CarMax 2002 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002 94

contributions allocated to the CarMax Group were $1,304,000

in fiscal 2002, $1,630,000 in fiscal 2001 and $625,000 in fis-

cal 2000.

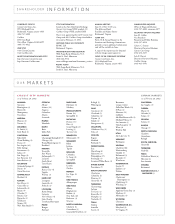

The following tables set forth the CarMax Group’s share of

the pension plan’s financial status and amounts recognized in

the balance sheets as of February 28:

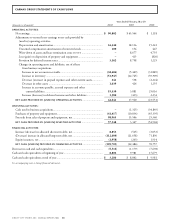

(Amounts in thousands) 2002 2001

Change in benefit obligation:

Benefit obligation at beginning of year .................. $ 7,837 $ 4,443

Service cost ............................................................ 2,549 1,525

Interest cost............................................................ 588 355

Actuarial loss.......................................................... 4,002 1,514

Benefits paid .......................................................... (108) –

Benefit obligation at end of year ............................ $14,868 $ 7,837

Change in plan assets:

Fair value of plan assets at beginning of year.......... $ 4,074 $ 2,715

Actual return on plan assets ................................... (262) (271)

Employer contributions......................................... 1,304 1,630

Benefits paid .......................................................... (108) –

Fair value of plan assets at end of year.................... $ 5,008 $ 4,074

Reconciliation of funded status:

Funded status......................................................... $ (9,860) $(3,763)

Unrecognized actuarial loss.................................... 7,524 3,039

Unrecognized transitional asset.............................. – (3)

Unrecognized prior service benefit......................... (2) (4)

Net amount recognized.......................................... $ (2,338) $ (731)

The components of net pension expense were as follows:

Years Ended February 28 or 29

(Amounts in thousands) 2002 2001 2000

Service cost ............................................... $2,549 $1,525 $1,250

Interest cost .............................................. 588 355 173

Expected return on plan assets.................. (424) (283) (159)

Amortization of prior service cost............. (2) (2) (2)

Amortization of transitional asset ............. (3) (3) (3)

Recognized actuarial loss .......................... 203 91 77

Net pension expense................................. $2,911 $1,683 $1,336

Assumptions used in the accounting for the pension plan were:

Years Ended February 28 or 29

2002 2001 2000

Weighted average discount rate.................... 7.25% 7.50% 8.00%

Rate of increase in compensation levels........ 7.00% 6.00% 6.00%

Expected rate of return on plan assets .......... 9.00% 9.00% 9.00%

The Company also has an unfunded nonqualified plan that

restores retirement benefits for certain senior executives who are

affected by Internal Revenue Code limitations on benefits pro-

vided under the Company’s pension plan. The projected benefit

obligation under this plan and allocated to the CarMax Group

was $1.6 million at February 28, 2002, and $600,000 at

February 28, 2001.

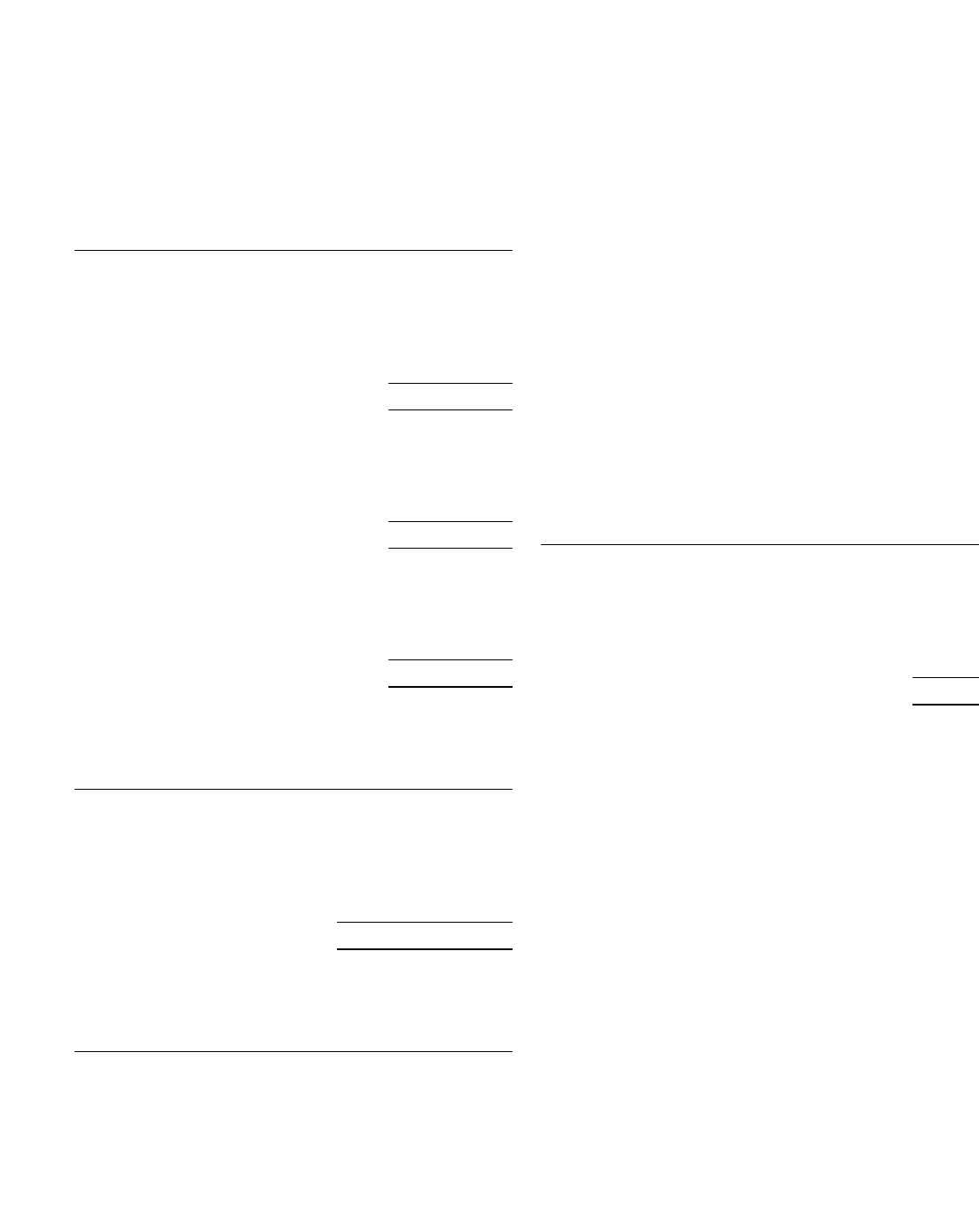

8. LEASE COMMITMENTS

CarMax conducts a substantial portion of its business in leased

premises. CarMax’s lease obligations are based upon contractual

minimum rates. Rental expense for all operating leases was

$41,362,000 in fiscal 2002, $36,057,000 in fiscal 2001 and

$34,706,000 in fiscal 2000. Most leases provide that CarMax

pay taxes, maintenance, insurance and operating expenses appli-

cable to the premises.

The initial term of most real property leases will expire within

the next 20 years; however, most of the leases have options pro-

viding for renewal periods of 10 to 20 years at terms similar to

the initial terms.

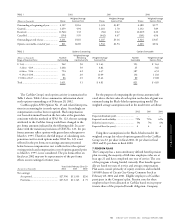

Future minimum fixed lease obligations, excluding taxes,

insurance and other costs payable directly by CarMax, as of

February 28, 2002, were:

Operating

(Amounts in thousands) Lease

Fiscal Commitments

2003 ..................................................................................... $ 43,077

2004 ..................................................................................... 43,364

2005 ..................................................................................... 43,332

2006 ..................................................................................... 42,737

2007 ..................................................................................... 41,991

After 2007 ............................................................................ 508,516

Total minimum lease payments ............................................ $723,017

In August 2001, CarMax entered into a sale-leaseback trans-

action with unrelated parties covering nine superstore proper-

ties. This transaction, which represented the first sale-leaseback

entered into by CarMax without a Circuit City Stores, Inc.

guarantee, was structured at competitive rates with an initial

lease term of 15 years and two 10-year renewal options. In con-

junction with this sale-leaseback transaction, CarMax must

meet financial covenants relating to minimum tangible net

worth and minimum coverage of rent expense. CarMax was in

compliance with all such covenants at February 28, 2002. The

aggregate selling price of sale-leaseback transactions was

$102,388,000 in fiscal 2002 and $12,500,000 in fiscal 2000. In

fiscal 2001, the Company did not enter into any sale-leaseback

transactions. Gains or losses on sale-leaseback transactions are

deferred and amortized over the term of the leases. Neither the

Company nor CarMax has continuing involvement under sale-

leaseback transactions.

9. SUPPLEMENTARY FINANCIAL STATEMENT INFORMATION

(A) ADVERTISING EXPENSE: Advertising expense, which is

included in selling, general and administrative expenses in

the accompanying statements of earnings, amounted to

$47,255,000 (1.5 percent of net sales and operating revenues)