CarMax 2002 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

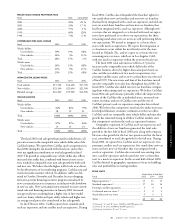

81 CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002

CARMAX GROUP

In a public offering completed during the second quarter of

fiscal 2002, the Company sold 9,516,800 shares of CarMax

Group Common Stock that previously had been reserved for

the Circuit City Group or for issuance to holders of Circuit

City Group Common Stock. With the impact of the offering,

69.2 percent of the CarMax Group’s earnings were attributed to

the Circuit City Group’s reserved CarMax Group shares in fiscal

2002. In fiscal 2001, 74.6 percent of the CarMax Group’s earn-

ings were attributed to the Circuit City Group’s reserved

CarMax Group shares, and in fiscal 2000, 77.1 percent of the

CarMax Group’s earnings were attributed to the Circuit City

Group’s reserved CarMax Group shares. The net proceeds of

$139.5 million from the offering were allocated to the Circuit

City Group to be used for general purposes of the Circuit City

business, including remodeling of Circuit City Superstores.

Operations Outlook

Over the past two years, CarMax has demonstrated that its con-

sumer offer and business model can produce strong sales and

earnings growth. Given its solid financial performance, we

believe CarMax is able to support its growth independently.

In fiscal 2003, CarMax’s geographic expansion will continue

to focus on entries into mid-sized markets and satellite store

opportunities in existing markets. We have identified more than

30 additional markets that could support a standard superstore,

the principal CarMax store size going forward. We also believe

that we can add approximately 10 satellite stores in our existing

markets. In fiscal 2003, CarMax plans to open four to six

stores, approximately one half of which are expected to be satel-

lite stores.

We believe comparable store used-car unit sales growth,

which drives our profitability, will be in the low- to mid-teens

in the first half of fiscal 2003, moderating to high-single to

low-double digits in the second half. Fiscal 2003 will be a year

of transition for CarMax as it ramps up its growth pace. Addi-

tional growth-related costs such as training, recruiting and

employee relocation for our new stores will moderate earnings

growth. In addition, we anticipate a reduction in yield spreads

from the CarMax finance operation as interest rates rise above

the low levels experienced in fiscal 2002. Our earnings expecta-

tions for CarMax also include preliminary estimates of

expenses expected to be incurred in the second half of fiscal

2003 if the planned separation is approved. We expect the

expense leverage improvement achieved from total and compa-

rable store sales growth to be substantially offset by these three

factors. Refer to the “Circuit City Stores, Inc. Management’s

Discussion and Analysis of Results of Operations and Financial

Condition” for the estimated contribution of the CarMax busi-

ness earnings attributed to the outstanding CarMax Group

Common Stock in fiscal 2003.

We plan to open six to eight stores per year in fiscal 2004

through fiscal 2006, including openings in mid-sized markets

and satellite stores in existing markets.

RECENT ACCOUNTING PRONOUNCEMENTS

Refer to the “Circuit City Stores, Inc. Management’s Discussion

and Analysis of Results of Operations and Financial Condition”

for a review of recent accounting pronouncements.

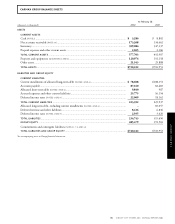

FINANCIAL CONDITION

Liquidity and Capital Resources

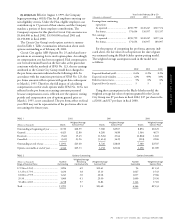

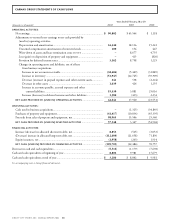

CASH FLOW HIGHLIGHTS

Years Ended February 28 or 29

(Amounts in millions) 2002 2001 2000

Net earnings .................................................. $ 90.8 $ 45.6 $ 1.1

Depreciation and amortization...................... $ 16.3 $ 18.1 $ 15.2

Provision for deferred income taxes ............... $ 3.2 $ 8.8 $ 1.2

Cash used for working capital, net................. $ (71.0) $(63.7) $(49.0)

Cash provided by (used in)

operating activities ................................... $ 42.6 $ 18.0 $(23.6)

Purchases of property and equipment............ $ (41.4) $(10.8) $(45.4)

Proceeds from sales of property

and equipment, net.................................. $ 99.0 $ 15.5 $ 25.3

Net (decrease) increase in allocated

short-term and long-term debt................. $(103.7) $(22.2) $ 68.8

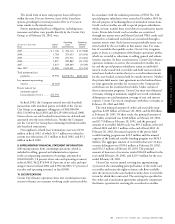

CASH PROVIDED BY OR USED IN OPERATIONS. CarMax generated

net cash from operating activities of $42.6 million in fiscal 2002

and $18.0 million in fiscal 2001. Net cash used in operating

activities was $23.6 million in fiscal 2000. The fiscal 2002

improvement primarily resulted from a $45.2 million increase in

net earnings, partly offset by an increase in accounts receivable,

which resulted from increased sales generating increased auto-

mobile loans and increased yield spreads from the finance opera-

tion. The fiscal 2001 increase reflects a $44.4 million increase in

net earnings, partly offset by an increase in working capital.

INVESTING ACTIVITIES. Net cash provided by investing activities

was $57.5 million in fiscal 2002 and $3.3 million in fiscal

2001. Net cash used in investing activities was $54.9 million in

fiscal 2000. CarMax’s capital expenditures were $41.4 million

in fiscal 2002, $10.8 million in fiscal 2001 and $45.4 million in

fiscal 2000. Fiscal 2002 capital expenditures included spending

for the construction of two standard-sized used-car superstores,

one of which opened during the first quarter of fiscal 2003, and

one satellite used-car superstore. In fiscal 2001, capital expendi-

tures were related to equipment purchases. Fiscal 2000 capital

expenditures included spending for the construction of four

used-car superstores.

Capital expenditures have been funded primarily through

sale-leaseback transactions, allocated short- and long-term debt

and internally generated funds. Net proceeds from sales of

property and equipment, including sale-leasebacks, totaled

$99.0 million in fiscal 2002, $15.5 million in fiscal 2001 and

$25.3 million in fiscal 2000. In August 2001, CarMax entered

into a sale-leaseback transaction covering nine superstore prop-

erties for an aggregate sale price of $102.4 million. This trans-

action, which represented the first sale-leaseback entered into

by CarMax without a Circuit City Stores, Inc. guarantee, was

structured at competitive rates with an initial lease term of 15

years and two 10-year renewal options.