Capital One 2000 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2000 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

md&a 35

During January 2001, the Corporation issued 6,750,390 shares of

common stock in a public offering under these shelf registration

statements, increasing equity by $412.8 million.

The Company has significantly expanded its retail deposit

gathering efforts through both direct and broker marketing chan-

nels. The Company uses its IBS capabilities to test and market a

variety of retail deposit origination strategies, including via the

Internet, as well as to develop customized account management

programs. As of December 31, 2000, the Company had $8.4 billion

in interest-bearing deposits, with original maturities up to ten years.

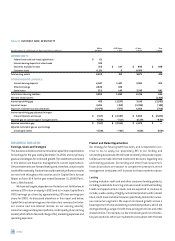

Table 9 reflects the costs of short-term borrowings of the Com-

pany as of and for each of the years ended December 31, 2000,

1999 and 1998.

table 9: SHORT-TERM BORROWINGS Maximum

Outstanding Outstanding Average Year-End

as of any as of Average Interest Interest

(Dollars in Thousands) Month-End Year-End Outstanding Rate Rate

2000

Federal funds purchased

and resale agreements $ 1,303,714 $ 1,010,693 $ 1,173,267 6.26% 6.58%

Other 371,020 43,359 129,700 11.52 6.17

Total $ 1,054,052 $ 1,302,967 6.79% 6.56%

1999

Federal funds purchased

and resale agreements $ 1,491,463 $ 1,240,000 $ 1,046,475 5.33% 5.84%

Other 193,697 97,498 175,593 8.42 3.97

Total $ 1,337,498 $ 1,222,068 5.77% 5.70%

1998

Federal funds purchased

and resale agreements $ 1,451,029 $ 1,227,000 $ 1,169,952 6.09% 5.53%

Other 417,279 417,279 206,204 8.44 6.58

Total $ 1,644,279 $ 1,376,156 6.44% 5.80%

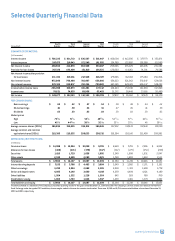

Table 10 shows the maturities of certificates of deposit in

denominations of $100,000 or greater (large denomination CDs)

as of December 31, 2000.

table 10: MATURITIES OF LARGE DENOMINATION CERTIFICATES

— $100,000 OR MORE

December 31, 2000 (Dollars in Thousands) Balance Percent

3 months or less $ 529,726 14.32%

Over 3 through 6 months 460,581 12.46

Over 6 through 12 months 925,414 25.03

Over 12 months 1,782,167 48.19

Total $ 3,697,888 100.00%

Internationally, the Company has funding programs designed

specifically for foreign investors and to allow the Company to raise

funds in foreign currencies. The Company has multiple committed

revolving credit facilities that offer foreign currency funding

options. The Company funds its foreign assets by directly or syn-

thetically borrowing or securitizing in the local currency to mitigate

the financial statement effect of currency translation.

Additionally, the Corporation has three shelf registration state-

ments under which the Corporation from time to time may offer and

sell senior or subordinated debt securities, preferred stock and

common stock. As of December 31, 2000, the Company had exist-

ing unsecured senior debt outstanding under the shelf registrations

of $550 million, with another $1.0 billion of availability.