CarMax 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35 CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002

consumer credit delinquency and default rates, interest rates,

inflation, personal discretionary spending levels and consumer

sentiment about the economy in general.

•The presence or absence of, or consumer acceptance of,

new products or product features in the merchandise categories

we sell and changes in our actual merchandise sales mix.

•Significant changes in retail prices for products sold by

either of our businesses.

•Lack of availability or access to sources of inventory for

either of our businesses.

•Inability on the part of either of our businesses to liquidate

excess inventory should excess inventory develop.

•Unanticipated adverse results from remodeling or relocat-

ing Circuit City Superstores.

•The ability to attract and retain an effective management

team in a dynamic environment or changes in the cost or avail-

ability of a suitable work force to manage and support our

service-driven operating strategies.

•Changes in the availability of securitization financing for

credit card and automobile installment loan receivables and the

availability or cost of capital expenditure and working capital

financing, including the availability of long-term financing to

support development of our businesses.

•Changes in production or distribution costs or cost of

materials for our advertising.

•Availability of appropriate real estate locations for expansion.

•The imposition of new restrictions or regulations regarding

the sale of products and/or services we sell, changes in tax rules

and regulations applicable to us or our competitors, or any failure

to comply with such laws or any adverse change in such laws.

•Adverse results in significant litigation matters.

The board of directors has authorized management to initiate a

process that would separate the CarMax business from the Circuit

City business through a tax-free transaction in which CarMax,

Inc. would become an independent, separately traded public com-

pany. CarMax, Inc. has filed a registration statement related to this

transaction with the SEC. The cautionary statements listed above

should be read in conjunction with the risk factors in the registra-

tion statement and in the Company’s other SEC filings.

We believe our forward-looking statements are reasonable;

however, undue reliance should not be placed on any forward-

looking statements, which are based on current expectations.

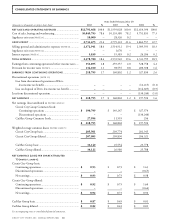

CIRCUIT CITY STORES, INC.

COMMON STOCK

The common stock of Circuit City Stores, Inc. includes two series: Circuit City Stores, Inc. – Circuit City Group Common Stock

and Circuit City Stores, Inc. – CarMax Group Common Stock. Both Group stocks are traded on the New York Stock Exchange.

The quarterly dividend data shown below applies to the Circuit City Group Common Stock for the applicable periods. No divi-

dend data is shown for the CarMax Group Common Stock since it pays no dividends at this time.

Circuit City Group CarMax Group

Market Price of Common Stock Dividends Market Price of Common Stock

Fiscal 2002 2001 2002 2001 2002 2001

Quarter HIGH LOW HIGH LOW HIGH LOW HIGH LOW

1st...................................... $16.85 $10.34 $65.19 $37.25 $.0175 $.0175 $15.49 $ 4.70 $4.25 $1.56

2nd .................................... $20.25 $14.50 $56.63 $21.00 $.0175 $.0175 $20.50 $11.50 $4.88 $2.63

3rd..................................... $17.84 $ 9.55 $28.25 $11.56 $.0175 $.0175 $21.00 $ 9.20 $5.38 $3.38

4th..................................... $31.40 $16.08 $19.90 $ 8.69 $.0175 $.0175 $29.02 $19.35 $5.50 $3.69

Total .................................. $.0700 $.0700