Capital One 2000 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2000 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56 notes

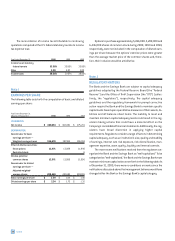

In April 1999, the Company established the 1999 Non-

Employee Directors Stock Incentive Plan. The plan authorizes a

maximum of 525,000 shares of the Company's common stock for

the grant of nonstatutory stock options to eligible members of the

Company's Board of Directors. In April 1999, all non-employee direc-

tors of the Company were given the option to receive

performance-based options under this plan in lieu of their annual

cash retainer and their time-vesting options for 1999, 2000 and

2001. As a result, 497,490 performance-based options were

granted to the non-employee directors of the Company. The options

vest in full if, on or before June 15, 2002, the market value of the

Under the Company's Purchase Plan, associates of the Company

are eligible to purchase common stock through monthly salary

deductions of a maximum of 15% and a minimum of 1% of monthly

base pay. To date, the amounts deducted are applied to the purchase

of unissued common or treasury stock of the Company at 85% of the

current market price. Shares may also be acquired on the market. An

aggregate of three million common shares has been authorized for

Company's stock equals or exceeds $100 per share for ten trading

days in a thirty consecutive calendar day period. All options vest

immediately upon a change of control of the Company. As of Decem-

ber 31, 2000, 27,510 shares were available for grant under this plan.

All options under this plan have a maximum term of ten years. The

exercise price of each option equals or exceeds the market price of

the Company's stock on the date of grant.

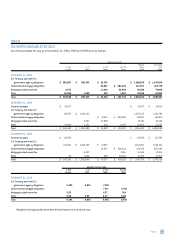

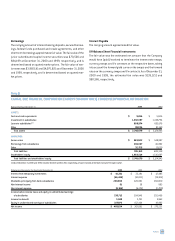

A summary of the status of the Company's options as of

December 31, 2000, 1999 and 1998, and changes for the years

then ended is presented below:

issuance under the Purchase Plan, of which 929,084 shares were

available for issuance as of December 31, 2000.

On November 16, 1995, the Board of Directors of the Company

declared a dividend distribution of one Right for each outstanding

share of common stock. As amended, each Right entitles a regis-

tered holder to purchase from the Company one three-hundredth of

a share of the Company's authorized Cumulative Participating Junior

2000 1999 1998

Weighted- Weighted- Weighted-

Average Average Average

Options Exercise Price Options Exercise Price Options Exercise Price

(000s) Per Share (000s) Per Share (000s) Per Share

Outstanding at beginning of year 37,058 $ 27.24 29,139 $ 15.99 21,375 $ 9.22

Granted 4,063 51.14 10,541 55.71 10,350 27.97

Exercised (3,330) 12.20 (2,111) 11.44 (2,226) 6.76

Canceled (1,102) 49.79 (511) 38.17 (360) 17.32

Outstanding at end of year 36,689 $ 30.57 37,058 $ 27.24 29,139 $ 15.99

Exercisable at end of year 22,108 $ 16.48 19,635 $ 12.16 17,898 $ 10.16

Weighted-average fair value of

options granted during the year $ 23.41 $ 25.92 $ 11.82

The following table summarizes information about options outstanding as of December 31, 2000:

Options Outstanding Options Exercisable

Number Weighted-Average Weighted-Average Number Weighted-Average

Outstanding Remaining Exercise Price Exercisable Exercise Price

Range of Exercise Prices (000s) Contractual Life Per Share (000s) Per Share

$4.31–$6.46 3,504 3.89 years $ 5.39 3,504 $ 5.39

$6.47–$9.70 317 4.99 8.05 317 8.05

$9.71–$14.56 9,590 5.00 10.29 9,590 10.29

$14.57–$21.85 3,865 6.96 16.08 3,865 16.08

$21.86–$32.79 1,212 7.38 31.66 140 31.38

$32.80–$49.20 7,652 8.12 39.73 4,235 35.94

$49.21–$60.00 10,549 8.55 56.60 457 55.74