Capital One 2000 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2000 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Certain estimates inherent in the determination of the fair

value of the I/O strip are influenced by factors outside the Com-

pany's control, and as a result, such estimates could materially

change in the near term. Any future gains that will be recognized in

accordance with SFAS 125 and SFAS 140 (see Note A to the Consol-

idated Financial Statements) will be dependent on the timing and

amount of future securitizations. The Company will continuously

assess the performance of new and existing securitization trans-

actions as estimates of future cash flows change.

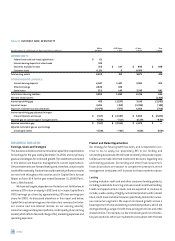

OTHER NON-INTEREST INCOME

Interchange income increased $93.5 million, or 65%, to $237.8

million for the year ended December 31, 2000, from $144.3 million

in 1999. Service charges and other customer-related fees increased

to $1.6 billion, or 58%, for the year ended December 31, 2000,

compared to $1.0 billion for the year ended December 31, 1999.

These increases were primarily due to a 41% increase in the average

number of accounts for the year ended December 31, 2000, from

1999, an increase in purchase volume, customer usage patterns

and increased purchases of cross-sell products.

Interchange income increased $57.8 million, or 67%, to $144.3

million for the year ended December 31, 1999, from $86.5 million

in 1998. Service charges and other customer-related fees increased

to $1.0 billion, or 70%, for the year ended December 31, 1999, com-

pared to $612.0 million for the year ended December 31, 1998.

These increases were primarily due to a 42% increase in the aver-

age number of accounts for the year ended December 31, 1999,

from 1998, an increase in purchase volume, an increase in inter-

change rates received by the Company and a shift to more

fee-intensive products.

NON-INTEREST EXPENSE

Non-interest expense for the year ended December 31, 2000,

increased $682.7 million, or 28%, to $3.1 billion from $2.5 billion for

the year ended December 31, 1999. Contributing to the increase in

non-interest expense were marketing expenses which increased

$174.2 million, or 24%, to $906.1 million in 2000, from $731.9 mil-

lion in 1999. The increase in marketing expenses during 2000

reflects the Company's continued identification of and investments

in opportunities for growth. Salaries and associate benefits

increased $243.2 million, or 31%, to $1.0 billion in 2000, from

$780.2 million in 1999, as the Company added approximately 3,800

net new associates to our staffing levels to manage the growth in

the Company's accounts. All other non-interest expenses increased

$265.2 million, or 28%, to $1.2 billion for the year ended December

31, 2000, from $952.9 million in 1999. The increase in other non-

interest expense, as well as the increase in salaries and associate

benefits, was primarily a result of a

41% increase in the average number of

accounts for the year ended December

31, 2000, and the Company's contin-

ued exploration and testing of new

products and markets.

Non-interest expense for the

year ended December 31, 1999,

increased $1.0 billion, or 68%, to $2.5

billion from $1.5 billion for the year

ended December 31, 1998. Contribut-

ing to the increase in non-interest expense were marketing

expenses which increased $285.6 million, or 64%, to $731.9 million

in 1999, from $446.3 million in 1998. The increase in marketing

expenses during 1999 reflects the Company's continued identifi-

cation of and investments in opportunities for growth. Salaries and

associate benefits increased $303.8 million, or 64%, to $780.2 mil-

lion in 1999, from $476.4 million in 1998, as the Company added

approximately 5,000 associates to our staffing levels to manage

the growth in the Company's accounts. All other non-interest

expenses increased $411.0 million, or 76%, to $952.9 million for the

year ended December 31, 1999, from $541.9 million in 1998. The

increase in other non-interest expense, as well as the increase in

salaries and associate benefits, was primarily a result of a 42%

increase in the average number of accounts for the year ended

December 31, 1999 and the Company's continued exploration and

testing of new products and markets.

INCOME TAXES

The Company's effective income tax rate was 38%, 37% and 38%,

for the years ended December 31, 2000, 1999 and 1998, respec-

tively. The effective rate includes both state and federal income

tax components.

ASSET QUALITY

The asset quality of a portfolio is generally a function of the initial

underwriting criteria used, levels of competition, account

management activities and demographic concentration, as well as

general economic conditions. The seasoning of the accounts is also

an important factor, as accounts tend to exhibit a rising trend of

delinquency and credit losses as they season. As of December 31,

2000 and 1999, 60% of managed accounts representing 51% of the

total managed loan balance were less than eighteen months old.

Accordingly, it is likely that the Company's managed loan portfolio

could experience increased levels of delinquency and credit losses

as the average age of the Company's accounts increases.

md&a 31