CarMax 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002 26

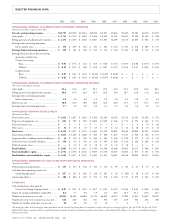

CARMAX AVERAGE RETAIL SELLING PRICES

Fiscal 2002 2001 2000

Used vehicles .................................. $15,100 $14,400 $13,700

New vehicles .................................. $23,100 $22,600 $22,500

Blended average.............................. $16,200 $15,500 $14,900

CARMAX VEHICLE SALES MIX

Fiscal 2002 2001 2000

Vehicle dollars:

Used vehicles ............................ 82% 81% 79%

New vehicles............................. 18 19 21

Total............................................... 100% 100% 100%

Vehicle units:

Used vehicles ............................ 87% 87% 86%

New vehicles............................. 13 13 14

Total............................................... 100% 100% 100%

The fiscal 2002 total sales growth primarily resulted from a 28

percent increase in the comparable store vehicle dollar sales of the

CarMax business. We opened two CarMax used-car superstores in

fiscal 2002 during the last month of the fiscal year, and so they

were not significant contributors to total sales growth in fiscal

2002. The growth in comparable store vehicle dollar sales reflects

increased store traffic that, combined with better in-store execu-

tion, resulted in comparable store unit sales growth for both used

and new cars. We believe that the higher traffic levels were driven

by the effectiveness of our marketing programs, CarMax.com and

word-of-mouth customer referrals. In addition, traffic was bol-

stered in October, November and December by cross-shopping

from zero-percent financing incentive programs introduced by

new-car manufacturers to counteract an industry-wide slowdown

in new-car sales. New-car manufacturers returned to more conven-

tional sales and financing incentives in January 2002. Increased

average retail prices resulting from a higher mix of later-model used

cars, luxury vehicles and sport utility vehicles and higher new-car

average retail prices also contributed to the sales growth.

In late February 2002, CarMax opened one standard-sized

used-car superstore and one satellite used-car superstore. During

fiscal 2002, CarMax also relinquished the franchise rights for

one stand-alone new-car franchise and one new-car franchise

that had been integrated with a used-car superstore and sold one

new-car stand-alone franchise and one new-car franchise that

had been integrated with a used-car superstore. Although new-

car stores that are integrated or co-located with used-car super-

stores have performed at or above our expectations, the three

remaining stand-alone new-car stores are still performing below

our expectations. We intend to integrate or co-locate these stores

with used-car superstores. We expect this integration or co-loca-

tion to occur within the next fiscal year for the store located in

Orlando, Fla., and we expect to co-locate the two remaining

new-car stores, which are in Los Angeles, Calif., with one used-

car superstore within the next two fiscal years.

The fiscal 2001 total sales increase reflects a 17 percent

increase in the comparable store vehicle dollar sales of the

CarMax business, driven by higher-than-anticipated used-car

sales, and the net addition of two used-car superstores, two

prototype satellite stores and six new-car franchises since the end

of fiscal 1999. The new stores and four of the franchises moved

into the comparable store sales base throughout fiscal 2001. In

fiscal 2001, CarMax also added two new-car franchises, integrat-

ing them with existing used-car superstores. We believe CarMax’s

fiscal 2001 sales performance primarily reflects the improved exe-

cution of the CarMax offer at individual stores, increased con-

sumer awareness and use of CarMax.com and the exit of

CarMax’s primary used-car superstore competitor late in fiscal

2000. We believe this competitor’s exit from five multi-store mar-

kets helped eliminate consumer confusion over the two offers.

CarMax’s used-car comparable store vehicle dollar and unit sales

growth has remained strong in all these CarMax markets since

this competitor’s exit from the used-car superstore business.

Geographic expansion of CarMax used-car superstores and the

addition of new-car franchises generated the total sales growth in

the first half of fiscal 2000 and, along with comparable store sales

growth for the last two quarters and for the fiscal year, contributed

to total sales growth for the full year. During fiscal 2000, we opened

two CarMax used-car superstores, two prototype satellite used-car

superstores, five stand-alone new-car stores and one new-car fran-

chise that was integrated with a used-car superstore. CarMax also

converted one existing store into a satellite operation and relocated

one new-car franchise next to a used-car superstore. In the second

half of fiscal 2000, CarMax limited its geographic expansion to

focus on building sales and profitability in existing markets.

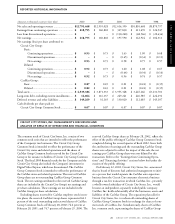

CARMAX RETAIL UNITS

Retail Units at Year-End

Fiscal 2002 2001 2000

Mega superstores(1) ................................................ 13 13 13

Standard superstores(2) ........................................... 17 16 16

Prototype satellite superstores................................ 5 4 4

Co-located new-car stores(3)................................... 2 2 2

Stand-alone new-car stores .................................... 3 5 5

Total...................................................................... 40 40 40

(1) Formerly “C” and “B” stores; 70,000 to 100,000 square feet.

(2) Formerly “A” stores; 40,000 to 60,000 square feet.

(3) Formerly included as “A” and “C” stores.

CARMAX NEW-CAR FRANCHISES

New-Car Franchises

at Year-End

Fiscal 2002 2001 2000

Integrated/co-located new-car franchises............... 15 17 15

Stand-alone new-car franchises.............................. 3 5 5

Total...................................................................... 18 22 20

CarMax sells extended warranties on behalf of unrelated

third parties who are the primary obligors. Under these third-

party warranty programs, we have no contractual liability to the

customer. Extended warranty revenue, which is reported in

total sales, was 1.7 percent of total sales in fiscal 2002, 1.8 per-

cent in fiscal 2001 and 1.6 percent in fiscal 2000. Used cars

achieve a higher warranty penetration rate than new cars.

IMPACT OF INFLATION. Inflation has not been a significant con-

tributor to the Company’s results. For the Circuit City business,

average retail prices have declined in many of Circuit City’s