CarMax 2002 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83 CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002

transfers the purchased receivables to a securitization trust. The

securitization trust then issues asset-backed securities secured by

the transferred receivables in public offerings, and the proceeds

are distributed through the special purpose subsidiary to

CarMax’s finance operation. CarMax continues to service the

transferred receivables for a fee. Asset-backed securities were

issued totaling $644.0 million in October 1999, $655.4 million

in January 2001 and $641.7 million in November 2001.

At February 28, 2002, the aggregate principal amount of

securitized automobile loan receivables totaled $1.54 billion. At

February 28, 2002, there were no provisions providing recourse

to the Company for credit losses on the securitized automobile

loan receivables. CarMax anticipates that it will be able to

expand or enter into new securitization arrangements to meet

the future needs of the automobile loan finance operation.

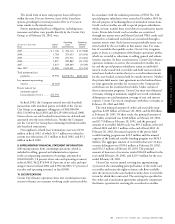

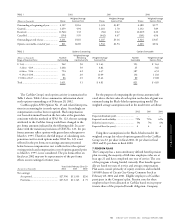

CONTRACTUAL OBLIGATIONS(1)

2 to 3 4 to 5 After 5

(Amounts in millions) Total 1 Year Years Years Years

Allocated contractual

obligations:

Long-term debt ................... $ 78.6 $ 78.6 $ – $ – $ –

Promissory note................... 8.5 8.5 – – –

Operating leases................... 723.0 43.1 86.7 84.7 508.5

Lines of credit...................... 1.4 1.4 – – –

Total.......................................... $811.5 $131.6 $86.7 $84.7 $508.5

(1) Amounts are based on the capital structure of Circuit City Stores, Inc. as of February 28,

2002. Future obligations depend upon the final outcome of the proposed separation of

CarMax.

CarMax currently operates 23 of its sales locations pursuant

to various leases under which Circuit City Stores, Inc. was the

original tenant and primary obligor. Circuit City Stores, Inc.,

and not CarMax, had originally entered into these leases so that

CarMax could take advantage of the favorable economic terms

available to the Company as a large retailer. The Company has

assigned each of these leases to CarMax. Despite the assignment

and pursuant to the terms of the leases, the Company remains

contingently liable under the leases. For example, if CarMax

were to fail to make lease payments under one or more of the

leases, the Company may be required to make those payments

on CarMax’s behalf. In recognition of this ongoing contingent

liability, CarMax has agreed to make a one-time special dividend

payment to Circuit City Stores, Inc. on the separation date,

assuming the separation is completed. We currently expect this

special dividend to be between $25 million and $35 million.

MARKET RISK

Receivables Risk

The Company manages the market risk associated with the

automobile installment loan portfolio of CarMax’s finance

operation. A portion of this portfolio has been securitized in

transactions accounted for as sales in accordance with SFAS

No. 140 and, therefore, is not presented on the Group

balance sheets.

AUTOMOBILE INSTALLMENT LOAN RECEIVABLES. At February 28,

2002, and February 28, 2001, all loans in the portfolio of auto-

mobile loan receivables were fixed-rate installment loans.

Financing for these automobile loan receivables is achieved

through asset securitization programs that, in turn, issue both

fixed- and floating-rate securities. Receivables held for invest-

ment or sale are financed with working capital. The total prin-

cipal amount of receivables securitized or held for investment

or sale as of February 28, 2002, and February 28, 2001, was

as follows:

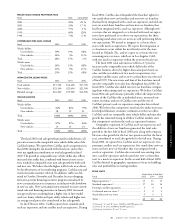

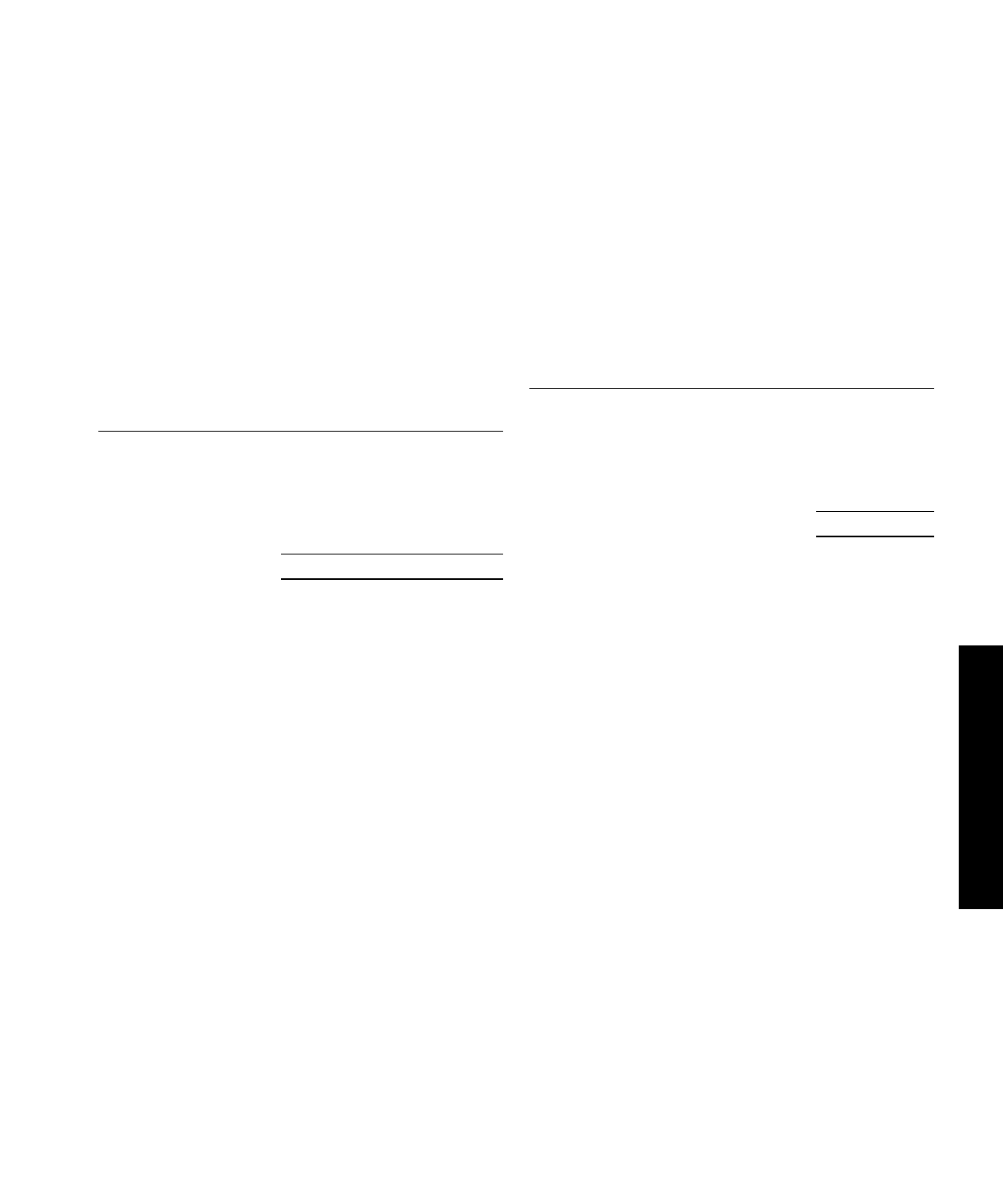

(Amounts in millions) 2002 2001

Fixed-rate securitizations....................................... $1,122 $ 984

Floating-rate securitizations

synthetically altered to fixed ............................ 413 299

Floating-rate securitizations .................................. 1 1

Held for investment(1)........................................... 12 9

Held for sale.......................................................... 2 3

Total...................................................................... $1,550 $1,296

(1) Held by a bankruptcy-remote special purpose subsidiary.

INTEREST RATE EXPOSURE. Interest rate exposure relating to the

securitized automobile loan receivables represents a market risk

exposure that we manage with matched funding and interest

rate swaps matched to projected payoffs. The market and credit

risks associated with financial derivatives are similar to those

relating to other types of financial instruments. Refer to Note

11 to the Group financial statements for a description of these

items. Market risk is the exposure created by potential fluctua-

tions in interest rates. The Company does not anticipate signifi-

cant market risk from swaps because they are used on a

monthly basis to match funding costs to the use of the funding.

Credit risk is the exposure to nonperformance of another party

to an agreement. The Company mitigates credit risk by dealing

with highly rated bank counterparties.

FORWARD-LOOKING STATEMENTS

Company statements that are not historical facts, including

statements about management’s expectations for fiscal year 2003

and beyond, are forward-looking statements and involve various

risks and uncertainties. Refer to the “Circuit City Stores, Inc.

Management’s Discussion and Analysis of Results of Operations

and Financial Condition” for a review of important factors that

could cause actual results to differ materially from estimates or

projections contained in our forward-looking statements.

CARMAX GROUP