CarMax 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

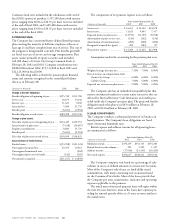

1. BASIS OF PRESENTATION

The common stock of Circuit City Stores, Inc. consists of two

common stock series that are intended to reflect the performance

of the Company’s two businesses. The Circuit City Group

Common Stock is intended to reflect the performance of the

Circuit City stores and related operations and the shares of

CarMax Group Common Stock reserved for the Circuit City

Group or for issuance to holders of Circuit City Group Common

Stock. The CarMax Group Common Stock is intended to reflect

the performance of the CarMax stores and related operations.

The reserved CarMax Group shares are not outstanding CarMax

Group Common Stock. Therefore, net earnings attributed to the

reserved CarMax Group shares are included in the net earnings

and earnings per share attributed to the Circuit City Group

Common Stock and not in the earnings per share attributed to

the CarMax Group Common Stock.

During the second quarter of fiscal 2002, Circuit City Stores

completed the public offering of 9,516,800 shares of CarMax

Group Common Stock. The shares sold in the offering were

shares of CarMax Group Common Stock that previously had

been reserved for the Circuit City Group or for issuance to hold-

ers of Circuit City Group Common Stock. The net proceeds of

$139.5 million from the offering were allocated to the Circuit

City Group to be used for general purposes of the Circuit City

business, including remodeling of Circuit City Superstores. As

of February 28, 2002, 65,923,200 shares of CarMax Group

Common Stock were reserved for the Circuit City Group or for

issuance to holders of Circuit City Group Common Stock.

Excluding shares reserved for CarMax employee stock incen-

tive plans, the reserved CarMax Group shares represented 64.1

percent of the total outstanding and reserved shares of CarMax

Group Common Stock at February 28, 2002; 74.6 percent at

February 28, 2001; and 74.7 percent at February 29, 2000. The

terms of each series of common stock are discussed in detail in

the Company’s Form 8-A registration statement on file with the

Securities and Exchange Commission.

On February 22, 2002, Circuit City Stores, Inc. announced

that its board of directors had authorized management to initi-

ate a process that would separate the CarMax auto superstore

business from the Circuit City consumer electronics business

through a tax-free transaction in which CarMax, Inc., presently

a wholly owned subsidiary of Circuit City Stores, Inc., would

become an independent, separately traded public company.

CarMax, Inc. holds substantially all of the businesses, assets and

liabilities of the CarMax Group. The separation plan calls for

Circuit City Stores, Inc. to redeem the outstanding shares of

CarMax Group Common Stock in exchange for shares of com-

mon stock of CarMax, Inc. Simultaneously, shares of CarMax,

Inc. common stock, representing the shares of CarMax Group

Common Stock reserved for the holders of Circuit City Group

Common Stock, would be distributed as a tax-free dividend to

the holders of Circuit City Group Common Stock.

In the proposed separation, the holders of CarMax Group

Common Stock would receive one share of CarMax, Inc.

common stock for each share of CarMax Group Common

Stock redeemed by the Company. Management anticipates that

the holders of Circuit City Group Common Stock would

receive a fraction of a share of CarMax, Inc. common stock for

each share of Circuit City Group Common Stock they hold.

The exact fraction would be determined on the record date for

the distribution. The separation is expected to be completed by

late summer, subject to shareholder approval and final approval

from the board of directors.

Notwithstanding the attribution of the Company’s assets

and liabilities, including contingent liabilities, and stockholders’

equity between the Circuit City Group and the CarMax Group

for the purposes of preparing the financial statements, holders

of Circuit City Group Common Stock and holders of CarMax

Group Common Stock are shareholders of the Company and as

such are subject to all of the risks associated with an investment

in the Company and all of its businesses, assets and liabilities.

Such attribution and the equity structure of the Company do

not affect title to the assets or responsibility for the liabilities of

the Company or any of its subsidiaries. Neither shares of

Circuit City Group Common Stock nor shares of CarMax

Group Common Stock represent a direct equity or legal interest

solely in the assets and liabilities allocated to a particular Group.

Instead, those shares represent direct equity and legal interests

in the assets and liabilities of the Company. The results of oper-

ations or financial condition of one Group could affect the

results of operations or financial condition of the other Group.

Net losses of either Group and dividends or distributions on, or

repurchases of, Circuit City Group Common Stock or CarMax

Group Common Stock will reduce funds legally available for

dividends on, or repurchases of, both stocks. Accordingly, the

Company’s consolidated financial statements included herein

should be read in conjunction with the financial statements of

each Group and the Company’s SEC filings.

The financial statements of the Company reflect each

Group’s business as well as the allocation of the Company’s

assets, liabilities, expenses and cash flows between the Groups

in accordance with the policies adopted by the board of direc-

tors. These policies may be modified or rescinded, or new poli-

cies may be adopted, at the sole discretion of the board of

directors, although the board of directors has no present plans

to do so. These management and allocation policies include

the following:

(A) FINANCIAL ACTIVITIES: Most financial activities are managed

by the Company on a centralized basis. Such financial activities

include the investment of surplus cash and the issuance and

repayment of short-term and long-term debt. Debt of the

Company is either allocated between the Groups (pooled debt)

or is allocated in its entirety to one Group. The pooled debt

bears interest at a rate based on the average pooled debt bal-

ance. Expenses related to increases in pooled debt are reflected

in the weighted average interest rate of such pooled debt.

CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002 40