CarMax 2002 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002 32

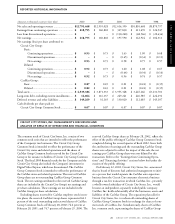

As scheduled, Circuit City Stores used existing working capital

to repay a $130 million term loan in fiscal 2002 and a $175 mil-

lion term loan in fiscal 2001. At February 28, 2002, a $100 million

outstanding term loan due in July 2002 was classified as a current

liability. Although the Company has the ability to refinance this

debt, we intend to repay it using existing working capital.

At February 28, 2002, the Company had cash and cash

equivalents of $1.25 billion and total outstanding debt of

$126.4 million. Circuit City Stores maintains a $150 million

unsecured revolving credit facility that expires on August 31,

2002. The Company does not anticipate renewing this facility.

The Company also maintains $195 million in committed sea-

sonal lines of credit that are renewed annually with various

banks. At February 28, 2002, total balances of $1.8 million

were outstanding under these facilities.

We anticipate that during the first quarter of fiscal 2003,

CarMax will enter into a multi-year, $200 million credit agree-

ment secured by vehicle inventory. We anticipate that some of

the proceeds from the agreement will be used for the repayment

of allocated debt; the payment on the separation date of a one-

time special dividend to Circuit City Stores, Inc., currently esti-

mated to be between $25 million and $35 million; the payment

of transaction expenses incurred in connection with the separa-

tion; and general corporate purposes. Refer to “Contractual Obli-

gations” for further discussion of the special dividend payment.

Receivables generated by the Circuit City and CarMax

finance operations are funded through securitization transac-

tions in which the finance operations sell their receivables while

retaining servicing rights. These securitization transactions pro-

vide an efficient and economical means of funding credit card

and automobile loan receivables. For transfers of receivables

that qualify as sales under SFAS No. 140, “Accounting for

Transfers and Servicing of Financial Assets and Extinguishments

of Liabilities,” we recognize gains and losses as a component of

the profits of Circuit City’s or CarMax’s finance operation.

On a daily basis, Circuit City’s finance operation sells its

private-label credit card and MasterCard and VISA credit card,

referred to as bankcard, receivables to special purpose subsidiaries,

which, in turn, transfer the receivables to two separate securitiza-

tion master trusts. The master trusts periodically issue asset-

backed securities in public offerings and private transactions, and

the proceeds are distributed through the special purpose sub-

sidiaries to Circuit City’s finance operation. The special purpose

subsidiaries retain an undivided interest in the transferred receiv-

ables and hold various subordinated asset-backed securities that

serve as credit enhancement for the asset-backed securities held

by outside investors. Circuit City’s finance operation continues to

service the transferred receivables for a fee.

The private-label and bankcard master trusts each have issued

multiple series of asset-backed securities, referred to as term secu-

rities, having fixed initial principal amounts. Investors in the term

securities are entitled to receive monthly interest payments and a

single principal payment on a stated maturity date. In addition,

each master trust has issued a series of asset-backed securities,

referred to as variable funding securities, having a variable principal

amount. Investors in the variable funding securities are generally

entitled to receive monthly interest payments and have commit-

ted to acquire additional undivided interests in the transferred

receivables up to a stated amount through a stated commitment

termination date. The commitment under the private-label variable

funding series is currently scheduled to expire on December 13,

2002, and the commitment under the bankcard variable funding

series is currently scheduled to expire on October 24, 2002. We

expect that the commitment termination dates of both variable

funding series will be extended. If certain events were to occur,

principal payment dates for the term series would be accelerated,

the variable funding commitments would terminate and the vari-

able funding investors would begin to receive monthly principal

payments until paid in full.

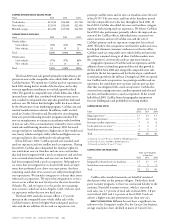

At February 28, 2002, the aggregate principal amount of securi-

tized credit card receivables totaled $1.31 billion under the private-

label program and $1.49 billion under the bankcard program. At

February 28, 2002, the unused capacity of the private-label variable

funding program was $22.9 million and the unused capacity of the

bankcard variable funding program was $496.5 million. At

February 28, 2002, there were no provisions providing recourse to

the Company for credit losses on the receivables securitized

through the private-label or bankcard master trusts.

We have conducted tests of a co-branded Circuit City

bankcard, which offers more utility to the customer than the

private-label card. We are considering transitioning our private-

label program to this card.

On a monthly basis, CarMax’s finance operation sells its auto-

mobile loan receivables to a special purpose subsidiary, which, in

turn, transfers the receivables to a group of third-party investors.

The investors sell commercial paper backed by the transferred

receivables, and the proceeds are distributed through the special

purpose subsidiary to CarMax’s finance operation. The special pur-

pose subsidiary retains a subordinated interest in the transferred

receivables. CarMax’s finance operation continues to service the

transferred receivables for a fee. The investors are generally entitled

to receive monthly interest payments and have committed to

acquire additional undivided interests in the transferred receivables

up to a stated amount through June 27, 2002. We expect that the

commitment termination date will be extended. If certain events

were to occur, the commitment to acquire additional undivided

interests would terminate and the investors would begin to receive

monthly principal payments until paid in full. At February 28,

2002, the unused capacity of this program was $211.0 million.

CarMax’s finance operation periodically refinances its auto-

mobile loan receivables through the public issuance of asset-

backed securities. The finance operation sells the receivables to

be refinanced to a special purpose subsidiary, which, in turn,

transfers the purchased receivables to a securitization trust. The

securitization trust then issues asset-backed securities secured by

the transferred receivables in public offerings, and the proceeds

are distributed through the special purpose subsidiary to

CarMax’s finance operation. CarMax continues to service the

transferred receivables for a fee. Asset-backed securities were

issued totaling $644.0 million in October 1999, $655.4 million

in January 2001 and $641.7 million in November 2001.