Capital One 2000 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2000 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34 md&a

The amount of allowance necessary is determined primarily

based on a migration analysis of delinquent and current accounts.

In evaluating the sufficiency of the allowance for loan losses, man-

agement also takes into consideration the following factors: recent

trends in delinquencies and charge-offs including bankrupt,

deceased and recovered amounts; historical trends in loan volume;

forecasting uncertainties and size of credit risks; the degree of risk

inherent in the composition of the loan portfolio; economic condi-

tions; credit evaluations and underwriting policies. Additional

information on the Company's allowance for loan loss policy can be

found in Note A to the Consolidated Financial statements.

Table 8 sets forth the activity in the allowance for loan losses

for the periods indicated. See "Asset Quality," "Delinquencies" and

"Net Charge-Offs" for a more complete analysis of asset quality.

FUNDING

The Company has established access to a wide range of domestic

funding alternatives, in addition to securitization of its consumer

loans. In June 2000, the Company established a $5.0 billion global

senior and subordinated bank note program, of which $994.8 mil-

lion was outstanding as of December 31, 2000, with original terms

of three to five years. In February 2001, the Company issued an

additional $1.3 billion fixed rate senior global bank note with a term

of five years. The Company has historically issued senior unsecured

debt of the Bank through its $8.0 billion domestic bank note pro-

gram, of which $2.5 billion was outstanding as of December 31,

2000, with original terms of one to ten years.

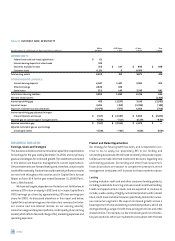

table 8: SUMMARY OF ALLOWANCE FOR LOAN LOSSES

Year Ended December 31 (Dollars in Thousands) 2000 1999 1998 1997 1996

Balance at beginning of year $ 342,000 $ 231,000 $ 183,000 $ 118,500 $ 72,000

Provision for loan losses 718,170 382,948 267,028 262,837 167,246

Acquisitions/other (549) 3,522 7,503 (2,770) (18,887)

Charge-offs (772,402) (400,143) (294,295) (223,029) (115,159)

Recoveries 239,781 124,673 67,764 27,462 13,300

Net charge-offs (532,621) (275,470) (226,531) (195,567) (101,859)

Balance at end of year $527,000 $ 342,000 $ 231,000 $ 183,000 $ 118,500

Allowance for loan losses to loans at end of year 3.49% 3.45% 3.75% 3.76% 2.73%

For the year ended December 31, 2000, the provision for loan

losses increased 88% to $718.2 million from the 1999 provision for

loan losses of $382.9 million as a result of an increase in average

reported loans of 50%, continued seasoning of the reported portfo-

lio and the shift in the mix of the composition of the reported

portfolio. As a result of these factors, the Company increased the

allowance for loan losses by $185.0 million during 2000.

For the year ended December 31, 1999, the provision for loan

losses increased 43% to $382.9 million from the 1998 provision for

loan losses of $267.0 million as average reported loans increased

43%. The Company increased the allowance for loan losses by

$111.0 million during 1999 due to the increase in the delinquency

rate, the growth in the reported loans and the increase in the dollar

amount of net charge-offs.