Capital One 2000 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2000 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

quarterly financial data 41

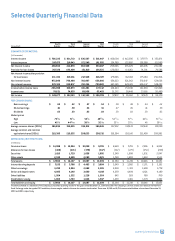

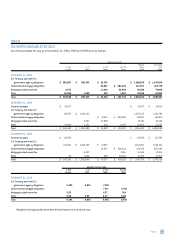

Selected Quarterly Financial Data

2000 1999

Fourth Third Second First Fourth Third Second First

(Unaudited) Quarter Quarter Quarter Quarter Quarter Quarter Quarter Quarter

SUMMARY OF OPERATIONS:

(In Thousands)

Interest income $ 706,235 $ 631,713 $ 536,507 $ 515,447 $ 450,604 $ 412,036 $ 377,773 $ 353,071

Interest expense 247,675 218,843 172,549 161,950 154,798 135,807 128,288 121,989

Net interest income 458,560 412,870 363,958 353,497 295,806 276,229 249,485 231,082

Provision for loan losses 247,226 193,409 151,010 126,525 120,000 114,061 74,301 74,586

Net interest income after provision

for loan losses 211,334 219,461 212,948 226,972 175,806 162,168 175,184 156,496

Non-interest income 872,080 796,469 710,807 655,060 654,623 621,063 572,047 524,626

Non-interest expense 876,516 818,957 742,264 709,920 681,185 629,421 606,137 548,253

Income before income taxes 206,898 196,973 181,491 172,112 149,244 153,810 141,094 132,869

Income taxes 78,621 74,850 68,966 65,403 51,372 58,448 53,616 50,490

Net income $ 128,277 $ 122,123 $ 112,525 $ 106,709 $ 97,872 $ 95,362 $ 87,478 $ 82,379

PER COMMON SHARE:

Basic earnings $.65$.62$.57$.54$.50$.48$.44$.42

Diluted earnings .61 .58 .54 .51 .47 .45 .41 .39

Dividends .03 .03 .03 .03 .03 .03 .03 .03

Market prices

High 735⁄23 713⁄4533⁄44813 ⁄16 5427 ⁄32 573⁄4601⁄65125⁄64

Low 457⁄84426⁄43 393⁄8321⁄16 357⁄8354⁄546 365⁄16

Average common shares (000s) 196,996 196,255 196,012 196,645 197,252 197,423 197,643 197,239

Average common and common

equivalent shares (000s) 210,395 210,055 208,633 208,710 210,284 210,142 211,499 209,991

AVERAGE BALANCE SHEET DATA:

(In Millions)

Consumer loans $ 14,089 $ 12,094 $ 10,029 $ 9,705 $ 8,620 $ 7,791 $ 7,406 $ 6,832

Allowance for loan losses (469) (415) (378) (347) (312) (273) (254) (239)

Securities 1,810 1,729 1,666 1,856 2,348 1,898 1,831 2,047

Other assets 2,530 2,699 2,380 1,825 1,728 1,803 1,663 1,511

Total assets $ 17,960 $ 16,107 $ 13,697 $ 13,039 $ 12,384 $ 11,219 $ 10,646 $ 10,151

Interest-bearing deposits $ 7,156 $ 5,788 $ 4,495 $ 3,894 $ 3,649 $ 3,002 $ 2,271 $ 2,101

Other borrowings 3,290 3,084 2,688 2,505 2,038 1,333 1,600 1,778

Senior and deposit notes 4,085 4,140 3,660 4,019 4,259 4,494 4,621 4,190

Other liabilities 1,564 1,352 1,228 1,054 945 929 780 780

Stockholders’ equity 1,865 1,743 1,626 1,567 1,493 1,461 1,374 1,302

Total liabilities and equity $ 17,960 $ 16,107 $ 13,697 $ 13,039 $ 12,384 $ 11,219 $ 10,646 $ 10,151

The above schedule is a tabulation of the Company’s unaudited quarterly results for the years ended December 31, 2000 and 1999. The Company’s common shares are traded on the New York

Stock Exchange under the symbol COF. In addition, shares may be traded in the over-the-counter stock market. There were 10,019 and 9,738 common stockholders of record as of December 31,

2000 and 1999, respectively.