CarMax 2002 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002 82

In fiscal 2003, we anticipate capital expenditures for the

CarMax business of approximately $175 million. Planned

expenditures primarily relate to new store construction, includ-

ing furniture, fixtures and equipment and land purchases, and

leasehold improvements to existing properties. CarMax expects

to open four to six stores during fiscal 2003, approximately one

half of which will be satellite stores, and, assuming the business

continues to meet our expectations, 22 to 30 stores over the fol-

lowing four years. We expect the initial cash investment per store

to be in the range of $20 million to $27 million for a standard

superstore and $10 million to $15 million for a satellite store. If

CarMax takes full advantage of building and land sale-lease-

backs, then we expect the net cash used to fund a new store will

be $8 million to $12 million for a standard superstore and $5

million to $7 million for a satellite superstore. As a new store

matures, sales financed through CarMax’s finance operation will

require additional use of capital in the form of a seller’s interest in

the receivables or reserves. For a standard used-car superstore, we

would expect the cash investment for the seller’s interest to range

from $0.8 million to $1.5 million at the end of the first year of

operation, growing to $2.2 million to $3.4 million after five years

of operation.

We expect that proceeds from an anticipated credit agreement

secured by vehicle inventory, sale-leaseback transactions and cash

generated by operations will be sufficient to fund capital expendi-

tures of the CarMax business for the foreseeable future.

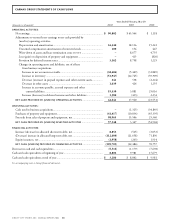

FINANCING ACTIVITIES. Most financial activities, including the

investment of surplus cash and the issuance and repayment of

short-term and long-term debt, are managed by the Company

on a centralized basis. Allocated debt of the CarMax Group con-

sists of (1) Company debt, if any, that has been allocated in its

entirety to the CarMax Group and (2) a portion of the

Company’s debt that is allocated between the Groups. This

pooled debt bears interest at a rate based on the average pooled

debt balance. Expenses related to increases in pooled debt are

reflected in the weighted average interest rate of the pooled debt.

In December 2001, CarMax entered into an $8.5 million

secured promissory note in conjunction with the purchase of land

for new store construction. This note, which is payable in August

2002, was included in short-term debt as of February 28, 2002.

As scheduled, the Company used existing working capital to

repay a $130 million term loan in fiscal 2002 and a $175 mil-

lion term loan in fiscal 2001. At February 28, 2002, a $100 mil-

lion outstanding term loan due in July 2002 was classified as a

current liability. Although the Company has the ability to refi-

nance this debt, we intend to repay it using existing working

capital. Payment of corporate pooled debt does not necessarily

result in a reduction of the CarMax Group allocated debt.

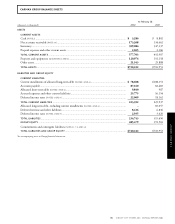

At February 28, 2002, the Company allocated cash of $3.3

million and debt of $88.4 million to the CarMax Group.

Circuit City Stores maintains a $150 million unsecured revolv-

ing credit facility that expires on August 31, 2002. The

Company does not anticipate renewing this facility. The

Company also maintains $195 million in committed seasonal

lines of credit that are renewed annually with various banks. At

February 28, 2002, total balances of $1.8 million were out-

standing under these facilities.

We anticipate that during the first quarter of fiscal 2003,

CarMax will enter into a multi-year, $200 million credit agree-

ment secured by vehicle inventory. We anticipate that some of the

proceeds from the agreement will be used for the repayment of

allocated debt; the payment on the separation date of a one-time

special dividend to Circuit City Stores, Inc., currently estimated to

be between $25 million and $35 million; the payment of transac-

tion expenses incurred in connection with the separation; and

general corporate purposes. Refer to “Contractual Obligations” for

further discussion of the special dividend payment.

Receivables generated by the CarMax finance operation are

funded through securitization transactions in which the finance

operation sells its receivables while retaining servicing rights.

These securitization transactions provide an efficient and eco-

nomical means of funding automobile loan receivables. For

transfers of receivables that qualify as sales under Statement of

Financial Accounting Standards No. 140, “Accounting for

Transfers and Servicing of Financial Assets and Extinguishments

of Liabilities,” we recognize gains and losses as a component of

the profits of CarMax’s finance operation.

On a monthly basis, CarMax’s finance operation sells its

automobile loan receivables to a special purpose subsidiary,

which, in turn, transfers the receivables to a group of third-

party investors. The investors sell commercial paper backed by

the transferred receivables, and the proceeds are distributed

through the special purpose subsidiary to CarMax’s finance

operation. The special purpose subsidiary retains a subordinated

interest in the transferred receivables. CarMax’s finance opera-

tion continues to service the transferred receivables for a fee.

The investors are generally entitled to receive monthly interest

payments and have committed to acquire additional undivided

interests in the transferred receivables up to a stated amount

through June 27, 2002. We expect that the commitment termi-

nation date will be extended. If certain events were to occur, the

commitment to acquire additional undivided interests would

terminate and the investors would begin to receive monthly

principal payments until paid in full. At February 28, 2002, the

unused capacity of this program was $211.0 million.

CarMax’s finance operation periodically refinances its auto-

mobile loan receivables through the public issuance of asset-

backed securities. The finance operation sells the receivables to

be refinanced to a special purpose subsidiary, which, in turn,