Capital One 2000 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2000 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

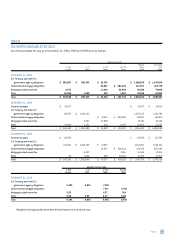

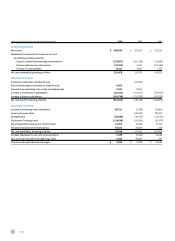

Note M

SECURITIZATIONS

During 2000 and 1999, the Company transferred $6,142,709

($141,140 international) and $2,586,517 ($47,642 international),

respectively, of consumer loan receivables in securitization trans-

actions accounted for as sales in accordance with the provisions of

SFAS 125. At December 31, 2000, the fair value of the retained inter-

ests relating to securitizations of consumer loan receivables totaled

$408,447.

The key assumptions used in determining the fair value of

retained interests at December 31, 2000, included a weighted aver-

age charge-off rate of 4%, an average prepayment rate of 16%, an

average life for receivables of seven months and a discount rate of

12%. The fair value of the Company’s retained interests at December

31, 2000, would decrease by $16,733, $5,912 and $245 from a 10%

adverse change in the assumed charge-off rate, prepayment rate

and discount rate, respectively. The fair value of the Company’s

retained interests at December 31, 2000, would decrease by

$33,467, $10,626 and $488 from a 20% adverse change in the

assumed charge-off rate, prepayment rate and discount rate,

respectively. These sensitivities are hypothetical and should be used

with caution. A change in fair value based on a 10% or 20% variation

in assumptions cannot necessarily be extrapolated because the

relationship of change in assumption to the change in fair value may

not be linear. Also, the effect of a variation in a particular assump-

tion on the fair value of the retained interest is calculated

independent from any change in another assumption, however,

changes in one factor may result in changes in other factors, which

might magnify or counteract the sensitivities. During 2000, the

Company recognized $30,466 in gains related to the transfer of

receivables accounted for as sales. The Company also received other

cash flows from the securitization trusts of $72,540 for servicing

the transferred receivables and $1,025,436 of net interest income

relating to the transferred receivables, including $34,007 for interest

income relating to subordinated interests retained by the Company.

Additionally, collections reinvested in revolving period securitizations

were $18,566,784.

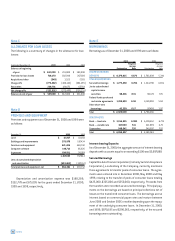

At December 31, 2000, the Company’s managed consumer

loan portfolio of $29,524,026 is comprised of $15,112,712 in

reported consumer loans and $14,411,314 in off-balance sheet con-

sumer loans. At December 31, 2000, the Company’s 30-plus days

loan delinquency on a reported and managed basis were

$1,097,311, or 7.26%, and $1,544,654, or 5.23%, respectively. Net

charge-offs include the principal amount of losses (excluding

accrued and unpaid finance charges, fees, and fraud losses) less

current period recoveries. The Company charges off loans (net of

collateral) at 180 days past due. The Company’s net charge-offs for

the year ended December 31, 2000, on a reported and managed

basis were $532,621, or 4.64% of average reported loans, and

$883,667, or 3.90% of average managed loans, respectively.

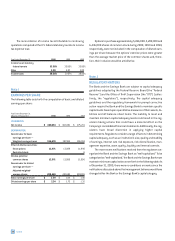

The key assumptions used in determining the fair value of

retained interests resulting from securitizations of consumer loan

receivables completed during the period included weighted aver-

age charge-off rates ranging from 4% to 6%, weighted average

prepayment rates ranging from 13% to 16%, weighted average life

for receivables ranging from 7 to 8 months and weighted average

discount rates ranging from 11% to 13%. Static pool credit losses

are calculated by summing the actual and projected future credit

losses and dividing them by the original balance of each pool of

asset. Due to the short term revolving nature of consumer loan

receivables, the weighted average percentage of static pool credit

losses is not considered to be materially different from the

assumed charge-off rates used to determine the fair value of

retained interests.

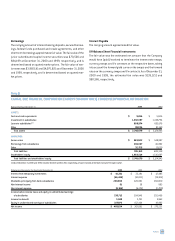

Note N

OFF-BALANCE SHEET FINANCIAL INSTRUMENTS

The Company has entered into interest rate swaps to effectively

convert certain interest rates on bank notes from variable to fixed.

The pay-fixed, receive-variable swaps, which had a notional amount

totaling $157,000 as of December 31, 2000, will mature from 2001

to 2007 to coincide with maturities of the variable bank notes to

which they are designated. The Company has also entered into

interest rate swaps and amortizing notional interest rate swaps to

effectively reduce the interest rate sensitivity of loan securitiza-

tions. These pay-fixed, receive-variable interest rate swaps and

amortizing notional interest rate swaps had notional amounts total-

ing $2,050,000 and $1,991,062 respectively, as of December 31,

2000. The interest rate swaps will mature from 2002 to 2005 and

the amortizing notional interest rate swaps will fully amortize

between 2004 and 2006 to coincide with the estimated paydown

of the securitizations to which they are designated. The Company

also had a pay-fixed, receive-variable, interest rate swap with an

amortizing notional amount of $545,000 as of December 31, 2000,

which will amortize through 2003 to coincide with the estimated

attrition of the fixed rate Canadian dollar consumer loans to which

it is designated.

The Company has also entered into currency swaps that effec-

tively convert fixed rate pound sterling interest receipts to fixed rate

U.S. dollar interest receipts on pound sterling denominated assets.

notes 61