CarMax 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23 CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002

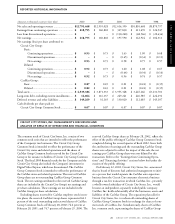

REPORTED HISTORICAL INFORMATION

CIRCUIT CITY STORES, INC.

The common stock of Circuit City Stores, Inc. consists of two

common stock series that are intended to reflect the performance

of the Company’s two businesses. The Circuit City Group

Common Stock is intended to reflect the performance of the

Circuit City stores and related operations and the shares of

CarMax Group Common Stock reserved for the Circuit City

Group or for issuance to holders of Circuit City Group Common

Stock. The fiscal 2000 financial results for the Company and the

Circuit City Group also include the Company’s investment in

Digital Video Express, which was discontinued. The CarMax

Group Common Stock is intended to reflect the performance of

the CarMax stores and related operations. The reserved CarMax

Group shares are not outstanding CarMax Group Common

Stock. The net earnings attributed to the reserved CarMax Group

shares are included in the Circuit City Group’s net earnings and

per share calculations. These earnings are not included in the

CarMax Group per share calculations.

Excluding shares reserved for CarMax employee stock incen-

tive plans, the reserved CarMax Group shares represented 64.1

percent of the total outstanding and reserved shares of CarMax

Group Common Stock at February 28, 2002; 74.6 percent at

February 28, 2001; and 74.7 percent at February 29, 2000. The

reserved CarMax Group shares at February 28, 2002, reflect the

effect of the public offering of CarMax Group Common Stock

completed during the second quarter of fiscal 2002. Since both

the attribution of earnings and the outstanding CarMax Group

shares were adjusted to reflect the impact of this sale, the net

earnings per CarMax Group share were not diluted by this

transaction. Refer to the “Earnings from Continuing Opera-

tions” and “Financing Activities” sections below for further dis-

cussion of the public offering.

On February 22, 2002, Circuit City Stores, Inc. announced

that its board of directors had authorized management to initi-

ate a process that would separate the CarMax auto superstore

business from the Circuit City consumer electronics business

through a tax-free transaction in which CarMax, Inc., presently

a wholly owned subsidiary of Circuit City Stores, Inc., would

become an independent, separately traded public company.

CarMax, Inc. holds substantially all of the businesses, assets and

liabilities of the CarMax Group. The separation plan calls for

Circuit City Stores, Inc. to redeem all outstanding shares of

CarMax Group Common Stock in exchange for shares of com-

mon stock of CarMax, Inc. Simultaneously, shares of CarMax,

Inc. common stock, representing the shares of CarMax Group

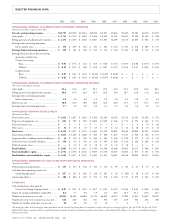

(Amounts in thousands except per share data) 2002 2001 2000 1999 1998

Net sales and operating revenues ........................... $12,791,468 $12,959,028 $12,614,390 $10,810,468 $8,870,797

Earnings from continuing operations .................... $ 218,795 $ 160,802 $ 327,830 $ 211,470 $ 124,947

Loss from discontinued operations ........................ $–$ – $ (130,240) $ (68,546) $ (20,636)

Net earnings.......................................................... $ 218,795 $ 160,802 $ 197,590 $ 142,924 $ 104,311

Net earnings (loss) per share attributed to:

Circuit City Group:

Basic:

Continuing operations............................ $ 0.93 $ 0.73 $ 1.63 $ 1.09 $ 0.68

Discontinued operations......................... $–$ – $ (0.65) $ (0.34) $ (0.11)

Net earnings ........................................... $ 0.93 $ 0.73 $ 0.98 $ 0.75 $ 0.57

Diluted:

Continuing operations............................ $ 0.92 $ 0.73 $ 1.60 $ 1.08 $ 0.67

Discontinued operations......................... $–$ – $ (0.64) $ (0.34) $ (0.10)

Net earnings ........................................... $ 0.92 $ 0.73 $ 0.96 $ 0.74 $ 0.57

CarMax Group:

Basic ............................................................ $ 0.87 $ 0.45 $ 0.01 $ (0.24) $ (0.35)

Diluted........................................................ $ 0.82 $ 0.43 $ 0.01 $ (0.24) $ (0.35)

Total assets ............................................................ $ 4,539,386 $ 3,871,333 $ 3,955,348 $ 3,445,266 $3,231,701

Long-term debt, excluding current installments .... $ 14,064 $ 116,137 $ 249,241 $ 426,585 $ 424,292

Deferred revenue and other liabilities .................... $ 149,269 $ 92,165 $ 130,020 $ 112,085 $ 145,107

Cash dividends per share paid on

Circuit City Group Common Stock ................. $ 0.07 $ 0.07 $ 0.07 $ 0.07 $ 0.07

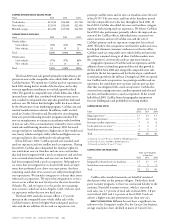

CIRCUIT CITY STORES, INC. MANAGEMENT’S DISCUSSION AND

ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL CONDITION