CarMax 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002 74

Accordingly, no servicing asset or liability has been recorded.

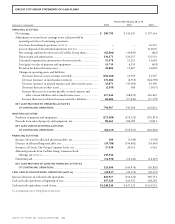

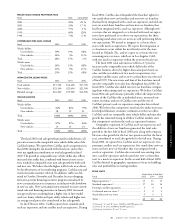

The table below summarizes certain cash flows received from

and paid to the securitization trusts:

Years Ended February 28

(Amounts in thousands) 2002 2001

Proceeds from new securitizations ................ $1,193,300 $1,092,500

Proceeds from collections reinvested

in previous credit card securitizations...... $1,591,085 $1,730,511

Servicing fees received .................................. $ 51,777 $ 52,044

Other cash flows received on

retained interests*.................................... $ 195,375 $ 173,775

*This amount represents cash flows received from retained interests by the transferor other

than servicing fees, including cash flows from interest-only strips and cash above the mini-

mum required level in cash collateral accounts.

When determining the fair value of retained interests,

Circuit City estimates future cash flows using management’s

projections of key factors, such as finance charge income,

default rates, payment rates, forward interest rate curves and

discount rates appropriate for the type of asset and risk. Circuit

City employs a risk-based pricing strategy that increases the

stated annual percentage rate for accounts that have a higher

predicted risk of default. Accounts with a lower risk profile may

qualify for promotional financing.

Future finance income from securitized credit card receiv-

ables that exceeds the contractually specified investor returns

and servicing fees (interest-only strips) is carried at fair value,

amounted to $131.9 million at February 28, 2002 and $131.0

million at February 28, 2001, and is included in net accounts

receivable. Gains of $167.8 million on sales of credit card

receivables were recorded in fiscal 2002; gains of $176.2 million

on sales of credit card receivables were recorded in fiscal 2001.

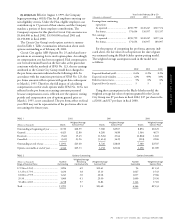

The fair value of retained interests at February 28, 2002, was

$394.5 million, with a weighted-average life ranging from 0.2

years to 1.8 years. The following table shows the key economic

assumptions used in measuring the fair value of retained inter-

ests at February 28, 2002, and a sensitivity analysis showing the

hypothetical effect on the fair value of those interests when

there are unfavorable variations from the assumptions used. Key

economic assumptions at February 28, 2002, are not materially

different from assumptions used to measure the fair value of

retained interests at the time of securitization. These sensitivi-

ties are hypothetical and should be used with caution. In this

table, the effect of a variation in a particular assumption on the

fair value of the retained interest is calculated without changing

any other assumption; in actual circumstances, changes in one

factor may result in changes in another, which might magnify

or counteract the sensitivities.

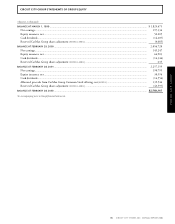

Assumptions Impact on Fair Impact on Fair

(Dollar amounts Used Value of 10% Value of 20%

in thousands) (Annual) Adverse Change Adverse Change

Payment rate ......... 6.8%–10.4% $ 8,426 $15,629

Default rate ........... 7.9%–17.1% $23,315 $46,363

Discount rate......... 8.0%–15.0% $ 2,742 $ 5,454

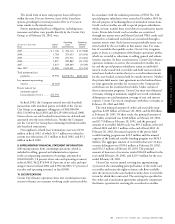

11. FINANCIAL DERIVATIVES

On behalf of Circuit City, the Company enters into interest

rate cap agreements to meet the requirements of the credit card

receivable securitization transactions. The total notional

amount of interest rate caps outstanding was $654.9 million at

February 28, 2002, and $839.4 million at February 28, 2001.

Purchased interest rate caps were included in net accounts

receivable and had a fair value of $2.4 million as of February

28, 2002, and $6.5 million as of February 28, 2001. Written

interest rate caps were included in accounts payable and had a

fair value of $2.4 million as of February 28, 2002, and $6.5

million at February 28, 2001.

The market and credit risks associated with interest rate caps

are similar to those relating to other types of financial instru-

ments. Market risk is the exposure created by potential fluctua-

tions in interest rates and is directly related to the product type,

agreement terms and transaction volume. The Company has

entered into offsetting interest rate cap positions and, therefore,

does not anticipate significant market risk arising from interest

rate caps. Credit risk is the exposure to nonperformance of

another party to an agreement. The Company mitigates credit

risk by dealing with highly rated bank counterparties.

12. CONTINGENT LIABILITIES

In the normal course of business, Circuit City is involved in

various legal proceedings. Based upon the evaluation of the

information presently available, management believes that the

ultimate resolution of any such proceedings will not have a

material adverse effect on the Circuit City Group’s financial

position, liquidity or results of operations.