Capital One 2000 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2000 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Since then we have extended IBS to installment loans, auto finance, money market accounts and certifi-

cates of deposit. We are a price leader in all of these markets, each of which offers us a large platform for

growth. New businesses open new fields for innovation. Deposit accounts, for example, give Capital One an

alternative source of funding—one more buffer against downdrafts in corporate credit markets. Deposits at

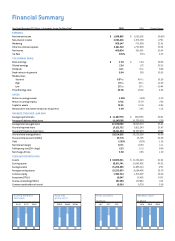

year-end totaled $8.4 billion, financing 25% of our total managed assets.

We have recently taken IBS into other industries through strategic alliances with Kmart® and

BMG Entertainment.® The Kmart alliance, launched in September, brought Capital One more than one million

new customers during the last quarter of the year. The co-branded Visa® card and rewards program for

BMG Entertainment offer numerous benefits to music fans. In South Africa, we are marketing credit cards and

other products through a joint venture with Nedcor®, one of the country’s leading financial institutions. We

view these alliances as prototypes for ventures with market leaders in other industries.

To maximize the benefits of the learning and momentum generated by IBS, we are now committing sub-

stantial resources to building Capital One’s brand through advertising, sponsorship and other customer “touch

points.” These new efforts are guided by our long-standing conviction that the best way to build a brand is to

live it. We want Capital One to be the brand consumers prefer when they're in the market for financial services.

IBS has made Capital One a formidable competitor and—just as we dreamed—a transformational force

in financial services. With 34 million customers, we have one of the world’s largest consumer franchises. The

Company also has used IBS to build enormous operational strength. IBS provides the ultimate precision tools

for risk management, which we have used to achieve one of the industry's lowest charge-off rates, increasing

our marketing opportunities and improving our financial performance. We use IBS to track and continuously

improve customer service and operating efficiency. In human resources, IBS helps us identify the strongest

job candidates and reduce recruiting costs.

Our associates even take Capital One’s passion for achieving measurable results to the work they do with

community organizations. They have chosen to focus on helping children at risk, and in 2000 more than half

of them volunteered in Capital One-sponsored community programs, collectively contributing in excess of

50,000 hours of service. They facilitate interagency collaboration, share technology and resources, and use

their analytical and managerial know-how to assist in evaluating and refining community services. Early in

2001, social investments made by Capital One and its associates were recognized with one of the most pres-

tigious honors in American philanthropy, a Points of Light Foundation® Award for Excellence in Corporate

Community Service.

Thanks to IBS, which lets us quickly scale our business up or down, we believe we are well prepared for a

slowdown in the economy or a decline in consumer credit quality. Our financial structure is the strongest it

has ever been. We also have built-in buffers that will mitigate the impact of a recession on earnings, for exam-

ple, we have the lowest average credit lines in the industry, which limits potential losses per account. In addi-

tion, the steady diversification of our product lines and our customer base has increased financial stability

while expanding possibilities for growth.

In 2000, we significantly reduced the cost of serving each customer, from $89 to $81, for an annualized

saving of more than $200 million, and we did it without compromising service quality, associate morale or

operating flexibility.

From our associates, from the marketplace, from Wall Street and from other quarters, there is growing

recognition that Capital One is a topflight company. That’s what we have always worked for. And from the

beginning we’ve had a destination clearly in mind. It’s a beacon just past the horizon, invisible to the naked

eye but not beyond the dreams of the people of Capital One. Over the next year they will strive for another

record financial performance (with earnings up 30%, by our estimate). And they will carry out thousands of

new test flights so that Capital One can continue to break through price and risk barriers, carrying consumers

and shareholders to new heights.

Richard D. Fairbank, Nigel W. Morris,

Chairman and Chief Executive Officer President and Chief Operating Officer