CarMax 2002 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

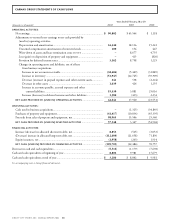

CARMAX GROUP STATEMENTS OF CASH FLOWS

CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002 86

Years Ended February 28 or 29

(Amounts in thousands) 2002 2001 2000

OPERATING ACTIVITIES:

Net earnings...................................................................................................... $ 90,802 $ 45,564 $ 1,118

Adjustments to reconcile net earnings to net cash provided by

(used in) operating activities:

Depreciation and amortization..................................................................... 16,340 18,116 15,241

Unearned compensation amortization of restricted stock.............................. 100 154 447

Write-down of assets and lease termination costs [NOTE 9] ............................. –8,677 4,755

Loss (gain) on disposition of property and equipment.................................. –415 (820)

Provision for deferred income taxes .............................................................. 3,162 8,758 1,225

Changes in operating assets and liabilities, net of effects

from business acquisitions:

Increase in net accounts receivable........................................................... (38,606) (5,409) (31,889)

Increase in inventory ............................................................................... (51,947) (62,745) (39,909)

Decrease (increase) in prepaid expenses and other current assets .............. 241 538 (2,224)

Decrease in other assets ........................................................................... 1,639 424 1,255

Increase in accounts payable, accrued expenses and other

current liabilities................................................................................. 19,330 3,881 25,016

Increase (decrease) in deferred revenue and other liabilities...................... 1,580 (413) 2,234

NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES ............................ 42,641 17,960 (23,551)

INVESTING ACTIVITIES:

Cash used in business acquisitions..................................................................... –(1,325) (34,849)

Purchases of property and equipment................................................................ (41,417) (10,834) (45,395)

Proceeds from sales of property and equipment, net.......................................... 98,965 15,506 25,340

NET CASH PROVIDED BY (USED IN) INVESTING ACTIVITIES ............................. 57,548 3,347 (54,904)

FINANCING ACTIVITIES:

Increase (decrease) in allocated short-term debt, net.......................................... 8,853 (565) (3,053)

(Decrease) increase in allocated long-term debt, net .......................................... (112,600) (21,658) 71,896

Equity issuances, net ......................................................................................... (1,958) (263) 1,914

NET CASH (USED IN) PROVIDED BY FINANCING ACTIVITIES ............................ (105,705) (22,486) 70,757

Decrease in cash and cash equivalents .................................................................... (5,516) (1,179) (7,698)

Cash and cash equivalents at beginning of year ...................................................... 8,802 9,981 17,679

Cash and cash equivalents at end of year................................................................ $ 3,286 $ 8,802 $ 9,981

See accompanying notes to Group financial statements.