CarMax 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002 30

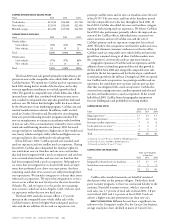

We believe comparable store used-car unit sales growth,

which drives our profitability, will be in the low to mid-teens in

the first half of fiscal 2003, moderating to high-single to low-

double digits in the second half. Fiscal 2003 will be a year of

transition for CarMax as it ramps up its growth pace. Additional

growth-related costs such as training, recruiting and employee

relocation for our new stores will moderate earnings growth. In

addition, we anticipate a reduction in yield spreads from the

CarMax finance operation as interest rates rise above the low lev-

els experienced in fiscal 2002. Our earnings expectations for

CarMax also include preliminary estimates of expenses expected

to be incurred in the second half of fiscal 2003 if the planned

separation is approved. We expect the expense leverage improve-

ment achieved from total and comparable store sales growth to

be substantially offset by these three factors. As a result, we

anticipate earnings per CarMax Group share of 95 cents to

$1.00 for fiscal 2003, excluding the non-recurring costs of sepa-

ration, which are not tax-deductible and are estimated to be

approximately $8 million, or 8 cents per CarMax Group share.

We plan to open six to eight CarMax stores per year in fiscal

2004 through fiscal 2006, including openings in mid-sized

markets and satellite stores in existing markets.

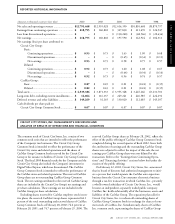

RECENT ACCOUNTING PRONOUNCEMENTS

In July 2000, the Financial Accounting Standards Board issued

EITF No. 00-14, “Accounting for Certain Sales Incentives,”

which is effective for fiscal quarters beginning after December 15,

2001. EITF No. 00-14 provides that sales incentives, such as

mail-in rebates, offered to customers should be classified as a

reduction of revenue. The Company offers certain mail-in

rebates that are currently recorded in cost of sales, buying and

warehousing. However, in the first quarter of fiscal 2003, the

Company expects to reclassify these rebate expenses from cost

of sales, buying and warehousing to net sales and operating rev-

enues to be in compliance with EITF No. 00-14. On a pro

forma basis, this reclassification would have increased the fiscal

2002 Circuit City Stores, Inc. gross profit margin by 12 basis

points and the expense ratio by 10 basis points. For fiscal 2001,

this reclassification would have increased the gross profit margin

and the expense ratio by 20 basis points. For the Circuit City

Group, this reclassification would have increased the gross profit

margin by 18 basis points and the expense ratio by 17 basis

points in fiscal 2002, and the gross profit margin by 29 basis

points and the expense ratio by 27 basis points in fiscal 2001.

The Company does not expect the adoption of EITF No. 00-14

to have a material impact on its financial position, results of

operations or cash flows.

In June 2001, the FASB issued Statement of Financial

Accounting Standards No. 141, “Business Combinations,” effec-

tive for business combinations initiated after June 30, 2001, and

SFAS No. 142, “Goodwill and Other Intangible Assets,” effective

for fiscal years beginning after December 15, 2001. Under SFAS

No. 141, the pooling of interests method of accounting for busi-

ness combinations is eliminated, requiring that all business com-

binations initiated after the effective date be accounted for using

the purchase method. Also under SFAS No. 141, identified

intangible assets acquired in a purchase business combination

must be separately valued and recognized on the balance sheet if

they meet certain requirements. Under the provisions of SFAS

No. 142, goodwill and intangible assets deemed to have indefi-

nite lives will no longer be amortized but will be subject to

annual impairment tests in accordance with the pronouncement.

Other intangible assets that are identified to have finite useful

lives will continue to be amortized in a manner that reflects the

estimated decline in the economic value of the intangible asset

and will be subject to review when events or circumstances arise

which indicate impairment. For the CarMax Group, goodwill

totaled $20.1 million and covenants not to compete totaled $1.5

million as of February 28, 2002. In fiscal 2002, goodwill amorti-

zation totaled $1.8 million, and amortization of covenants not to

compete totaled $931,000. Covenants not to compete will con-

tinue to be amortized on a straight-line basis over the life of the

covenant, not to exceed five years. Application of the nonamorti-

zation provisions of SFAS No. 142 in fiscal 2003 is not expected

to have a material impact on the financial position, results of

operations or cash flows of the Company. During fiscal 2003, the

Company will perform the first of the required impairment tests

of goodwill, as outlined in the new pronouncement. Based on

preliminary estimates, as well as ongoing periodic assessments of

goodwill, the Company does not expect to recognize any material

impairment losses from these tests.

In August 2001, the FASB issued SFAS No. 143, “Account-

ing For Asset Retirement Obligations.” This statement

addresses financial accounting and reporting for obligations

associated with the retirement of tangible long-lived assets and

the associated asset retirement costs. It applies to legal obliga-

tions associated with the retirement of long-lived assets that

result from the acquisition, construction, development and the

normal operation of a long-lived asset, except for certain obliga-

tions of lessees. This standard requires entities to record the fair

value of a liability for an asset retirement obligation in the

period incurred. SFAS No. 143 is effective for fiscal years begin-

ning after June 15, 2002. The Company has not yet determined

the impact, if any, of adopting this standard.

In August 2001, the FASB issued SFAS No. 144, “Account-

ing for the Impairment or Disposal of Long-Lived Assets,”

which supersedes both SFAS No. 121, “Accounting for the

Impairment of Long-Lived Assets and for Long-Lived Assets to

Be Disposed Of,” and the accounting and reporting provisions

of Accounting Principles Board Opinion No. 30, “Reporting the

Results of Operations-Reporting the Effects of Disposal of a

Segment of a Business, and Extraordinary, Unusual and Infre-

quently Occurring Events and Transactions,” related to the dis-

posal of a segment of a business (as previously defined in that

Opinion). SFAS No. 144 retains the fundamental provisions in

SFAS No. 121 for recognizing and measuring impairment losses

on long-lived assets held for use and long-lived assets to be dis-

posed of by sale, while also resolving significant implementation

issues associated with SFAS No. 121. The Company is required

to adopt SFAS No. 144 no later than the fiscal year beginning

after December 15, 2001, and plans to adopt the provisions in

the first quarter of fiscal 2003. The Company does not expect

the adoption of SFAS No. 144 to have a material impact on its

financial position, results of operations or cash flows.