Capital One 2000 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2000 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50 notes

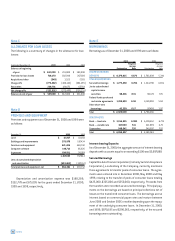

Premises and Equipment

Premises and equipment are stated at cost less accumulated depre-

ciation and amortization. Depreciation and amortization expenses are

computed generally by the straight-line method over the estimated

useful lives of the assets. Useful lives for premises and equipment are

as follows: buildings and improvements — 5–39 years; furniture and

equipment — 3–10 years; computers and software — 3 years.

Marketing

The Company expenses marketing costs as incurred.

Credit Card Fraud Losses

The Company experiences fraud losses from the unauthorized use of

credit cards. Transactions suspected of being fraudulent are charged

to non-interest expense after a sixty-day investigation period.

Income Taxes

Deferred tax assets and liabilities are determined based on differ-

ences between the financial reporting and tax bases of assets and

liabilities, and are measured using the enacted tax rates and laws that

will be in effect when the differences are expected to reverse.

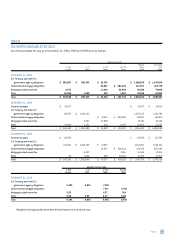

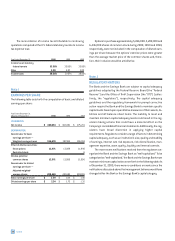

Comprehensive Income

As of December 31, 2000 and 1999, cumulative other comprehen-

sive income, net of tax, consisted of $777 and $32,608 in net

unrealized losses on securities and $3,695 and $1,346 in foreign

currency translation adjustments, respectively. As of December 31,

1998, cumulative other comprehensive income, net of tax, consisted

of $63,260 in net unrealized gains on securities and $(2,605) in for-

eign currency translation adjustments. As of December 31, 2000, the

net unrealized loss on securities was comprised of $18,332 of gross

unrealized losses and $17,075 of gross unrealized gains. As of

December 31, 1999, substantially all of the net unrealized loss on

securities was comprised of gross unrealized losses.

Segments

The Company maintains three distinct business segments: lending,

telecommunications and "other." The lending segment is comprised

primarily of credit card lending activities. The telecommunications

segment consists primarily of direct marketing wireless service.

"Other" consists of various non-lending new business initiatives, none

of which exceed the quantitative thresholds for reportable segments

in SFAS No. 131, "Disclosures about Segments of an Enterprise and

Related Information" ("SFAS 131").

The accounting policies of these reportable segments are the

same as those described above. Management measures the per-

formance of its business segments and makes resource allocation

decisions based upon several factors, including income before taxes,

less indirect expenses. Lending is the Company’s only reportable busi-

ness segment, based on the definitions provided in SFAS 131.

Substantially all of the Company’s reported assets, revenues and

income are derived from the lending segment in all periods presented.

All revenue is generated from external customers and is pre-

dominantly derived in the United States. Revenues and operating

losses from international operations comprised less than 6% and 9%,

and 6% and 7%, of total managed revenues and operating income for

the years ended December 31, 2000 and 1999, respectively.

Recent Accounting Pronouncements

In June 1998, the Financial Accounting Standards Board ("FASB")

issued SFAS No. 133, "Accounting for Certain Derivative Instruments

and Certain Hedging Activities." SFAS No. 133 was subsequently

amended in June 1999 by SFAS No. 137, "Accounting for Derivative

Instruments and Hedging Activities – Deferral of the Effective Date of

FASB Statement No. 133," and in June 2000 by SFAS No. 138,

"Accounting for Certain Derivative Instruments and Certain Hedging

Activities – an amendment of FASB Statement No. 133." SFAS No. 133,

SFAS No. 137 and SFAS No. 138 (all together "SFAS 133 as amended")

will require the Company to recognize all derivatives on the balance

sheet at fair value. Derivatives that are not hedges must be adjusted

to fair value through earnings. If the derivative qualifies as a hedge,

depending on the nature of the hedge, changes in the fair value of

derivatives will either be offset against the change in fair value of the

hedged assets, liabilities or firm commitments through earnings or

recognized in other comprehensive income until the hedged item is

recognized in earnings. The ineffective portion of a derivative’s

change in fair value will be immediately recognized in earnings. SFAS

133 as amended is effective for all fiscal quarters of all fiscal years

beginning after June 15, 2000. Adoption of SFAS 133 as amended on

January 1, 2001 will result in an increase in cumulative other com-

prehensive income of $27,222, net of taxes of $16,685.

In September 2000, the FASB issued SFAS No. 140, "Accounting

for Transfers and Servicing of Financial Assets and Extinguishments

of Liabilities - a replacement of SFAS No. 125" ("SFAS 140"). SFAS 140

revises the standards for accounting for securitizations and other

transfers of financial assets and collateral and requires certain addi-

tional disclosures. The disclosure requirements and collateral

provisions of SFAS 140 are effective for fiscal years ending after

December 15, 2000, while the other provisions of the new standard

apply prospectively to transfers and servicing of financial assets and

extinguishments of liabilities occurring after March 31, 2001. The

adoption of SFAS 140 is not expected to have a material effect on the

Company's financial position or the results of operations.