CarMax 2002 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002 90

(L) STOCK-BASED COMPENSATION: CarMax accounts for stock-

based compensation in accordance with Accounting Principles

Board Opinion No. 25, “Accounting For Stock Issued to

Employees,” and provides the pro forma disclosures required by

SFAS No. 123, “Accounting for Stock-Based Compensation.”

(M) DERIVATIVE FINANCIAL INSTRUMENTS: On behalf of CarMax

and in connection with securitization activities, the Company

enters into interest rate swap agreements to manage exposure to

interest rates and to more closely match funding costs to the use

of funding. The Company adopted SFAS No. 133, “Accounting

for Derivative Instruments and Hedging Activities,” as amended,

on March 1, 2001. SFAS No. 133 requires the Company to rec-

ognize all derivative instruments as either assets or liabilities on

the balance sheets at fair value. The adoption of SFAS No. 133

did not have a material impact on the financial position, results

of operations or cash flows of the Group. The changes in fair

value of derivative instruments are included in earnings.

(N) RISKS AND UNCERTAINTIES: CarMax is a used- and new-car

retail business. The diversity of CarMax’s customers and suppli-

ers reduces the risk that a severe impact will occur in the near

term as a result of changes in its customer base, competition or

sources of supply. However, because of CarMax’s limited overall

size, management cannot assure that unanticipated events will

not have a negative impact on CarMax.

The preparation of financial statements in conformity with

accounting principles generally accepted in the United States of

America requires management to make estimates and assump-

tions that affect the reported amounts of assets, liabilities, rev-

enues and expenses and the disclosure of contingent assets and

liabilities. Actual results could differ from those estimates.

(O) RECLASSIFICATIONS: Certain prior year amounts have been

reclassified to conform to classifications adopted in fiscal 2002.

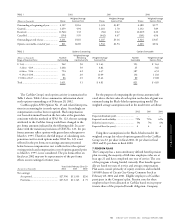

3. PROPERTY AND EQUIPMENT

Property and equipment, at cost, at February 28 is summarized

as follows:

(Amounts in thousands) 2002 2001

Land and buildings (20 to 25 years) ....................... $ 3,442 $101,382

Land held for sale ................................................... 8,762 27,971

Land held for development .................................... 8,021 4,285

Construction in progress ........................................ 64,122 14,324

Furniture, fixtures and equipment

(3 to 8 years) ..................................................... 69,435 64,866

Leasehold improvements (10 to 15 years)............... 17,281 21,196

171,063 234,024

Less accumulated depreciation and amortization.... 50,087 41,866

Property and equipment, net.................................. $120,976 $192,158

Land held for development is land owned for future sites

that are scheduled to open more than one year beyond the fiscal

year reported.

4. DEBT

Long-term debt of the Company at February 28 is summarized

as follows:

(Amounts in thousands) 2002 2001

Term loans.............................................................. $100,000 $230,000

Industrial Development Revenue

Bonds due through 2006 at various

prime-based rates of interest

ranging from 3.1% to 6.7%.............................. 3,717 4,400

Obligations under capital leases.............................. 11,594 12,049

Note payable .......................................................... 826 2,076

Total long-term debt............................................... 116,137 248,525

Less current installments ........................................ 102,073 132,388

Long-term debt, excluding current installments..... $ 14,064 $116,137

Portion of long-term debt, excluding current

installments, allocated to the

CarMax Group ................................................. $ – $ 83,057

Portion of current installments of long-term

debt allocated to the CarMax Group ................ $ 78,608 $108,151

In July 1994, the Company entered into a seven-year,

$100,000,000 unsecured bank term loan. The loan was restruc-

tured in August 1996 as a six-year, $100,000,000 unsecured

bank term loan. Principal is due in full at maturity with interest

payable periodically at LIBOR plus 0.40 percent. At February 28,

2002, the interest rate on the term loan was 2.25 percent. This

term loan is due in July 2002 and was classified as a current lia-

bility at February 28, 2002. Although the Company has the

ability to refinance this loan, it intends to repay the debt using

existing working capital.

In June 1996, the Company entered into a five-year,

$130,000,000 unsecured bank term loan. Principal was due in

full at maturity with interest payable periodically at LIBOR

plus 0.35 percent. As scheduled, the Company used existing

working capital to repay this term loan in June 2001.

The Company maintains a multi-year, $150,000,000 unse-

cured revolving credit agreement with four banks. The agree-

ment calls for interest based on both committed rates and

money market rates and a commitment fee of 0.18 percent per

annum. The agreement was entered into as of August 31, 1996,

and expires on August 31, 2002. No amounts were outstanding

under the revolving credit agreement at February 28, 2002 or

2001, and the Company does not plan to renew this agreement.

In November 1998, CarMax entered into a four-year,

$5,000,000 unsecured promissory note. A portion of the prin-

cipal amount is due annually with interest payable periodically

at 8.25 percent. The outstanding balance at February 28, 2002,

was $826,000 and was included in current installments of long-

term debt.