CarMax 2002 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75 CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002

CIRCUIT CITY GROUP

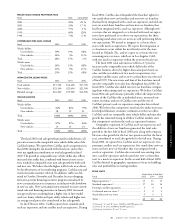

13. APPLIANCE EXIT COSTS

On July 25, 2000, the Company announced plans to exit the

major appliance category and expand its selection of key con-

sumer electronics and home office products in all Circuit City

Superstores. A product profitability analysis had indicated that

the appliance category produced below-average profits. This

analysis, combined with declining appliance sales, expected

increases in appliance competition and the Company’s profit

expectations for the consumer electronics and home office cate-

gories led to the decision to exit the major appliance category.

The Company maintains control over Circuit City’s in-home

major appliance repair business, although repairs are subcon-

tracted to an unrelated third party.

To exit the appliance business, the Company closed eight

distribution centers and eight service centers. The majority of

these closed properties are leased. While the Company has

entered into contracts to sublease some of these properties, it

continues the process of marketing the remaining properties to

be subleased.

Approximately 910 employees were terminated as a result of

the exit from the appliance business. These reductions mainly

were in the service, distribution and merchandising functions.

Because severance was paid to employees on a biweekly sched-

ule based on years of service, cash payments lagged job elimina-

tions. Certain fixed assets were written down in connection

with the exit from the appliance business, including appliance

build-to-order kiosks in stores and non-salvageable fixed assets

and leasehold improvements at the closed locations.

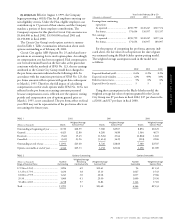

In the second quarter of fiscal 2001, the Company recorded

appliance exit costs of $30.0 million. In the fourth quarter of fis-

cal 2002, the Company recorded additional lease termination

costs of $10.0 million to reflect the current rental market for

these leased properties. These expenses are reported separately on

the fiscal 2002 and 2001 statements of earnings. The appliance

exit cost liability is included in the accrued expenses and other

current liabilities line item on the Group balance sheet. The

appliance exit cost accrual activity is presented in Table 3.

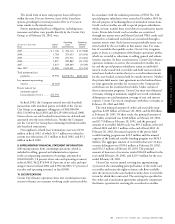

14. DISCONTINUED OPERATIONS

On June 16, 1999, Digital Video Express announced that it

would cease marketing the Divx home video system and dis-

continue operations. Discontinued operations have been segre-

gated on the consolidated statements of cash flows; however,

Divx is not segregated on the consolidated balance sheets.

For fiscal 2002 and 2001, the discontinued Divx operations

had no impact on the net earnings of Circuit City Stores, Inc.

In fiscal 2000, the loss from the discontinued Divx operations

totaled $16.2 million after an income tax benefit of $9.9 mil-

lion and the loss on the disposal of the Divx business totaled

$114.0 million after an income tax benefit of $69.9 million.

The loss on the disposal included a provision for operating

losses to be incurred during the phase-out period. It also

included provisions for commitments under licensing agree-

ments with motion picture distributors, the write-down of

assets to net realizable value, lease termination costs, employee

severance and benefit costs and other contractual commitments.

As of February 28, 2002, entities comprising the Divx opera-

tions have been dissolved and the related net liabilities have been

assumed by the Company. Net liabilities reflected in the accom-

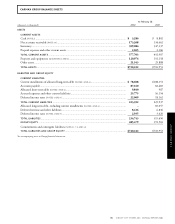

panying Group balance sheets as of February 28 were as follows:

(Amounts in thousands) 2002 2001

Current assets................................................ $ – $ 8

Other assets................................................... – 324

Current liabilities .......................................... (18,457) (27,522)

Other liabilities ............................................. – (14,082)

Net liabilities of discontinued operations ...... $(18,457) $(41,272)

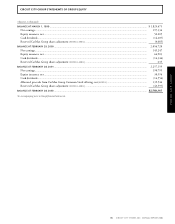

TABLE 3

Total Fiscal 2001 Fiscal 2002 Fiscal 2002

Original Payments Liability at Adjustments Payments Liability at

Exit Cost or February 28, to Exit Cost or February 28,

(Amounts in millions) Accrual Write-Downs 2001 Accrual Write-Downs 2002

Lease termination costs ............................. $17.8 $ 1.8 $16.0 $10.0 $6.3 $19.7

Fixed asset write-downs, net ...................... 5.0 5.0 – – – –

Employee termination benefits.................. 4.4 2.2 2.2 – 2.2 –

Other ........................................................ 2.8 2.8 – – – –

Appliance exit costs ................................... $30.0 $11.8 $18.2 $10.0 $8.5 $19.7