Capital One 2000 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2000 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

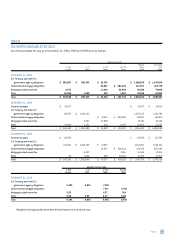

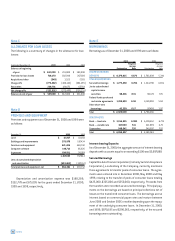

Note B

SECURITIES AVAILABLE FOR SALE

Securities available for sale as of December 31, 2000, 1999 and 1998 were as follows:

Maturity Schedule

Market Amortized

1 Year 1–5 5–10 Over 10 Value Cost

or Less Years Years Years Totals Totals

DECEMBER 31, 2000

U.S. Treasury and other U.S.

government agency obligations $ 283,607 $ 893,745 $ 10,702 $ 1,188,054 $ 1,178,386

Collateralized mortgage obligations 20,867 $ 391,240 412,107 414,770

Mortgage backed securities 3,752 11,420 61,648 76,820 74,695

Other 16,260 1,380 343 1,851 19,834 19,986

Total $ 303,619 $ 895,125 $ 43,332 $ 454,739 $ 1,696,815 $ 1,687,837

DECEMBER 31, 1999

Commercial paper $ 24,927 $ 24,927 $ 24,927

U.S. Treasury and other U.S.

government agency obligations 437,697 $ 1,014,335 1,452,032 1,471,783

Collateralized mortgage obligations $ 37,421 $ 299,846 337,267 345,619

Mortgage backed securities 5,293 13,828 19,121 19,426

Other 19,443 1,361 441 1,829 23,074 23,254

Total $ 482,067 $ 1,020,989 $ 51,690 $ 301,675 $ 1,856,421 $ 1,885,009

DECEMBER 31, 1998

Commercial paper $ 117, 395 $ 117,395 $ 117,395

U.S. Treasury and other U.S.

government agency obligations 125,831 $ 1,072,109 $ 17,051 1,214,991 1,196,313

Collateralized mortgage obligations 25,877 $ 401,443 427,320 426,485

Mortgage backed securities 8,337 7,265 15,602 15,210

Other 76 1,360 589 19,454 21,479 21,356

Total $ 243,302 $ 1,081,806 $ 43,517 $ 428,162 $ 1,796,787 $ 1,776,759

Weighted Average Yields

1 Year 1–5 5–10 Over 10

or LessYearsYearsYears

DECEMBER 31, 2000

U.S. Treasury and other U.S.

government agency obligations 5.48% 6.05% 7.04%

Collateralized mortgage obligations 7.04 6.35%

Mortgage backed securities 5.02 6.77 7.04

Other 6.09 3.93 6.47 6.89

Total 5.50% 6.05% 6.95% 6.44%

Weighted average yields were determined based on amortized cost.

notes 51