay interest rate swaps relating to our automobile loan receivable securitizations. Swaps are used to better match funding costs to the fixed-rate receivables being securitized by converting variablerate financing costs in the warehouse facility to... -

Page 59

... land owned for potential expansion. Leased property meeting capital lease criteria is capitalized and the present value of the related lease payments is recorded as long-term debt. Accumulated amortization on capital lease assets was $6.0 million as of February 28, 2007, and $3.6 million as of... -

Page 60

...of full-time employees. We also have an unfunded nonqualified plan (the "restoration plan") that restores retirement benefits for certain senior executives who are affected by Internal Revenue Code limitations on benefits provided under the pension plan. We use a fiscal year end measurement date for... -

Page 61

... the benefit plans for past service as of the measurement date. ABO is the present value of benefits earned to date with benefits computed based on current service and compensation levels. PBO is ABO increased to reflect expected future service and increased compensation levels. ASSUMPTIONS USED TO... -

Page 62

... are measured using current market values. No plan assets are expected to be returned to us during the fiscal year ended February 29, 2008. Funding Policy. For the pension plan, we contribute amounts sufficient to meet minimum funding requirements as set forth in the employee benefit and tax laws... -

Page 63

... use participant-specific information such as salary, age, and years of service, as well as certain assumptions, the most significant being the discount rate, expected rate of return on plan assets, rate of compensation increases, and mortality rate. We evaluate these assumptions annually... -

Page 64

... directors continue to receive awards of nonqualified stock options and stock grants. Stock options are awards that allow the recipient to purchase shares of our stock at a fixed price. Stock options are granted at an exercise price equal to the fair market value of our stock on the grant date... -

Page 65

...-based awards exchanged for employee services. Under the provisions of SFAS 123(R), share-based compensation cost is measured at the grant date, based on the estimated fair value of the award. We recognize the compensation cost as an expense on a straight-line basis over the requisite service period... -

Page 66

... option-pricing model. For stock options granted to employees on or after March 1, 2006, the fair value of each award is estimated as of the date of grant using a binomial valuation model. In computing the value of the option, the binomial model considers characteristics of fair-value option pricing... -

Page 67

... stock to our employees in fiscal 2007. There were no restricted stock grants in fiscal 2006. The fair value of a restricted stock award is determined and fixed based on the price of our stock on the grant date. The unrecognized compensation costs related to nonvested restricted stock awards... -

Page 68

...interest ...Present value of net minimum capital lease payments [Note 9]...(1) Excludes taxes, insurance, and other costs payable directly by the company. We entered into no sale-leaseback transactions in fiscal 2007. We entered into sale-leaseback transactions involving five superstores valued at... -

Page 69

... our customer service strategy, we guarantee the used vehicles we retail with a 30-day limited warranty. A vehicle in need of repair within 30 days of the customer's purchase will be repaired free of charge. As a result, each vehicle sold has an implied liability associated with it. Accordingly, we... -

Page 70

...financial position, results of operations, or cash flows. In February 2007, the FASB issued SFAS No. 159, "The Fair Value Option for Financial Assets and Financial... 0.93 0.92 Net sales and operating revenues ...Gross profit...CarMax Auto Finance income.. Selling, general, and administrative expenses... -

Page 71

...and reported within the time periods specified in the U.S. Securities and Exchange Commission' s rules and forms. Disclosure controls are also designed to ensure that this information is accumulated and communicated to management, including the chief executive officer ("CEO") and the chief financial... -

Page 72

... Vice President, Chief Financial Officer, Corporate Secretary, and Director 57 Executive Vice President and Chief Administrative Officer 44 Senior Vice President, Marketing and Strategy 49 Senior Vice President and Chief Information Officer Mr. Folliard joined CarMax in 1993 as senior buyer and... -

Page 73

... section titled "Executive Compensation" appearing in our 2007 Proxy Statement. Additional information required by this Item is incorporated by reference to the sub-section titled "Non-Employee Director Compensation in Fiscal 2007" in our 2007 Proxy Statement. Item 12. Security Ownership of Certain... -

Page 74

... Statement Schedules. "Schedule II - Valuation and Qualifying Accounts and Reserves" and the accompanying Report of Independent Registered Public Accounting Firm on CarMax, Inc. Financial Statement Schedule for the fiscal years ended February 28, 2007, 2006, and 2005, are filed as part of this... -

Page 75

... Exchange Act of 1934, this report has been signed by the following persons on behalf of the registrant and in the capacities and on the dates indicated: /s/ THOMAS J. FOLLIARD /s/ HUGH G. ROBINSON* Hugh G. Robinson Director April 25, 2007 Thomas J. Folliard President, Chief Executive Officer... -

Page 76

Schedule II CARMAX, INC. AND SUBSIDIARIES VALUATION AND QUALIFYING ACCOUNTS AND RESERVES Balance at Beginning of Fiscal ... ended February 28, 2005: Allowance for doubtful accounts ...Year ended February 28, 2006: Allowance for doubtful accounts ...Year ended February 28, 2007: Allowance for doubtful... -

Page 77

...amended and restated October 19, 2004, filed as Exhibit 10.2 to CarMax' s Annual Report on Form 10-K, filed May 13, 2005 (File No. 1-31420), is incorporated by this reference. * CarMax, Inc. 2002 Non-Employee Directors Stock Incentive Plan, as amended and restated April 24, 2006, filed as Exhibit 10... -

Page 78

... 2002 Employee Stock Purchase Plan, as amended and restated July 1, 2006, filed as Exhibit 10.1 to CarMax's Current Report on Form 8-K, filed June 22, 2006 (File No. 1-31420), is incorporated by this reference. Credit Agreement, dated August 24, 2005, among CarMax Auto Superstores, Inc., CarMax, Inc... -

Page 79

.... Certification of the Chief Executive Officer Pursuant to 18 U.S.C. Section 1350, filed herewith. Certification of the Chief Financial Officer Pursuant to 18 U.S.C. Section 1350, filed herewith. Indicates management contracts, compensatory plans, or arrangements of the company required to be filed... -

Page 80

... Vice President Chief Financial Officer Corporate Secretary Mike Dolan Executive Vice President Chief Administrative Officer Joe Kunkel Senior Vice President Marketing and Strategy Richard Smith Senior Vice President Chief Information Officer Anu Agarwal Vice President Business Strategy Dave Banks... -

Page 81

... Managing Partner - Chief Executive Andersen Worldwide S.C. (an accounting and professional services firm) Potomac, Maryland Edgar H. Grubb Retired Executive Vice President and Chief Financial Officer Transamerica Corporation (an insurance and financial services company) Walnut Creek, California... -

Page 82

... visit our investor website at: http://investor.carmax.com. Information may also be obtained from the Investor Relations Department at: Email: [email protected] Telephone: (804) 747-0422, ext. 4489 CEO and CFO Certifications Our chief executive officer and chief financial officer have... -

Page 83

CARMAX, INC. 12800 TUCKAHOE CREEK PARKWAY, RICHMOND, VIRGINIA 23238 804-747-0422 WWW.CARMAX.COM