CarMax 2002 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61 CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002

CarMax could take advantage of the favorable economic terms

available to the Company as a large retailer. The Company has

assigned each of these leases to CarMax. Despite the assignment

and pursuant to the terms of the leases, the Company remains

contingently liable under the leases. For example, if CarMax

were to fail to make lease payments under one or more of the

leases, the Company may be required to make those payments

on CarMax’s behalf. In recognition of this ongoing contingent

liability, CarMax has agreed to make a one-time special dividend

payment to Circuit City Stores, Inc. on the separation date,

assuming the separation is completed. We currently expect this

special dividend to be between $25 million and $35 million.

MARKET RISK

Receivables Risk

The Company manages the market risk associated with the pri-

vate-label credit card and bankcard revolving loan portfolios of

Circuit City’s finance operation. Portions of these portfolios

have been securitized in transactions accounted for as sales in

accordance with SFAS No. 140 and, therefore, are not pre-

sented on the Group balance sheets.

CONSUMER REVOLVING CREDIT RECEIVABLES. The majority of

accounts in the private-label credit card and bankcard portfolios

are charged interest at rates indexed to the prime rate,

adjustable on a monthly basis subject to certain limitations. The

balance of the accounts are charged interest at a fixed annual

percentage rate. As of February 28, 2002, and February 28,

2001, the total outstanding principal amount of private-label

credit card and bankcard receivables had the following interest

rate structure:

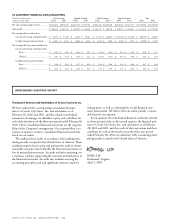

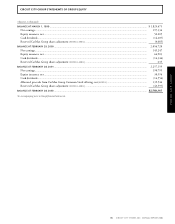

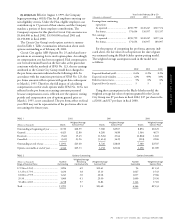

(Amounts in millions) 2002 2001

Indexed to prime rate............................................ $2,645 $2,596

Fixed APR............................................................. 202 203

Total...................................................................... $2,847 $2,799

Financing for the private-label credit card and bankcard

receivables is achieved through asset securitization programs that,

in turn, issue both private and public market debt, principally at

floating rates based on LIBOR and commercial paper rates.

Receivables held for sale are financed with working capital. The

total principal amount of receivables securitized or held for sale at

February 28, 2002, and February 28, 2001, was as follows:

(Amounts in millions) 2002 2001

Floating-rate securitizations .................................. $2,798 $2,754

Held for sale.......................................................... 49 45

Total...................................................................... $2,847 $2,799

INTEREST RATE EXPOSURE. Circuit City is exposed to interest

rate risk on its securitized credit card portfolio, especially when

interest rates move dramatically over a relatively short period of

time. We have attempted to mitigate this risk through matched

funding. In addition, our ability to increase the finance charge

yield of our variable rate credit cards may be contractually lim-

ited or limited at some point by competitive conditions.

Generally, changes only in interest rates do not have a material

impact on the Group results of operations.

The market and credit risks associated with financed deriva-

tives are similar to those relating to other types of financial

instruments. Refer to Note 11 to the Group financial state-

ments for a description of these items. Market risk is the expo-

sure created by potential fluctuations in interest rates. On

behalf of Circuit City, the Company enters into interest rate

cap agreements to meet the requirements of the credit card

receivable securitization transactions. The Company has entered

into offsetting interest rate cap positions and, therefore, does

not anticipate significant market risk arising from interest rate

caps. Credit risk is the exposure to nonperformance of another

party to an agreement. The Company mitigates credit risk by

dealing with highly rated bank counterparties.

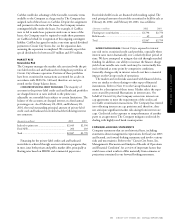

FORWARD-LOOKING STATEMENTS

Company statements that are not historical facts, including

statements about management’s expectations for fiscal year 2003

and beyond, are forward-looking statements and involve various

risks and uncertainties. Refer to the “Circuit City Stores, Inc.

Management’s Discussion and Analysis of Results of Operations

and Financial Condition” for a review of important factors that

could cause actual results to differ materially from estimates or

projections contained in our forward-looking statements.

CIRCUIT CITY GROUP