Capital One 2000 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2000 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

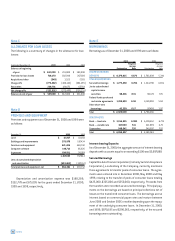

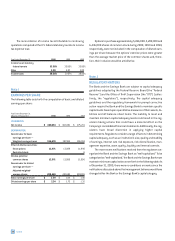

In October 1999, the Bank entered into a £750,000 revolving

credit facility collateralized by a security interest in certain consumer

loan assets of the Company. Interest on the facility is based on com-

mercial paper rates or London InterBank Offering Rates ("LIBOR"). The

facility matures in 2001. At December 31, 2000, £600,000

($895,800 equivalent) was outstanding under the facility.

Junior Subordinated Capital Income Securities

In January 1997, Capital One Capital I, a subsidiary of the Bank cre-

ated as a Delaware statutory business trust, issued $100,000

aggregate amount of Floating Rate Junior Subordinated Capital

Income Securities that mature on February 1, 2027. The securities

represent a preferred beneficial interest in the assets of the trust.

Other Short-Term Borrowings

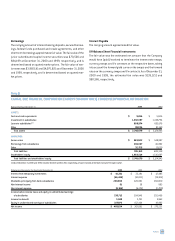

In August 2000, the Bank entered into a multicurrency revolving

credit facility (the "Multicurrency Facility"). The Multicurrency

Facility is intended to finance the Company’s business in the United

Kingdom and is comprised of two Tranches, each in the amount of

Euro 300,000 ($270,800 equivalent based on the exchange rate

at closing). The Tranche A facility is intended for general corporate

purposes whereas the Tranche B facility is intended to replace and

extend the Corporation’s prior credit facility for U.K. pounds sterling

and Canadian dollars, which matured on August 29, 2000. All

borrowings under the Multicurrency Facility are based on varying

terms of LIBOR. The Corporation serves as guarantor of all

borrowings under the Multicurrency Facility. In October 2000, the

Bank’s subsidiary, Capital One Bank Europe plc, replaced the Bank

as a borrower under the Bank’s guarantee. Tranche A of the

commitment terminates on August 9, 2001, and Tranche B of the

commitment terminates August 9, 2004. As of December 31, 2000,

the Company had no outstandings under the Multicurrency Facility.

In August 2000, the Company entered into four bilateral revolv-

ing credit facilities with different lenders (the "Bilateral Facilities").

The Bilateral Facilities were entered into to finance the Company's

business in Canada and for general corporate purposes. Two of the

Bilateral Facilities are for Capital One Inc., guaranteed by the Cor-

poration, and are each in the amount of C$100,000 ($67,400

equivalent based on the exchange rate at closing) with interest

rates based on varying terms of the lenders’ cost of funds. The other

two Bilateral Facilities are for the Corporation in the amount of

$70,000 and $30,000 with interest rates based on varying terms

of LIBOR. In February 2001, the two Bilateral Facilities for Capital

One Inc. were terminated. The two remaining Bilateral Facilities will

terminate on August 10, 2001. As of December 31, 2000, the Com-

pany had $36,689 outstanding under the Bilateral Facilities.

In May 1999, the Company entered into a four-year,

$1,200,000 unsecured revolving credit arrangement (the "Credit

Facility"). The Credit Facility is comprised of two tranches: a

$810,000 Tranche A facility available to the Bank and the Savings

Bank, including an option for up to $250,000 in multicurrency

availability, and a $390,000 Tranche B facility available to the Cor-

poration, the Bank and the Savings Bank, including an option for up

to $150,000 in multicurrency availability. Each tranche under the

facility is structured as a four-year commitment and is available for

general corporate purposes. All borrowings under the Credit Facil-

ity are based on varying terms of LIBOR. The Bank has irrevocably

undertaken to honor any demand by the lenders to repay any bor-

rowings which are due and payable by the Savings Bank but which

have not been paid. Any borrowings under the Credit Facility will

mature on May 24, 2003; however, the final maturity of each

tranche may be extended for three additional one-year periods with

the lenders’ consent. As of December 31, 2000 and 1999, the Com-

pany had no outstandings under the Credit Facility.

Bank Notes

In June 2000, the Bank entered into a Global Bank Note Program,

from which it may issue and sell up to a maximum of U.S.

$5,000,000 aggregate principal amount (or the equivalent thereof

in other currencies) of senior global bank notes and subordinated

global bank notes with maturities from 30 days to 30 years. This

Global Bank Note Program must be renewed annually. As of Decem-

ber 31, 2000, the Bank had $994,794 outstanding with maturities

of three and five years. On February 6, 2001, the Bank also issued

a $1,250,000 five-year fixed rate senior bank note under the pro-

gram. The Company has historically issued senior unsecured debt

of the Bank through its Domestic Bank Note Program. Under this

bank note program, the Bank from time to time may issue senior

bank notes at fixed or variable rates tied to LIBOR with maturities

from thirty days to thirty years. The aggregate principal amount

available for issuance under the program is $8,000,000 (of which,

up to $200,000 may be subordinated bank notes). As of December

31, 2000 and 1999, there were $2,501,761 and $3,626,651 out-

standing under the Domestic Bank Note Program, with no

subordinated bank notes issued or outstanding.

The Bank has established a program for the issuance of debt

instruments to be offered outside of the United States. Under this

program, the Bank from time to time may issue instruments in the

aggregate principal amount of $1,000,000 equivalent outstanding

at any one time ($5,000 outstanding as of December 31, 2000 and

1999). Instruments under this program may be denominated in

any currency or currencies. The Bank did not renew this program

in 2000 and it is no longer available for issuances.

notes 53