CarMax 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 CarMax annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CIRCUIT CITY STORES, INC. ANNUAL REPORT 2002 60

a current liability. Although the Company has the ability to

refinance this debt, we intend to repay it using existing working

capital. Payment of corporate pooled debt does not necessarily

result in a reduction of the Circuit City Group allocated debt.

At February 28, 2002, the Company allocated cash and cash

equivalents of $1.25 billion and debt of $37.9 million to the

Circuit City Group. Circuit City Stores maintains a $150 mil-

lion unsecured revolving credit facility that expires on August

31, 2002. The Company does not anticipate renewing this

facility. The Company also maintains $195 million in commit-

ted seasonal lines of credit that are renewed annually with vari-

ous banks. At February 28, 2002, total balances of $1.8 million

were outstanding under these facilities.

Receivables generated by the Circuit City finance operation

are funded through securitization transactions in which the

finance operation sells its receivables while retaining servicing

rights. These securitization transactions provide an efficient and

economical means of funding credit card receivables. For trans-

fers of receivables that qualify as sales under Statement of

Financial Accounting Standards No. 140, “Accounting for

Transfers and Servicing of Financial Assets and Extinguishments

of Liabilities,” we recognize gains and losses as a component of

the profits of Circuit City’s finance operation.

On a daily basis, Circuit City’s finance operation sells its

private-label credit card and MasterCard and VISA credit card,

referred to as bankcard, receivables to special purpose sub-

sidiaries, which, in turn, transfer the receivables to two separate

securitization master trusts. The master trusts periodically issue

asset-backed securities in public offerings and private transac-

tions, and the proceeds are distributed through the special pur-

pose subsidiaries to Circuit City’s finance operation. The special

purpose subsidiaries retain an undivided interest in the trans-

ferred receivables and hold various subordinated asset-backed

securities that serve as credit enhancement for the asset-backed

securities held by outside investors. Circuit City’s finance opera-

tion continues to service the transferred receivables for a fee.

The private-label and bankcard master trusts each have issued

multiple series of asset-backed securities, referred to as term secu-

rities, having fixed initial principal amounts. Investors in the term

securities are entitled to receive monthly interest payments and a

single principal payment on a stated maturity date. In addition,

each master trust has issued a series of asset-backed securities,

referred to as variable funding securities, having a variable princi-

pal amount. Investors in the variable funding securities are gener-

ally entitled to receive monthly interest payments and have

committed to acquire additional undivided interests in the trans-

ferred receivables up to a stated amount through a stated com-

mitment termination date. The commitment under the

private-label variable funding series is currently scheduled to

expire on December 13, 2002, and the commitment under the

bankcard variable funding series is currently scheduled to expire

on October 24, 2002. We expect that the commitment termina-

tion dates of both variable funding series will be extended. If cer-

tain early amortization events were to occur, principal payment

dates for the term series would be accelerated, the variable fund-

ing commitments would terminate and the variable funding

investors would begin to receive monthly principal payments

until paid in full.

At February 28, 2002, the aggregate principal amount of securi-

tized credit card receivables totaled $1.31 billion under the private-

label program and $1.49 billion under the bankcard program. At

February 28, 2002, the unused capacity of the private-label variable

funding program was $22.9 million and the unused capacity of the

bankcard variable funding program was $496.5 million. At

February 28, 2002, there were no provisions providing recourse to

the Company for credit losses on the receivables securitized

through the private-label or bankcard master trusts. We anticipate

that we will be able to expand or enter into new securitization

arrangements to meet future needs of the finance operation.

We have conducted tests of a co-branded Circuit City

bankcard, which offers more utility to the consumer than the pri-

vate-label card. We are considering transitioning our private-label

program to this card.

During the second quarter of fiscal 2002, Circuit City Stores,

Inc. completed the public offering of 9,516,800 shares of CarMax

Group Common Stock. The shares sold in the offering were

shares of CarMax Group Common Stock that previously had

been reserved for the Circuit City Group or for issuance to holders

of Circuit City Group Common Stock. The net proceeds of

$139.5 million from the offering were allocated to the Circuit

City Group to be used for general purposes of the Circuit City

business, including remodeling of Circuit City Superstores.

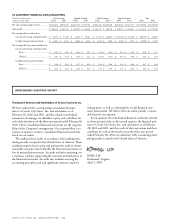

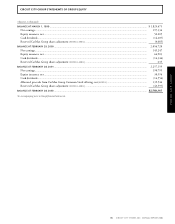

CONTRACTUAL OBLIGATIONS(1)

2 to 3 4 to 5 After 5

(Amounts in millions) Total 1 Year Years Years Years

Allocated contractual

obligations:

Long-term debt.......... $ 25.9 $ 22.9 $ 2.6 $ 0.4 $ –

Capital lease

obligations............ 11.6 0.6 1.3 1.7 8.0

Operating leases ......... 4,078.8 296.1 585.6 574.4 2,622.7

Lines of credit ............ 0.4 0.4 – – –

Other contractual

obligations............ 18.5 18.5 – – –

Total ................................ $4,135.2 $338.5 $589.5 $576.5 $2,630.7

(1) Amounts are based on the capital structure of Circuit City Stores, Inc. as of February 28,

2002. Future obligations depend upon the final outcome of the proposed separation of

CarMax.

CarMax currently operates 23 of its sales locations pursuant

to various leases under which Circuit City Stores, Inc. was the

original tenant and primary obligor. Circuit City Stores, Inc.,

and not CarMax, had originally entered into these leases so that