Capital One 2000 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2000 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

notes 63

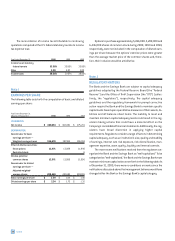

Borrowings

The carrying amount of interest-bearing deposits, secured borrow-

ings, federal funds purchased and resale agreements, and other

short-term borrowings approximates fair value. The fair value of the

junior subordinated capital income securities was $70,500 and

$84,199 at December 31, 2000 and 1999, respectively, and is

determined based on quoted market prices. The fair value of sen-

ior notes was $3,987,116 and $4,075,825 as of December 31, 2000

and 1999, respectively, and is determined based on quoted mar-

ket prices.

Interest Payable

The carrying amount approximated fair value.

Off-Balance Sheet Financial Instruments

The fair value was the estimated net amount that the Company

would have (paid)/received to terminate the interest rate swaps,

currency swaps and f/x contracts at the respective dates, taking

into account the forward yield curve on the swaps and the forward

rates on the currency swaps and f/x contracts. As of December 31,

2000 and 1999, the estimated fair value was $(39,121) and

$80,566, respectively.

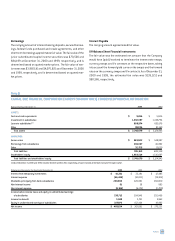

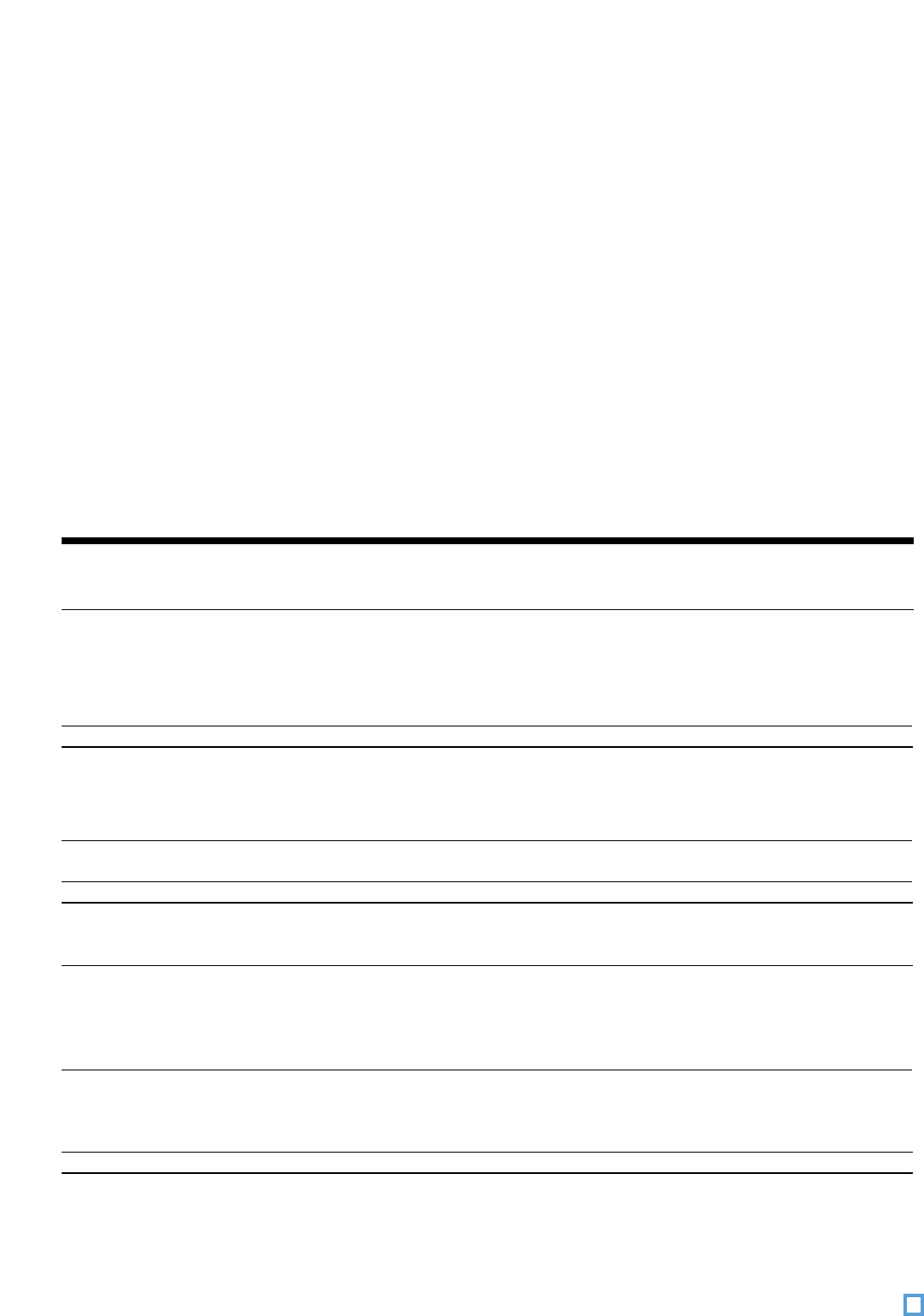

Note Q

CAPITAL ONE FINANCIAL CORPORATION (PARENT COMPANY ONLY) CONDENSED FINANCIAL INFORMATION

Balance Sheets at December 31 2000 1999

ASSETS:

Cash and cash equivalents $ 9,284 $ 5,846

Investment in subsidiaries 1,832,387 1,428,754

Loans to subsidiaries(1) 808,974 609,176

Other 98,034 81,169

Total assets $2,748,679 $2,124,945

LIABILITIES:

Senior notes $ 549,042 $548,897

Borrowings from subsidiaries 204,367 46,802

Other 32,756 13,639

Total liabilities 786,165 609,338

Stockholders’ equity 1,962,514 1,515,607

Total liabilities and stockholders’ equity $2,748,679 $2,124,945

(1) As of December 31, 2000 and 1999, includes $63,220 and $11,350, respectively, of cash invested at the Bank instead of the open market.

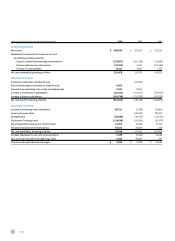

Statements of Income for the Year Ended December 31 2000 1999 1998

Interest from temporary investments $41,321 $32,191 $12,485

Interest expense (46,486) (41,011) (18,212)

Dividends, principally from bank subsidiaries 250,000 220,001 260,000

Non-interest income 61 39 893

Non-interest expense (8,184) (6,274) (2,700)

Income before income taxes and equity in undistributed earnings

of subsidiaries 236,712 204,946 252,466

Income tax benefit 5,049 5,721 2,863

Equity in undistributed earnings of subsidiaries 227,873 152,424 19,902

Net income $ 469,634 $ 363,091 $ 275,231