CarMax 2002 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59 CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002

CIRCUIT CITY GROUP

digital product innovation, will contribute to this growth. We

plan to open approximately 10 Superstores in fiscal 2003. Given

our presence in virtually all of the nation’s top metropolitan

markets, new Superstores are being added in one- or two-store

markets or to increase our presence in existing major markets.

Because of the limited planned geographic expansion, we expect

total sales growth to only slightly exceed comparable store sales

growth. We expect relatively stable gross profit margins in fiscal

2003. We also expect a modest increase in the expense ratio in

fiscal 2003, despite the anticipated increase in comparable store

sales. Planned increases in remodeling and relocation expenses,

advertising and systems enhancements are among the antici-

pated contributors to the higher expense ratio. For the full year,

we expect the fiscal 2003 profit contribution from Circuit City’s

finance operation to be similar to the contribution in fiscal

2002. Refer to the “Circuit City Stores, Inc. Management’s

Discussion and Analysis of Results of Operations and Financial

Condition” for the estimated contribution of the Circuit City

business earnings attributed to the Circuit City Group Com-

mon Stock in fiscal 2003.

RECENT ACCOUNTING PRONOUNCEMENTS

Refer to the “Circuit City Stores, Inc. Management’s Discussion

and Analysis of Results of Operations and Financial Condition”

for a review of recent accounting pronouncements.

FINANCIAL CONDITION

Liquidity and Capital Resources

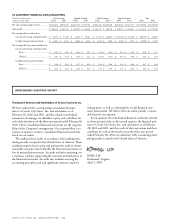

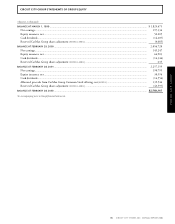

CASH FLOW HIGHLIGHTS

Years Ended February 28 or 29

(Amounts in millions) 2002 2001 2000

Net earnings from continuing

operations before income attributed

to the reserved CarMax shares.............. $ 128.0 $ 115.2 $ 326.7

Depreciation and amortization.................. $ 134.4 $ 126.3 $ 132.9

Provision for deferred income taxes ........... $ 28.0 $ 11.0 $ 41.8

Cash provided by (used for) working

capital, net ........................................... $ 407.6 $(102.0) $ 168.0

Cash provided by operating activities ........ $ 794.6 $ 149.2 $ 661.8

Purchases of property and equipment........ $(172.6) $(274.7) $(176.9)

Proceeds from sales of property

and equipment, net.............................. $ 88.5 $ 100.2 $ 74.8

Net decrease in allocated short-term

and long-term debt .............................. $ (19.6) $(157.6) $ (76.6)

Allocated proceeds from CarMax stock

offering, net ......................................... $ 139.5 – –

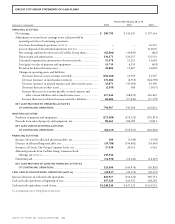

CASH PROVIDED BY OPERATIONS. Circuit City generated net cash

from operating activities of $794.6 million in fiscal 2002, com-

pared with $149.2 million in fiscal 2001 and $661.8 million in

fiscal 2000. The fiscal 2002 improvement primarily resulted

from working capital efficiencies. Improved supply chain man-

agement contributed to a $181.2 million reduction in working

capital used for inventories in fiscal 2002 compared with fiscal

2001. Increases in accounts payable, accrued expenses and other

current liabilities, and accrued income taxes reduced working

capital by an additional $385.5 million in fiscal 2002 compared

with fiscal 2001. The increase in accounts payable primarily

reflects extended payment terms achieved through supply chain

management. The fiscal 2001 decline in cash provided by oper-

ating activities was largely a function of lower net earnings and

an increase in working capital.

INVESTING ACTIVITIES. Net cash used in investing activities was

$84.1 million in fiscal 2002, compared with $174.5 million in

fiscal 2001 and $102.1 million in fiscal 2000. The Circuit City

Group’s capital expenditures were $172.6 million in fiscal

2002, $274.7 million in fiscal 2001 and $176.9 million in fis-

cal 2000. Fiscal 2002 capital expenditures included spending

for the construction of 11 new and eight relocated Circuit City

Superstores and $19.8 million of capitalized remodeling expen-

ditures. Fiscal 2001 capital expenditures included spending for

the construction of 23 new and two relocated Circuit City

Superstores and $106.0 million of capitalized remodeling

expenditures associated with full remodels of 26 Superstores,

primarily in south and central Florida, and partial remodels

associated with the exit from the appliance business. Fiscal

2000 capital expenditures included spending for the construc-

tion of 34 new and four relocated Circuit City Superstores.

Capital expenditures have been funded primarily through

internally generated funds, sale-leaseback transactions, landlord

reimbursements and allocated short- and long-term debt. Net

proceeds from sales of property and equipment, including sale-

leasebacks, totaled $88.5 million in fiscal 2002, $100.2 million

in fiscal 2001 and $74.8 million in fiscal 2000. In August 2001,

we completed a sale-leaseback transaction for the Orlando, Fla.,

distribution center, from which total proceeds of $19.5 million

were received. In November 2001, we completed a sale-lease-

back transaction for the Marion, Ill., distribution center, from

which total proceeds of $29.0 million were received.

In fiscal 2003, we anticipate capital expenditures for the

Circuit City business of approximately $150 million. In fiscal

2003, we plan to open approximately 10 Superstores, remodel

the video department and install lighting upgrades in approxi-

mately 300 Superstores and relocate approximately 10

Superstores. We expect to continue incurring remodeling and

relocation costs in fiscal years 2004 and 2005.

We expect that available cash resources, sale-leaseback trans-

actions, landlord reimbursements and cash generated by opera-

tions will be sufficient to fund capital expenditures of the

Circuit City business for the foreseeable future.

FINANCING ACTIVITIES. Most financial activities, including the

investment of surplus cash and the issuance and repayment of

short-term and long-term debt, are managed by the Company

on a centralized basis. Allocated debt of the Circuit City Group

consists of (1) Company debt, if any, that has been allocated in

its entirety to the Circuit City Group and (2) a portion of the

Company’s debt that is allocated between the Groups. This

pooled debt bears interest at a rate based on the average pooled

debt balance. Expenses related to increases in pooled debt are

reflected in the weighted average interest rate of the pooled debt.

As scheduled, the Company used existing working capital to

repay a $130 million term loan in fiscal 2002 and a $175 mil-

lion term loan in fiscal 2001. At February 28, 2002, a $100

million outstanding term loan due in July 2002 was classified as