CarMax 2002 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

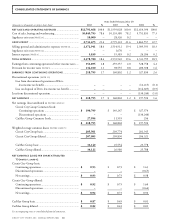

31 CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002

FINANCIAL CONDITION

Liquidity and Capital Resources

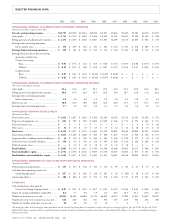

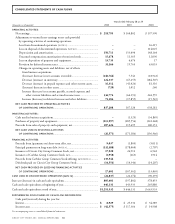

CASH FLOW HIGHLIGHTS

Years Ended February 28 or 29

(Amounts in millions) 2002 2001 2000

Net earnings from continuing operations... $ 218.8 $ 160.8 $ 327.8

Depreciation and amortization.................. $ 150.7 $ 153.1 $ 148.2

Provision for deferred income taxes ........... $ 31.2 $ 19.8 $ 43.1

Cash provided by (used for)

working capital, net ............................. $ 336.7 $(165.7) $ 122.4

Cash provided by operating activities ........ $ 837.2 $ 167.1 $ 638.3

Purchases of property and equipment........ $(214.0) $(285.6) $(222.3)

Proceeds from sales of property

and equipment, net.............................. $ 187.4 $ 115.7 $ 100.2

Net decrease in short-term and

long-term debt..................................... $(123.4) $(179.9) $ (7.7)

Proceeds from CarMax stock

offering, net ......................................... $ 139.5 – –

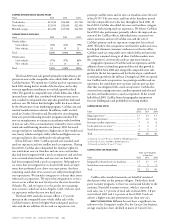

CASH PROVIDED BY OPERATIONS. Circuit City Stores generated

net cash from operating activities of $837.2 million in fiscal

2002, compared with $167.1 million in fiscal 2001 and $638.3

million in fiscal 2000. The fiscal 2002 improvement primarily

resulted from working capital efficiencies and a $58.0 million

increase in net earnings. Improved supply chain management in

the Circuit City business contributed to a $192.0 million

reduction in working capital used for inventories in fiscal 2002

compared with fiscal 2001. Increases in accounts payable,

accrued expenses and other current liabilities, and accrued

income taxes reduced working capital by an additional $401.0

million in fiscal 2002 compared with fiscal 2001. The increase

in accounts payable primarily reflects extended payment terms

achieved through supply chain management in the Circuit City

business. The fiscal 2001 decline in cash provided by operating

activities was largely a function of lower net earnings for the

Circuit City business and an increase in working capital, partly

offset by the increase in earnings for the CarMax business.

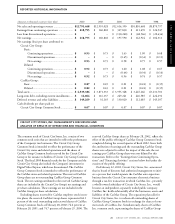

INVESTING ACTIVITIES. Net cash used in investing activities was

$26.6 million in fiscal 2002, compared with $171.2 million in fis-

cal 2001 and $157.0 million in fiscal 2000. Capital expenditures

were $214.0 million in fiscal 2002, $285.6 million in fiscal 2001

and $222.3 million in fiscal 2000. Fiscal 2002 capital expen-

ditures included spending for the construction of 11 new and

eight relocated Circuit City Superstores, $19.8 million of capital-

ized Circuit City remodeling expenditures and the construction of

two standard-sized CarMax used-car superstores, one of which

opened during the first quarter of fiscal 2003, and one satellite

used-car superstore. Fiscal 2001 capital expenditures included

spending for the construction of 23 new and two relocated

Circuit City Superstores and $106.0 million of capitalized

Circuit City remodeling expenditures associated with full remodels

of 26 Superstores, primarily in south and central Florida, and

partial remodels associated with the exit from the appliance busi-

ness. Fiscal 2000 capital expenditures included spending for the

construction of 34 new and four relocated Circuit City

Superstores and four CarMax used-car superstores.

Capital expenditures have been funded primarily through

internally generated funds, sale-leaseback transactions, landlord

reimbursements and short- and long-term debt. Net proceeds

from sales of property and equipment, including sale-leasebacks,

totaled $187.4 million in fiscal 2002, $115.7 million in fiscal

2001 and $100.2 million in fiscal 2000. In August 2001, Circuit

City completed a sale-leaseback transaction for its Orlando, Fla.,

distribution center, from which total proceeds of $19.5 million

were received. In November 2001, we completed a sale-leaseback

transaction for Circuit City’s Marion, Ill., distribution center,

from which total proceeds of $29.0 million were received. In

August 2001, CarMax entered into a sale-leaseback transaction

covering nine superstore properties for an aggregate sale price of

$102.4 million. This transaction, which represented the first sale-

leaseback entered into by CarMax without a Circuit City Stores,

Inc. guarantee, was structured at competitive rates with an initial

lease term of 15 years and two 10-year renewal options.

In fiscal 2003, we anticipate capital expenditures for the

Circuit City business of approximately $150 million. In fiscal

2003, the Circuit City business plans to open approximately 10

Superstores, remodel the video department and install lighting

upgrades in approximately 300 Superstores and relocate approx-

imately 10 Superstores. We expect Circuit City will continue

incurring remodeling and relocation costs in fiscal years 2004

and 2005.

In fiscal 2003, we anticipate capital expenditures for the

CarMax business of approximately $175 million. CarMax

planned expenditures primarily relate to new store construction,

including furniture, fixtures and equipment and land purchases,

and leasehold improvements to existing properties. CarMax

expects to open four to six stores during fiscal 2003, approxi-

mately one half of which will be satellite stores, and, assuming the

business continues to meet our expectations, 22 to 30 stores over

the following four years. We expect the initial cash investment per

store to be in the range of $20 million to $27 million for a stan-

dard superstore and $10 million to $15 million for a satellite store.

If CarMax takes full advantage of building and land sale-lease-

backs, then we expect the net cash used to fund a new store will be

$8 million to $12 million for a standard superstore and $5 million

to $7 million for a satellite superstore. As a new store matures,

sales financed through CarMax’s finance operation will require

additional use of capital in the form of a seller’s interest in the

receivables or reserves. For a standard used-car superstore, we

would expect the cash investment for the seller’s interest to range

from $0.8 million to $1.5 million at the end of the first year of

operation, growing to $2.2 million to $3.4 million after five years

of operation.

For the Company, we expect that available cash resources,

CarMax’s anticipated credit agreement secured by vehicle inven-

tory, sale-leaseback transactions, landlord reimbursements and

cash generated by operations will be sufficient to fund capital

expenditures for the foreseeable future.

FINANCING ACTIVITIES. In December 2001, CarMax entered

into an $8.5 million secured promissory note in conjunction

with the purchase of land for new store construction. This note,

which is payable in August 2002, was included in short-term

debt as of February 28, 2002.

CIRCUIT CITY STORES, INC.