CarMax 2002 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

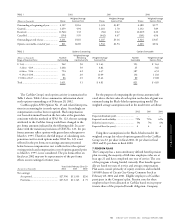

11. FINANCIAL DERIVATIVES

On behalf of CarMax, the Company enters into amortizing

swaps relating to automobile loan receivable securitizations to

convert variable-rate financing costs to fixed-rate obligations to

better match funding costs to the receivables being securitized.

The Company entered into twelve 40-month amortizing inter-

est rate swaps with notional amounts totaling approximately

$854.0 million in fiscal 2002, nine 40-month amortizing swaps

with notional amounts totaling approximately $735.0 million

in fiscal 2001 and four 40-month amortizing swaps with

notional amounts totaling approximately $344.0 million in fis-

cal 2000. The remaining total notional amount of all swaps

related to the automobile loan receivable securitizations was

approximately $413.3 million at February 28, 2002, and

$299.3 million at February 28, 2001. At February 28, 2002,

the fair value of these swaps totaled a net liability of $841,000

and were included in accounts payable.

The market and credit risks associated with interest rate

swaps are similar to those relating to other types of financial

instruments. Market risk is the exposure created by potential

fluctuations in interest rates. The Company does not anticipate

significant market risk from swaps because they are used on a

monthly basis to match funding costs to the use of the funding.

Credit risk is the exposure to nonperformance of another party

to an agreement. The Company mitigates credit risk by dealing

with highly rated bank counterparties.

12. CONTINGENT LIABILITIES

In the normal course of business, CarMax is involved in various

legal proceedings. Based upon CarMax’s evaluation of the infor-

mation presently available, management believes that the ulti-

mate resolution of any such proceedings will not have a

material adverse effect on the CarMax Group’s financial posi-

tion, liquidity or results of operations.

13. RECENT ACCOUNTING PRONOUNCEMENTS

In June 2001, the Financial Accounting Standards Board issued

SFAS No. 141, “Business Combinations,” effective for business

combinations initiated after June 30, 2001, and SFAS No. 142,

“Goodwill and Other Intangible Assets,” effective for fiscal years

beginning after December 15, 2001. Under SFAS No. 141, the

pooling of interests method of accounting for business combina-

tions is eliminated, requiring that all business combinations ini-

tiated after the effective date be accounted for using the purchase

method. Also under SFAS No. 141, identified intangible assets

acquired in a purchase business combination must be separately

valued and recognized on the balance sheet if they meet certain

requirements. Under the provisions of SFAS No. 142, goodwill

and intangible assets deemed to have indefinite lives will no

longer be amortized but will be subject to annual impairment

tests in accordance with the pronouncement. Other intangible

assets that are identified to have finite useful lives will continue

to be amortized in a manner that reflects the estimated decline

in the economic value of the intangible asset and will be subject

to review when events or circumstances arise which indicate

impairment. For the CarMax Group, goodwill totaled $20.1

million and covenants not to compete totaled $1.5 million as of

February 28, 2002. In fiscal 2002, goodwill amortization was

$1.8 million and amortization of covenants not to compete was

$931,000. Covenants not to compete will continue to be amor-

tized on a straight-line basis over the life of the covenant, not to

exceed five years. Application of the nonamortization provisions

of SFAS No. 142 in fiscal 2003 is not expected to have a mate-

rial impact on the financial position, results of operations or cash

flows of the Group. During fiscal 2003, the Company will per-

form the first of the required impairment tests of goodwill, as

outlined in the new pronouncement. Based on preliminary esti-

mates, as well as ongoing periodic assessments of goodwill, the

Company does not expect to recognize any material impairment

losses from these tests.

In August 2001, the FASB issued SFAS No. 143, “Account-

ing For Asset Retirement Obligations.” This statement addresses

financial accounting and reporting for obligations associated

with the retirement of tangible long-lived assets and the associ-

ated asset retirement costs. It applies to legal obligations asso-

ciated with the retirement of long-lived assets that result from

the acquisition, construction, development and the normal

operation of a long-lived asset, except for certain obligations of

lessees. This standard requires entities to record the fair value of

a liability for an asset retirement obligation in the period

incurred. SFAS No. 143 is effective for fiscal years beginning

after June 15, 2002. The Company has not yet determined the

impact, if any, of adopting this standard.

In August 2001, the FASB issued SFAS No. 144, “Account-

ing for the Impairment or Disposal of Long-Lived Assets,”

which supersedes both SFAS No. 121, “Accounting for the

Impairment of Long-Lived Assets and for Long-Lived Assets to

Be Disposed Of,” and the accounting and reporting provisions

of APB Opinion No. 30, “Reporting the Results of Operations-

Reporting the Effects of Disposal of a Segment of a Business,

and Extraordinary, Unusual and Infrequently Occurring Events

and Transactions,” related to the disposal of a segment of a

business (as previously defined in that Opinion). SFAS No. 144

retains the fundamental provisions in SFAS No. 121 for recog-

nizing and measuring impairment losses on long-lived assets

held for use and long-lived assets to be disposed of by sale, while

also resolving significant implementation issues associated with

SFAS No. 121. The Company is required to adopt SFAS No.

144 no later than the fiscal year beginning after December 15,

2001, and plans to adopt the provisions in the first quarter of

fiscal 2003. The Company does not expect the adoption of

SFAS No. 144 to have a material impact on its financial posi-

tion, results of operations or cash flows.

CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002 96