CarMax 2002 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

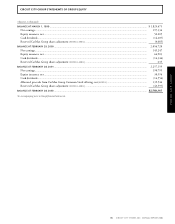

65 CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002

CIRCUIT CITY GROUP

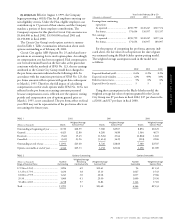

CIRCUIT CITY GROUP STATEMENTS OF GROUP EQUITY

(Amounts in thousands)

BALANCE AT MARCH 1, 1999 ........................................................................................................................................ $ 1,825,473

Net earnings............................................................................................................................................................. 197,334

Equity issuances, net ................................................................................................................................................ 50,205

Cash dividends......................................................................................................................................................... (14,207)

Reserved CarMax Group shares adjustment [NOTES 1 AND 2] ...................................................................................... (4,085)

BALANCE AT FEBRUARY 29, 2000 .................................................................................................................................. 2,054,720

Net earnings............................................................................................................................................................. 149,247

Equity issuances, net ................................................................................................................................................ 66,903

Cash dividends......................................................................................................................................................... (14,346)

Reserved CarMax Group shares adjustment [NOTES 1 AND 2] ...................................................................................... 635

BALANCE AT FEBRUARY 28, 2001 .................................................................................................................................. 2,257,159

Net earnings............................................................................................................................................................. 190,799

Equity issuances, net ................................................................................................................................................ 30,994

Cash dividends......................................................................................................................................................... (14,556)

Allocated proceeds from CarMax Group Common Stock offering, net [NOTE 1]........................................................ 139,546

Reserved CarMax Group shares adjustment [NOTES 1 AND 2] ...................................................................................... (43,597)

BALANCE AT FEBRUARY 28, 2002 .................................................................................................................................. $2,560,345

See accompanying notes to Group financial statements.