Capital One 2000 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2000 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Non-interest income increased $884.1 million, or 59%, primarily due

to the increase in average managed accounts of 42%. Increases in

marketing expenses of $285.6 million, or 64%, and salaries and

benefits expense of $303.8 million, or 64%, reflect the increase in

marketing investment in existing and new product opportunities

and the cost of operations to manage the growth in the Company's

accounts and products offered. Average managed consumer loans

grew 19% for the year ended December 31, 1999, to $18.0 billion

from $15.2 billion for the year ended December 31, 1998, and aver-

age accounts grew 42% for the same period to 19.6 million from

13.8 million as a result of the continued success of the Company's

marketing and account management strategies.

MANAGED CONSUMER LOAN PORTFOLIO

The Company analyzes its financial performance on a managed con-

sumer loan portfolio basis. Managed consumer loan data adds back

the effect of off-balance sheet consumer loans. The Company also

evaluates its interest rate exposure on a managed portfolio basis.

The Company's managed consumer loan portfolio is comprised

of reported and off-balance sheet loans. Off-balance sheet loans

are those which have been securitized and accounted for as sales

in accordance with Statement of Financial Accounting Standards

("SFAS") No. 125, "Accounting for Transfers and Servicing of Finan-

cial Assets and Extinguishments of Liabilities" ("SFAS 125"), and

are not assets of the Company. Therefore, those loans are not

shown on the balance sheet. Effective April 1, 2001, the Company

will adopt the accounting provisions of SFAS No. 140, "Accounting

for Transfers and Servicing of Financial Assets and Extinguishments

of Liabilities" ("SFAS 140"), a replacement of SFAS 125. SFAS 140

revises the standards for accounting for securitizations and other

transfers of financial assets and collateral and, as of December 31,

2000, requires certain additional disclosures, however, most of the

provisions of SFAS 125 have been carried forward without amend-

ment. The adoption of SFAS 140 is not expected to have a material

effect on the results of the Company’s operations.

Table 1 summarizes the Company’s managed consumer loan

portfolio.

md&a 25

table 1: MANAGED CONSUMER LOAN PORTFOLIO

Year Ended December 31 (In Thousands) 2000 1999 1998 1997 1996

YEAR-END BALANCES:

Reported consumer loans $ 15,112,712 $ 9,913,549 $ 6,157,111 $ 4,861,687 $ 4,343,902

Off-balance sheet consumer loans 14,411,314 10,323,039 11,238,015 9,369,328 8,460,067

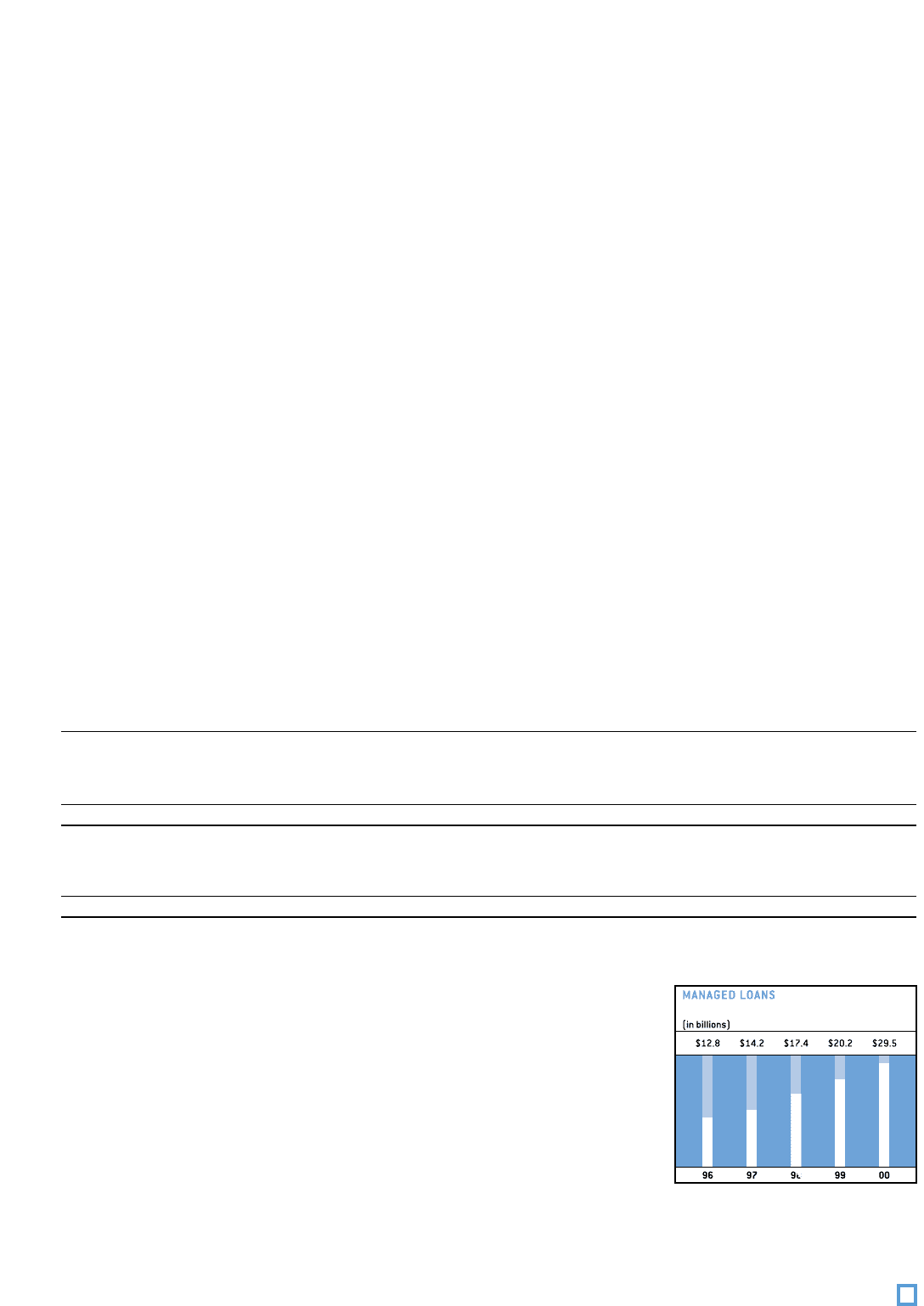

Total managed consumer loan portfolio $ 29,524,026 $ 20,236,588 $ 17,395,126 $ 14,231,015 $ 12,803,969

AVERAGE BALANCES:

Reported consumer loans $ 11,487,776 $ 7,667,355 $ 5,348,559 $ 4,103,036 $ 3,651,908

Off-balance sheet consumer loans 11,147,086 10,379,558 9,860,978 8,904,146 7,616,553

Total managed consumer loan portfolio $ 22,634,862 $ 18,046,913 $ 15,209,537 $ 13,007,182 $ 11,268,461

Since 1990, the Company has actively engaged in consumer

loan securitization transactions. Securitization involves the trans-

fer by the Company of a pool of loan receivables to an entity cre-

ated for securitizations, generally a trust or other special purpose

entity ("the trusts"). The credit quality of the receivables is sup-

ported by credit enhancements, which may be in various forms in-

cluding a letter of credit, a cash collateral guaranty or account, or a

subordinated interest in the receivables in the pool. Certificates

($14.4 billion outstanding as of December 31, 2000) representing

beneficial interests in

the receivables are sold

to the public through an

underwritten offering or

to private investors in

private placement trans-

actions. The Company

receives the proceeds of

the sale.